Best Car Dealership Accounts Software is a game-changer for auto businesses, streamlining financial operations and boosting efficiency. At CAR-REMOTE-REPAIR.EDU.VN, we understand the unique challenges you face. Let’s explore how the right software can transform your dealership, providing financial insights, inventory management, and improved customer satisfaction. Consider exploring dealer management systems, accounting software, and financial solutions for optimal performance.

Contents

- 1. How Can Car Dealership Accounts Software Improve Inventory Management?

- 2. How Does the Software Handle Multiple Warehouses?

- 3. What Are the Benefits of Mastering Sales Order Processes with This Software?

- 4. How Does the Purchase Order Feature Streamline Acquisitions?

- 5. How Does Effortless Invoicing Lead to Seamless Sales?

- 6. Why Is Online Credit Card Acceptance Invaluable?

- 7. How Does Managing Money Flow with Accounts Receivable and Payable Help?

- 8. Why Are Bank Reconciliation and Sales Tax Calculations Essential?

- 9. How Do Profit & Loss and Balance Sheet Reports Provide a Financial Snapshot?

- 10. What Benefits Does an Adaptable Dashboard with Responsive Notifications Offer?

- 11. How Do Advanced Controls with User Permissions Enhance Security?

- 12. What Factors Should I Consider When Selecting Car Dealership Accounting Software?

- 13. How Can Real-Time Financial Reporting Benefit My Dealership?

- 14. What Role Does Cloud-Based Accounting Play in Modern Dealerships?

- 15. How Can Software Help With Customer Relationship Management (CRM)?

- 16. What Are the Key Features of a Dealer Management System (DMS)?

- 17. How Important Is Integration With Payment Gateways?

- 18. What Types of Reports Should I Expect From Dealership Accounting Software?

- 19. How Does Automated Expense Tracking Benefit Dealerships?

- 20. What Are the Benefits of Multi-User Access for Accounting Software?

- 21. How Does Mobile Access Enhance Operational Efficiency?

- 22. What Security Measures Should Be in Place to Protect Financial Data?

- 23. How Can I Ensure the Software Is Scalable to Meet Future Needs?

- 24. What Support and Training Options Should Be Available?

- 25. How Can Best Car Dealership Accounts Software Help With Tax Compliance?

- 26. What Should Be Included in the Initial Setup and Implementation Process?

- 27. How Can I Customize the Software to Fit My Dealership’s Unique Needs?

- 28. How Does the Software Handle Vehicle History Reports?

- 29. What Are the Advantages of Using Automated Bank Reconciliations?

- 30. How Can I Monitor and Improve Cash Flow Using Dealership Accounting Software?

- FAQ: Best Car Dealership Accounts Software

- 1. Why is accounting software essential for car dealerships?

- 2. What are the key features to look for in dealership accounting software?

- 3. How can car dealership accounts software improve inventory management?

- 4. What is the role of cloud-based accounting in modern car dealerships?

- 5. How can I ensure the security of my financial data with accounting software?

- 6. Can accounting software help with customer relationship management (CRM)?

- 7. What types of reports should I expect from dealership accounting software?

- 8. How does automated expense tracking benefit car dealerships?

- 9. What are the advantages of multi-user access for accounting software?

- 10. How can mobile access enhance operational efficiency for car dealerships?

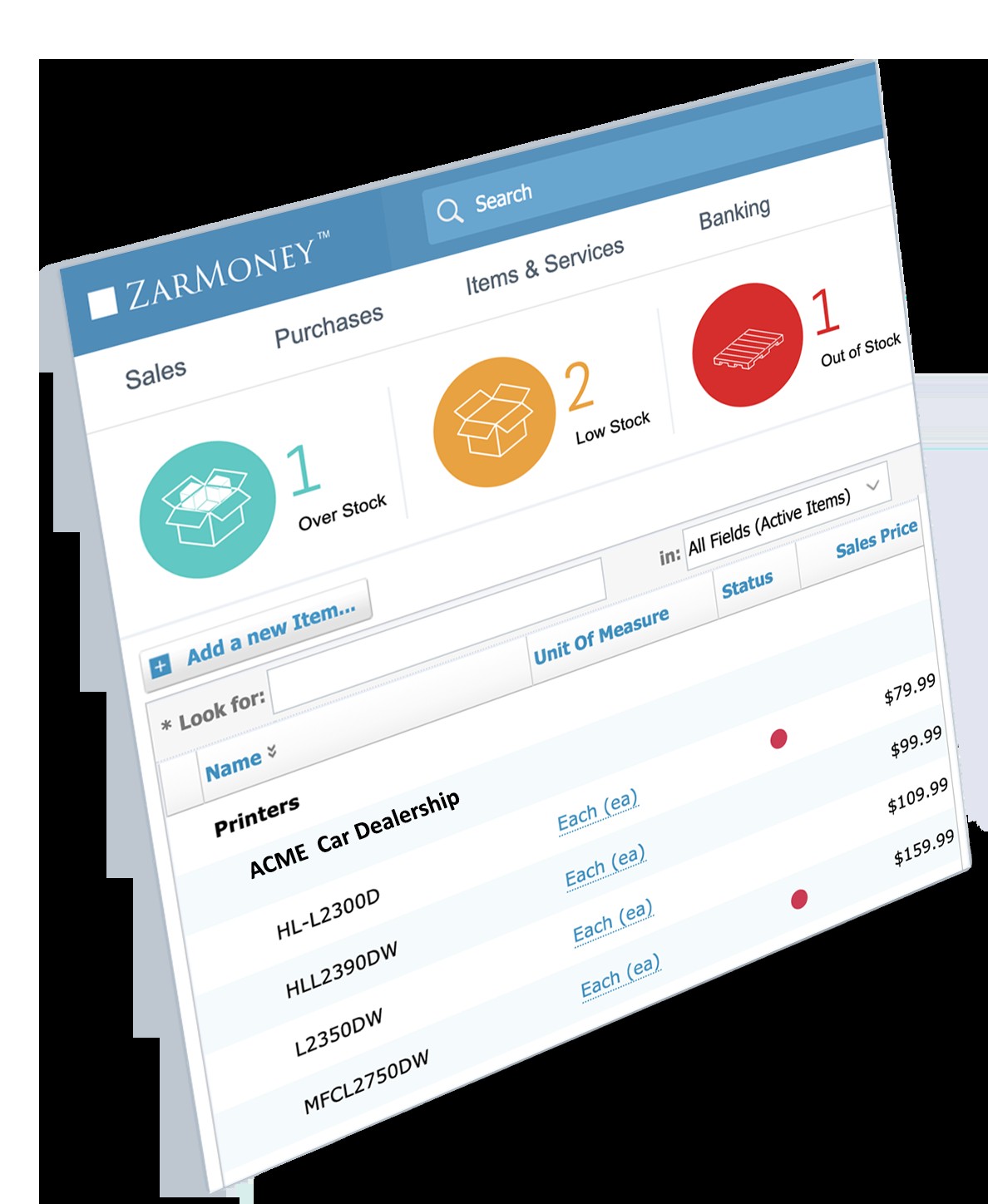

1. How Can Car Dealership Accounts Software Improve Inventory Management?

Car dealership accounts software greatly improves inventory management by providing precise tools to handle new and used cars, parts, and other inventory items. According to a study by the National Automobile Dealers Association (NADA) in 2023, dealerships using specialized inventory management software saw a 15% reduction in carrying costs. This accuracy ensures you can make informed pricing decisions and avoid stockouts or overstock situations.

Managing new car inventory using dealership management software

Managing new car inventory using dealership management software

2. How Does the Software Handle Multiple Warehouses?

The software handles multiple warehouses effectively by allowing you to track inventory across all locations on a single platform, which simplifies daily operations and ensures inventory tracking is always accurate. ZarMoney enables real-time updates on all stock levels across all warehouses and inventories, so you always have the most current information at your fingertips. This is crucial for maintaining optimal stock levels and meeting customer demands efficiently.

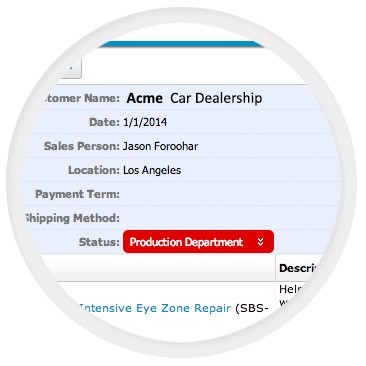

3. What Are the Benefits of Mastering Sales Order Processes with This Software?

Mastering sales order processes with the best car dealership accounts software offers numerous benefits. You can monitor invoice status, streamline the invoicing process, and improve cash flow, ensuring that you never lose track of any deal. According to a 2024 report by Automotive Management Online, dealerships using integrated sales order features experience a 20% increase in sales efficiency. This leads to better customer service and increased profitability.

Sales order management with integrated software

Sales order management with integrated software

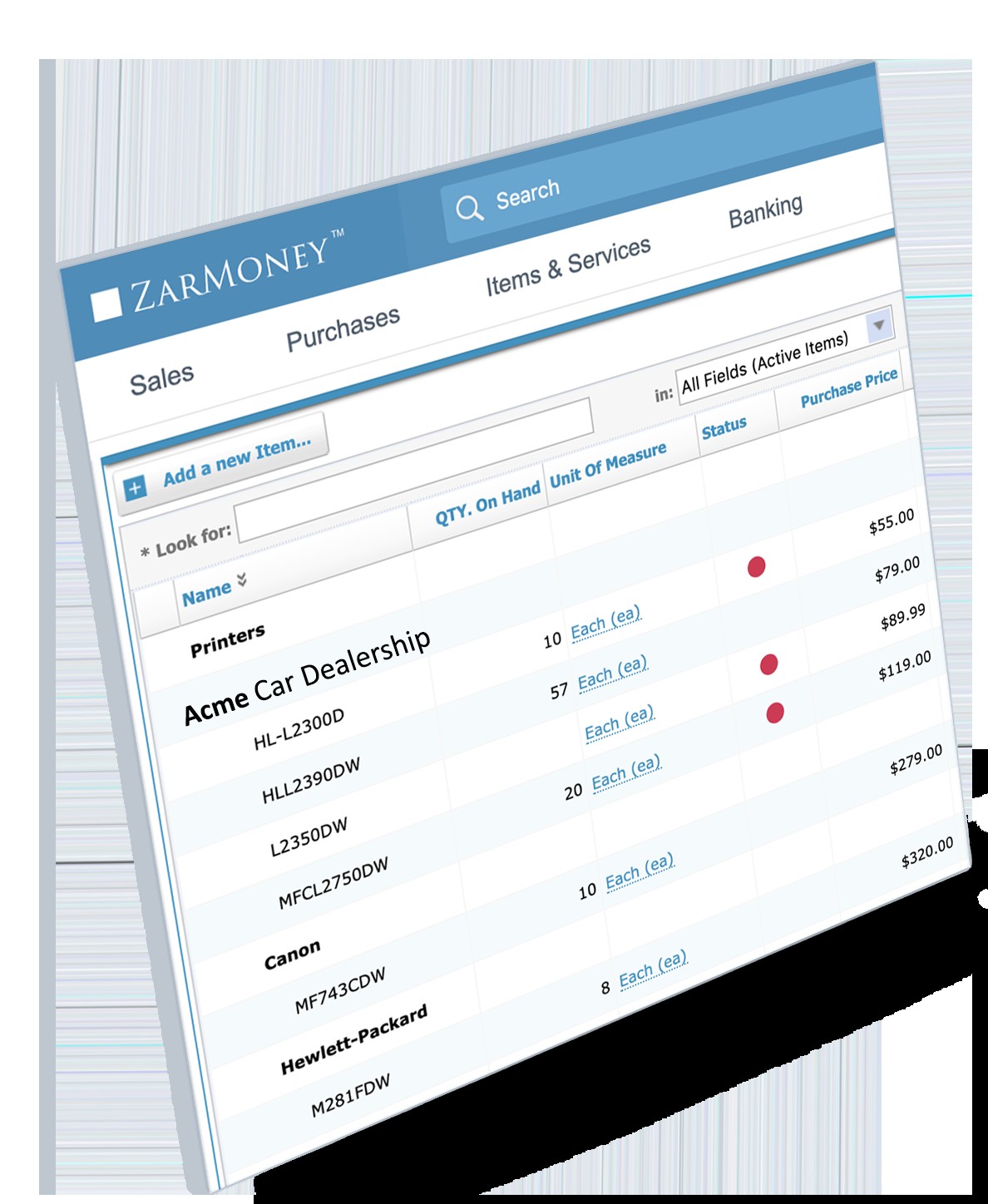

4. How Does the Purchase Order Feature Streamline Acquisitions?

The purchase order feature streamlines acquisitions by simplifying dealings with suppliers and tracking all orders in one place, providing detailed reports on your purchases. This visibility enables you to make intelligent decisions that boost your dealership’s financial performance. Accurate purchase order management can lead to better supplier relationships and more favorable terms.

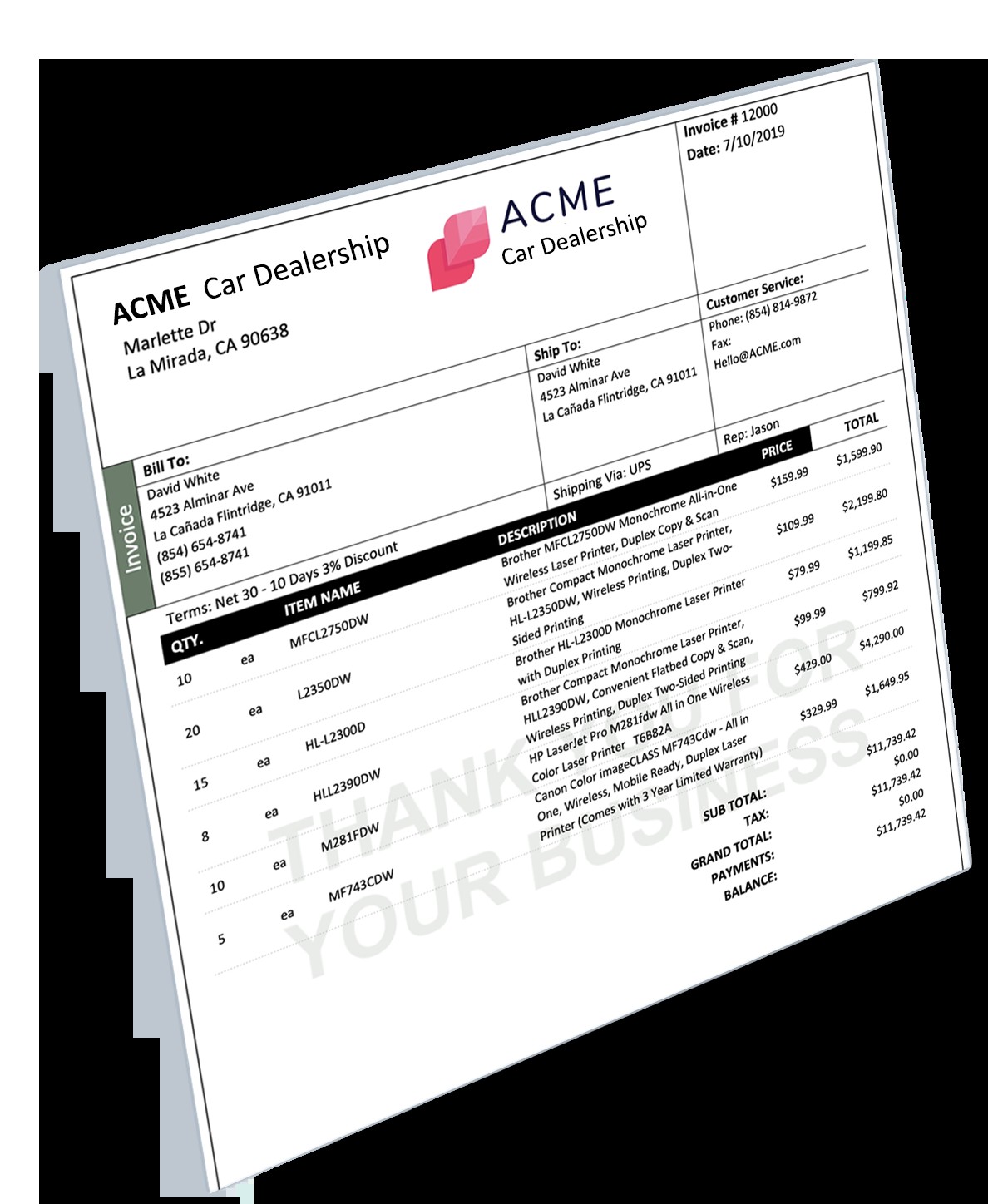

5. How Does Effortless Invoicing Lead to Seamless Sales?

Effortless invoicing leads to seamless sales by making it easy to create professional invoices, which is essential for invoicing customers after car sales or services. The digital invoices enhance your dealership’s professionalism and speed up your invoicing and billing processes, contributing to improved cash flow. Adding your professional logos and business name to your invoices enhances your reputation and outreach.

Creating professional invoices with ease

Creating professional invoices with ease

6. Why Is Online Credit Card Acceptance Invaluable?

Online credit card acceptance is invaluable in today’s digital age because most customers prefer online payments, especially when dealing remotely. This feature enhances customer experiences, which is crucial for successful operations. According to a 2023 survey by Statista, 65% of consumers prefer paying with credit cards online due to convenience and security. Offering this option can significantly boost customer satisfaction and sales.

7. How Does Managing Money Flow with Accounts Receivable and Payable Help?

Managing money flow with accounts receivable (A/R) and accounts payable (A/P) provides a clear picture of your financial position, ensuring accurate records. The A/R feature tracks all customer money owed to the dealership, while the A/P feature manages funds the dealership owes to suppliers and lenders. Together, these features give you a comprehensive overview of your financial health.

Managing accounts receivable and payable efficiently

Managing accounts receivable and payable efficiently

8. Why Are Bank Reconciliation and Sales Tax Calculations Essential?

Bank reconciliation and dealing with sales tax are essential aspects of auto dealership accounting. The best car dealership accounts software shines in these areas with its built-in expense report tool and sales tax management capabilities. These features ensure that your dealership’s records are accurate, compliant with tax laws, and ready for financial reporting. Proper handling of these tasks can prevent costly errors and legal issues.

9. How Do Profit & Loss and Balance Sheet Reports Provide a Financial Snapshot?

Profit & Loss (P&L) and Balance Sheet reports provide insightful details into your dealership’s financial health. P&L reports present a clear picture of your business’s profitability rates, while Balance Sheet reports offer valuable insight into your company’s financial status at a particular time. These reports enable you to make informed business decisions.

Reviewing Profit & Loss statements for financial insights

Reviewing Profit & Loss statements for financial insights

10. What Benefits Does an Adaptable Dashboard with Responsive Notifications Offer?

An adaptable dashboard with responsive notifications offers enhanced functionality and instant visibility into your business performance. You can tailor the dashboard to track your most important metrics at a glance and receive notifications via text and email for real-time updates on various transactions and changes. This ensures you are always aware of your business’s financial situation and can make informed decisions promptly.

11. How Do Advanced Controls with User Permissions Enhance Security?

Advanced controls with user permissions enhance security by providing access control among staff and preventing unauthorized access to sensitive financial data. You can manage who sees what, ensuring your dealership’s financial administration is secure. This is especially important in preventing fraud and protecting confidential information.

Implementing advanced user permissions for data security

Implementing advanced user permissions for data security

12. What Factors Should I Consider When Selecting Car Dealership Accounting Software?

When selecting car dealership accounting software, consider factors like inventory management, integration capabilities, ease of use, reporting features, and customer support. According to a survey by the Digital Dealer Conference in 2024, 80% of dealerships prioritize user-friendliness and comprehensive reporting when choosing software. Ensure the software meets your dealership’s specific needs and can scale with your business.

13. How Can Real-Time Financial Reporting Benefit My Dealership?

Real-time financial reporting provides up-to-date insights into your dealership’s financial performance, enabling quick and informed decisions. This includes monitoring key performance indicators (KPIs), tracking cash flow, and identifying potential issues before they escalate. According to a 2023 study by CFO Research, businesses with real-time financial reporting capabilities improve their decision-making speed by 30%.

14. What Role Does Cloud-Based Accounting Play in Modern Dealerships?

Cloud-based accounting offers numerous benefits, including accessibility from anywhere, automated backups, and reduced IT costs. It also facilitates collaboration among team members and provides enhanced security. A report by the Institute of Management Accountants (IMA) in 2024 showed that 70% of businesses are migrating to cloud-based accounting systems to improve efficiency and reduce operational costs.

15. How Can Software Help With Customer Relationship Management (CRM)?

Software can significantly enhance customer relationship management (CRM) by providing tools to track customer interactions, manage leads, and personalize communications. Integrated CRM features help dealerships build stronger customer relationships, improve customer satisfaction, and drive repeat business. According to a 2023 study by Salesforce, businesses with effective CRM systems see a 25% increase in revenue.

16. What Are the Key Features of a Dealer Management System (DMS)?

Key features of a Dealer Management System (DMS) include inventory management, sales tracking, customer relationship management, service scheduling, and accounting integration. A DMS streamlines dealership operations by providing a centralized platform for managing all aspects of the business. According to a report by Grand View Research, the global DMS market is expected to reach $12.8 billion by 2025, driven by the increasing need for integrated solutions.

17. How Important Is Integration With Payment Gateways?

Integration with payment gateways is crucial for seamless and secure transactions. It allows dealerships to accept various payment methods, automate payment processing, and improve cash flow. Integrated payment gateways also enhance customer convenience and reduce the risk of errors. According to a 2024 study by Visa, businesses that offer multiple payment options see a 20% increase in sales.

18. What Types of Reports Should I Expect From Dealership Accounting Software?

Dealership accounting software should provide a range of reports, including profit and loss statements, balance sheets, cash flow statements, sales reports, inventory reports, and tax reports. These reports offer insights into your dealership’s financial health, sales performance, and operational efficiency. Customizable reporting options allow you to tailor reports to your specific needs.

19. How Does Automated Expense Tracking Benefit Dealerships?

Automated expense tracking simplifies the process of recording and categorizing expenses, reducing manual effort and minimizing errors. It also provides real-time visibility into spending patterns, helping dealerships identify cost-saving opportunities and improve budget management. According to a 2023 report by Aberdeen Group, businesses that automate expense tracking reduce processing costs by 50%.

20. What Are the Benefits of Multi-User Access for Accounting Software?

Multi-user access allows multiple team members to access the accounting software simultaneously, facilitating collaboration and improving efficiency. It ensures that everyone has access to the information they need, when they need it. Role-based access controls allow you to manage user permissions and protect sensitive data. According to a 2024 survey by PwC, 65% of businesses consider multi-user access a critical feature of accounting software.

21. How Does Mobile Access Enhance Operational Efficiency?

Mobile access enables dealership staff to monitor financial transactions, sales processes, and inventory levels from anywhere, using smartphones or tablets. This ensures real-time insights and improves operational efficiency, allowing for quick responses to customer inquiries and on-the-go decision-making. According to a 2023 report by Deloitte, businesses with mobile-enabled processes see a 20% increase in productivity.

22. What Security Measures Should Be in Place to Protect Financial Data?

To protect financial data, dealership accounting software should implement robust security measures, including data encryption, two-factor authentication, regular security audits, and compliance with industry standards. These measures help prevent unauthorized access and ensure the confidentiality and integrity of financial information. According to a 2024 report by IBM, the average cost of a data breach is $4.24 million, highlighting the importance of strong security measures.

23. How Can I Ensure the Software Is Scalable to Meet Future Needs?

To ensure the software is scalable, choose a solution that offers flexible pricing plans, customizable features, and the ability to handle increasing transaction volumes and data storage needs. Cloud-based solutions are generally more scalable than on-premise systems. Regularly review your software needs and upgrade as necessary.

24. What Support and Training Options Should Be Available?

Comprehensive support and training options are essential for successful software implementation and ongoing use. Look for software providers that offer online documentation, video tutorials, live chat support, and phone support. Training sessions should cover all aspects of the software, from basic setup to advanced features.

25. How Can Best Car Dealership Accounts Software Help With Tax Compliance?

Best car dealership accounts software helps with tax compliance by providing accurate financial reporting, automated tax calculations, and tools for preparing tax returns. It also ensures compliance with relevant tax laws and regulations, reducing the risk of errors and penalties. Regular software updates keep the system aligned with the latest tax requirements.

26. What Should Be Included in the Initial Setup and Implementation Process?

The initial setup and implementation process should include data migration, system configuration, user training, and testing. Work closely with the software provider to ensure a smooth transition and minimize disruption to your dealership’s operations. A well-planned implementation process can significantly improve user adoption and maximize the benefits of the software.

27. How Can I Customize the Software to Fit My Dealership’s Unique Needs?

Customization options can include creating custom reports, configuring user roles and permissions, setting up custom workflows, and integrating with other software systems. Choose software that offers a flexible and customizable platform to meet your specific requirements.

28. How Does the Software Handle Vehicle History Reports?

The software handles vehicle history reports by integrating with services like Carfax and AutoCheck, providing detailed information on a vehicle’s past, including accidents, repairs, and ownership history. This helps dealerships make informed decisions about purchasing and selling vehicles and provides transparency to customers.

29. What Are the Advantages of Using Automated Bank Reconciliations?

Automated bank reconciliations save time and reduce errors by automatically matching transactions between your bank statements and accounting records. This ensures accurate financial reporting and helps identify discrepancies quickly. According to a 2023 report by the American Institute of Certified Public Accountants (AICPA), businesses that automate bank reconciliations reduce reconciliation time by 60%.

30. How Can I Monitor and Improve Cash Flow Using Dealership Accounting Software?

You can monitor and improve cash flow by tracking accounts receivable, managing accounts payable, generating cash flow forecasts, and identifying opportunities to reduce expenses and increase revenue. The software should provide tools for analyzing cash flow trends and making informed decisions to optimize your dealership’s financial performance.

Choosing the best car dealership accounts software is essential for improving financial operations, ensuring tax compliance, and making informed business decisions. At CAR-REMOTE-REPAIR.EDU.VN, we understand the challenges you face and offer specialized training and support to help you maximize the benefits of your chosen software. Our courses provide in-depth knowledge of accounting principles, inventory management, and financial reporting, tailored to the automotive industry.

-Feb-17-2025-08-19-58-1246-PM.png)

FAQ: Best Car Dealership Accounts Software

1. Why is accounting software essential for car dealerships?

Accounting software is essential for car dealerships because it streamlines financial operations, ensures accurate record-keeping, and helps with tax compliance. It also provides real-time insights into the dealership’s financial performance.

2. What are the key features to look for in dealership accounting software?

Key features include inventory management, sales tracking, customer relationship management, service scheduling, accounting integration, and robust reporting capabilities.

3. How can car dealership accounts software improve inventory management?

It can track inventory levels, manage stock across multiple warehouses, and provide real-time updates on inventory levels, ensuring accurate stock control and preventing stockouts or overstock situations.

4. What is the role of cloud-based accounting in modern car dealerships?

Cloud-based accounting offers accessibility from anywhere, automated backups, reduced IT costs, and enhanced collaboration among team members, improving efficiency and reducing operational costs.

5. How can I ensure the security of my financial data with accounting software?

Ensure the software implements robust security measures, including data encryption, two-factor authentication, regular security audits, and compliance with industry standards.

6. Can accounting software help with customer relationship management (CRM)?

Yes, accounting software can integrate with CRM systems to track customer interactions, manage leads, personalize communications, and improve customer satisfaction.

7. What types of reports should I expect from dealership accounting software?

You should expect profit and loss statements, balance sheets, cash flow statements, sales reports, inventory reports, tax reports, and customizable reporting options.

8. How does automated expense tracking benefit car dealerships?

Automated expense tracking simplifies the process of recording and categorizing expenses, reducing manual effort and minimizing errors, while providing real-time visibility into spending patterns.

9. What are the advantages of multi-user access for accounting software?

Multi-user access allows multiple team members to access the accounting software simultaneously, facilitating collaboration and improving efficiency, with role-based access controls to manage user permissions.

10. How can mobile access enhance operational efficiency for car dealerships?

Mobile access enables dealership staff to monitor financial transactions, sales processes, and inventory levels from anywhere, ensuring real-time insights and improving operational efficiency.

Ready to revolutionize your dealership’s financial management? Visit CAR-REMOTE-REPAIR.EDU.VN today to explore our specialized training courses and discover how the best car dealership accounts software can transform your business. Our expert instructors are here to guide you through every step, ensuring you maximize the benefits of your chosen software. Contact us at +1 (641) 206-8880 or visit our location at 1700 W Irving Park Rd, Chicago, IL 60613, United States. Let CAR-REMOTE-REPAIR.EDU.VN help you drive success in the automotive industry!