Financial Analysis Software For Auto Care Franchises is vital for understanding and optimizing business performance. CAR-REMOTE-REPAIR.EDU.VN offers training to master these tools, enhancing your financial management skills and boosting profitability. By leveraging financial KPIs and robust software, you can gain insights, make informed decisions, and drive your auto care franchise towards greater success. Explore inventory management, pricing strategies, and cost reduction.

Contents

- 1. Why Is Financial Analysis Software Important for Auto Care Franchises?

- 1.1. What Are The Key Benefits Of Using Financial Analysis Software?

- 1.2. How Does Financial Analysis Software Streamline Operations?

- 1.3. Why Is Data-Driven Decision-Making Critical?

- 2. Understanding Key Performance Indicators (KPIs) for Auto Care Franchises

- 2.1. What Are The Primary KPIs for Auto Care Franchises?

- 2.2. How Does Revenue Impact The Auto Care Franchise?

- 2.3. What Are The Ways To Use Data To Optimize Revenue?

- 2.4. How Is Gross Profit Measured In Auto Care Franchises?

- 2.5. What Does A Declining Gross Profit Margin Indicate?

- 2.6. What Is Net Profit And How Is It Calculated?

- 2.7. Why Is Comparing Net Profit To Industry Benchmarks Important?

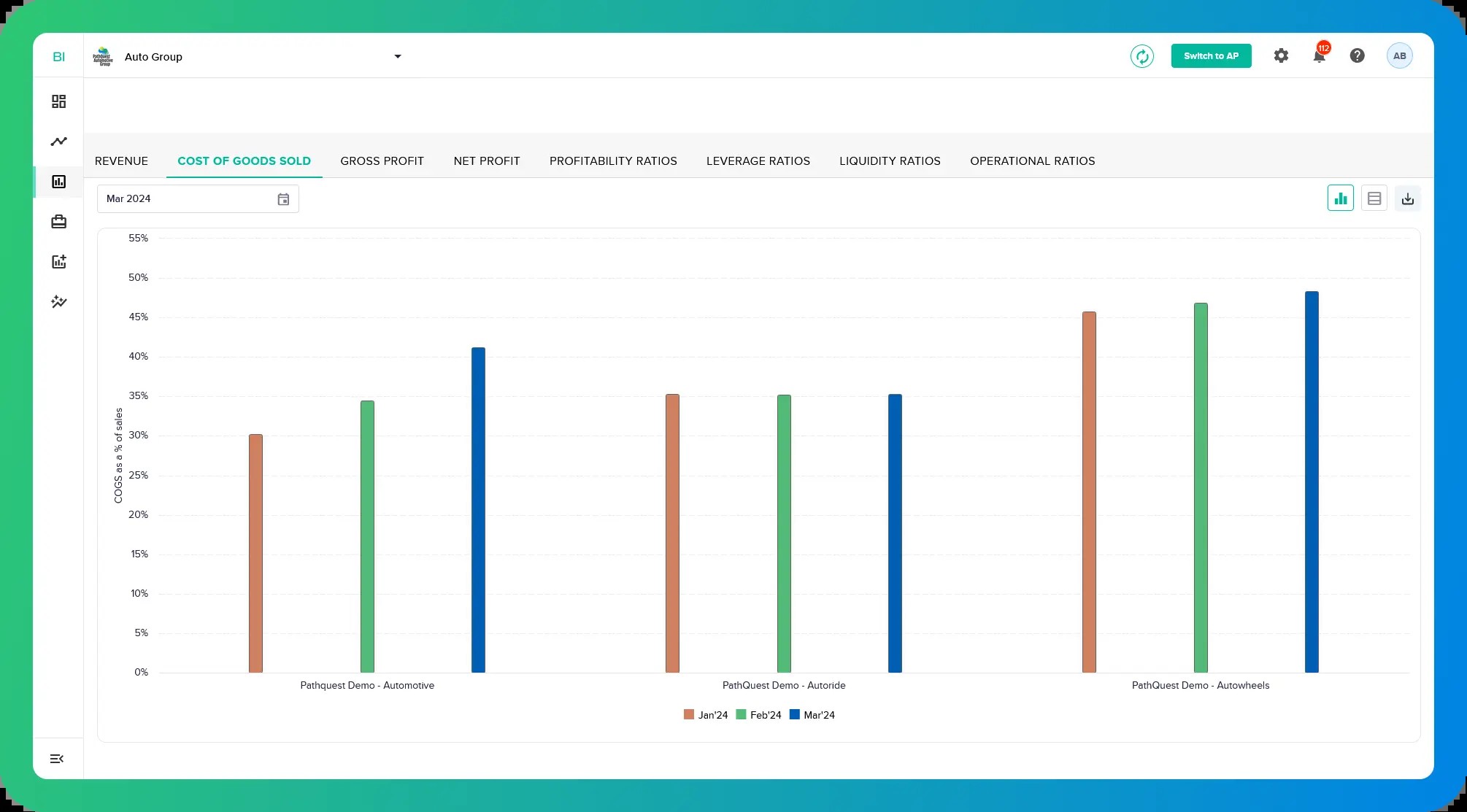

- 2.8. What Does COGS Include In Auto Care Franchises?

- 2.9. How Can Tracking COGS By Category Improve Efficiency?

- 2.10. How Do Financial Ratios Provide Valuable Insights?

- 2.11. What Do Profitability Ratios Reveal About Auto Care Franchises?

- 2.12. What Do Leverage Ratios Measure?

- 2.13. How Do Liquidity Ratios Help Manage Finances?

- 2.14. What Kind Of Insights Do Operational Ratios Provide?

- 3. Essential Features of Financial Analysis Software for Auto Care Franchises

- 3.1. Why Is Real-Time Reporting Important?

- 3.2. What Type Of Information Should Real-Time Reports Include?

- 3.3. How Do KPI Dashboards Help In Financial Management?

- 3.4. What Are The Benefits Of Monitoring KPIs Through Dashboards?

- 3.5. What Role Do Budgeting And Forecasting Play In Financial Analysis?

- 3.6. How Can Franchise Owners Use Budgeting Tools Effectively?

- 3.7. What Is The Importance Of Forecasting In Financial Planning?

- 3.8. Why Is Integration Capability Important For Financial Analysis Software?

- 3.9. What Are The Benefits Of Integrating Accounting Software With Financial Analysis Tools?

- 3.10. How Does Integration With Inventory Management Systems Improve Operations?

- 3.11. What Type Of Benefits Are Obtained Through CRM Integration?

- 4. Top Financial Analysis Software Options for Auto Care Franchises

- 4.1. What Are The Leading Financial Analysis Software Solutions?

- 4.2. How Does QuickBooks Benefit Auto Care Franchises?

- 4.3. What Accounting Features Does QuickBooks Include?

- 4.4. How Does Xero Compare To Other Financial Analysis Software?

- 4.5. What Integrations Does Xero Offer?

- 4.6. What Are The Benefits Of Sage Intacct For Larger Franchises?

- 4.7. What Advanced Reporting Capabilities Does Sage Intacct Provide?

- 4.8. What Makes Shop-Ware A Suitable Option For Auto Care Businesses?

- 4.9. What Management Features Does Shop-Ware Include?

- 4.10. How Does Mitchell 1 Help In Managing Auto Care Operations?

- 4.11. What Type Of Diagnostic Information Does Mitchell 1 Provide?

- 5. Implementing Financial Analysis Software in Your Auto Care Franchise

- 5.1. What Are The Steps Involved In Implementing Financial Analysis Software?

- 5.2. Why Is Assessing Your Needs Important Before Choosing Software?

- 5.3. What Type Of Questions Should You Ask When Assessing Your Needs?

- 5.4. What Preparations Are Needed Before Migrating Data To The New Software?

- 5.5. Why Is Data Validation Important?

- 5.6. How Can You Train Staff To Use The New Software Effectively?

- 5.7. What Type Of Training Methods Should Be Used?

- 5.8. Why Is Monitoring Performance Important After Implementation?

- 5.9. What Metrics Should Be Tracked To Assess Software Effectiveness?

- 6. Maximizing the Benefits of Financial Analysis Software

- 6.1. How Can Financial Analysis Software Be Used For Strategic Planning?

- 6.2. What Is The Role Of Market Trend Analysis?

- 6.3. How Can Profitability Driver Analysis Help In Decision-Making?

- 6.4. What Strategies Can Improve Customer Retention?

- 6.5. How Does Regular Financial Review Help In Identifying Issues?

- 6.6. What Type Of Reporting Is Essential For Regular Financial Review?

- 6.7. What Benchmarking Strategies Can Be Used To Improve Performance?

- 6.8. How Can Performance Be Compared Against Industry Standards?

- 6.9. Why Is Continuous Improvement Important For Long-Term Success?

- 6.10. What Strategies Can Improve Employee Engagement?

- 7. Training and Support for Financial Analysis Software

- 7.1. What Training Resources Are Available For Financial Analysis Software?

- 7.2. How Do Online Tutorials Help In Learning Software?

- 7.3. What Information Should Be Included In User Manuals?

- 7.4. What Are The Benefits Of Attending Webinars?

- 7.5. How Do In-Person Training Sessions Benefit Auto Care Franchises?

- 7.6. What Type Of Ongoing Support Should Be Provided To Software Users?

- 7.7. How Can A Help Desk Assist Software Users?

- 7.8. Why Is Technical Support Important For Financial Analysis Software?

- 7.9. How Do Software Updates Improve Performance?

- 7.10. What Role Does Vendor Support Play In Software Training?

- 8. Future Trends in Financial Analysis Software for Auto Care Franchises

- 8.1. What Are The Emerging Trends In Financial Analysis Technology?

- 8.2. How Is AI Transforming Financial Analysis?

- 8.3. What Role Does Machine Learning Play In Financial Forecasting?

- 8.4. How Does Predictive Analytics Benefit Auto Care Franchises?

- 8.5. What Security Benefits Does Blockchain Offer?

- 8.6. How Are Cloud-Based Solutions Improving Accessibility?

- 8.7. What Are The Cost Savings Associated With Cloud-Based Software?

- 8.8. What Integrations Can Be Expected In Future Financial Analysis Software?

- 8.9. How Can Telematics Systems Improve Financial Analysis?

- 9. Case Studies: Success Stories of Auto Care Franchises Using Financial Analysis Software

- 9.1. What Are Some Notable Success Stories Of Software Implementation?

- 9.2. How Did One Franchise Improve Profitability With Software?

- 9.3. How Did Another Franchise Increase Efficiency?

- 9.4. What Role Did Data Integration Play In Improving Business?

- 9.5. How Did Some Franchises Improve Customer Satisfaction?

- 9.6. What Strategies Did They Use To Retain Customers?

- 9.7. How Did Some Franchises Optimize Inventory Management?

- 9.8. What Cost-Saving Measures Did Franchises Take?

- 10. Frequently Asked Questions (FAQs) About Financial Analysis Software for Auto Care Franchises

- 10.1. What Is Financial Analysis Software?

- 10.2. Why Do Auto Care Franchises Need Financial Analysis Software?

- 10.3. What Are The Key Features To Look For In Financial Analysis Software?

- 10.4. How Much Does Financial Analysis Software Cost?

- 10.5. Is It Difficult To Implement Financial Analysis Software?

- 10.6. How Long Does It Take To See A Return On Investment (ROI)?

- 10.7. Can Financial Analysis Software Help With Tax Compliance?

- 10.8. Is Financial Analysis Software Secure?

- 10.9. Can Financial Analysis Software Integrate With Other Business Systems?

- 10.10. How Can I Get Started With Financial Analysis Software For My Auto Care Franchise?

1. Why Is Financial Analysis Software Important for Auto Care Franchises?

Financial analysis software is exceptionally important for auto care franchises because it provides critical insights into financial performance, helps streamline operations, and supports data-driven decision-making. Auto care franchises deal with numerous financial variables, including labor costs, parts inventory, customer billing, and overhead expenses. Managing these elements manually can be overwhelming and prone to errors.

1.1. What Are The Key Benefits Of Using Financial Analysis Software?

There are many key benefits to using financial analysis software including improved accuracy, time savings, and better decision-making. A study by the Automotive Management Institute (AMI) shows that franchises using financial analysis software report a 25% increase in profitability due to optimized resource allocation and cost management.

1.2. How Does Financial Analysis Software Streamline Operations?

Financial analysis software streamlines operations by automating data collection, generating real-time reports, and providing a consolidated view of financial metrics. According to a report by the National Automobile Dealers Association (NADA), businesses that automate financial processes experience a 30% reduction in administrative costs and improved operational efficiency.

1.3. Why Is Data-Driven Decision-Making Critical?

Data-driven decision-making is critical because it allows franchise owners to make informed choices based on concrete data rather than intuition. Research from the University of Michigan’s Ross School of Business indicates that companies using data-driven strategies are 23 times more likely to acquire customers and six times more likely to retain them.

2. Understanding Key Performance Indicators (KPIs) for Auto Care Franchises

Understanding Key Performance Indicators or KPIs is essential for auto care franchises to measure performance and identify areas for improvement. KPIs provide actionable insights into various aspects of the business, from revenue and profitability to operational efficiency and customer satisfaction.

2.1. What Are The Primary KPIs for Auto Care Franchises?

The primary KPIs for auto care franchises include revenue, gross profit, net profit, Cost of Goods Sold (COGS), customer retention rate, and employee productivity. A survey by the Automotive Aftermarket Industry Association (AAIA) highlights that tracking these KPIs enables franchises to pinpoint strengths and weaknesses, leading to strategic adjustments.

2.2. How Does Revenue Impact The Auto Care Franchise?

Revenue Impact

Revenue Impact

Revenue is a fundamental KPI that reflects the total income generated from all services and sales. Financial analysis software can categorize revenue by service type, enabling franchise owners to identify their most profitable offerings. For example, engine repairs might generate significantly more revenue than routine maintenance services like oil changes.

2.3. What Are The Ways To Use Data To Optimize Revenue?

To optimize revenue you can adjust pricing strategies, and focus marketing efforts on high-yield services. The insights provided by financial analysis software help in making informed decisions to boost overall revenue.

2.4. How Is Gross Profit Measured In Auto Care Franchises?

Gross profit is the difference between revenue and the Cost of Goods Sold (COGS). It indicates how efficiently a franchise manages its direct costs associated with providing services. Monitoring gross profit margin over time helps identify trends and potential issues.

2.5. What Does A Declining Gross Profit Margin Indicate?

A declining gross profit margin may suggest a need to re-evaluate pricing strategies or reduce COGS through better supplier negotiations or inventory management. Financial analysis software provides the tools to track and analyze these factors effectively.

2.6. What Is Net Profit And How Is It Calculated?

Net profit is the bottom line, representing the actual profit remaining after deducting all expenses, including rent, salaries, utilities, and taxes. Financial analysis software simplifies net profit calculation and allows for comparisons against industry benchmarks, year-to-date figures, and budgeted targets.

2.7. Why Is Comparing Net Profit To Industry Benchmarks Important?

Comparing net profit to industry benchmarks provides insights into how well the franchise is performing relative to its peers. This comparison can highlight areas where the franchise excels or areas needing improvement to achieve competitive performance.

2.8. What Does COGS Include In Auto Care Franchises?

COGS includes the cost of parts, materials, and labor directly involved in providing auto care services. Financial analysis software tracks COGS by category, such as engine parts, brakes, and fluids, enabling franchise owners to identify cost-saving opportunities.

2.9. How Can Tracking COGS By Category Improve Efficiency?

Tracking COGS by category helps in negotiating better deals with suppliers, optimizing inventory levels, and reducing waste. Detailed COGS analysis can lead to significant cost reductions and improved profitability.

2.10. How Do Financial Ratios Provide Valuable Insights?

Financial ratios offer a deeper understanding of a franchise’s financial health by comparing different aspects of its performance. Key ratios include profitability ratios, leverage ratios, liquidity ratios, and operational ratios.

2.11. What Do Profitability Ratios Reveal About Auto Care Franchises?

Profitability ratios, such as gross profit margin and net profit margin, show how efficiently a franchise converts revenue into profit. Monitoring these ratios helps in assessing the effectiveness of pricing strategies and cost management.

2.12. What Do Leverage Ratios Measure?

Leverage ratios measure the extent to which a franchise relies on debt financing and its ability to meet debt obligations. Analyzing leverage ratios is crucial for maintaining financial stability and avoiding excessive debt.

2.13. How Do Liquidity Ratios Help Manage Finances?

Liquidity ratios, including current ratio, quick ratio, and working capital, provide insights into a franchise’s ability to meet short-term obligations. Maintaining healthy liquidity ratios ensures that the franchise can cover its immediate liabilities.

2.14. What Kind Of Insights Do Operational Ratios Provide?

Operational ratios, such as accounts payable outstanding and accounts receivable outstanding, offer insights into how efficiently a franchise manages its working capital. Optimizing these ratios can improve cash flow and operational efficiency.

3. Essential Features of Financial Analysis Software for Auto Care Franchises

Essential features of financial analysis software for auto care franchises are designed to streamline financial management, improve decision-making, and enhance overall operational efficiency. These features include real-time reporting, KPI dashboards, budgeting and forecasting, and integration capabilities.

3.1. Why Is Real-Time Reporting Important?

Real-time reporting is essential because it provides up-to-date financial data, enabling franchise owners to monitor performance and make timely adjustments. According to a study by McKinsey, companies that use real-time data for decision-making outperform their peers by 20%.

3.2. What Type Of Information Should Real-Time Reports Include?

Real-time reports should include revenue, expenses, profit margins, and cash flow, allowing franchise owners to identify trends and address issues promptly. With CAR-REMOTE-REPAIR.EDU.VN, you’ll learn how to interpret these reports effectively.

3.3. How Do KPI Dashboards Help In Financial Management?

KPI dashboards offer a visual representation of key performance indicators, making it easy to track progress and identify areas needing attention. A survey by Bain & Company found that companies using KPI dashboards experience a 15% improvement in decision-making speed.

3.4. What Are The Benefits Of Monitoring KPIs Through Dashboards?

Monitoring KPIs through dashboards allows franchise owners to quickly assess the health of their business and make informed decisions. These dashboards provide a comprehensive overview of financial performance, highlighting key metrics and trends.

3.5. What Role Do Budgeting And Forecasting Play In Financial Analysis?

Budgeting and forecasting tools enable franchise owners to create financial plans, set targets, and predict future performance. A study by the Hackett Group shows that companies using budgeting and forecasting software achieve a 10% reduction in budget cycle time and improved accuracy.

3.6. How Can Franchise Owners Use Budgeting Tools Effectively?

Franchise owners can use budgeting tools to allocate resources efficiently, manage expenses, and plan for growth. Effective budgeting helps in maintaining financial discipline and achieving strategic goals.

3.7. What Is The Importance Of Forecasting In Financial Planning?

Forecasting is crucial for anticipating future financial performance and making proactive decisions. Accurate forecasts enable franchise owners to prepare for potential challenges and capitalize on opportunities.

3.8. Why Is Integration Capability Important For Financial Analysis Software?

Integration capability is important because it allows financial analysis software to connect with other business systems, such as accounting software, inventory management systems, and CRM platforms. A report by Forrester indicates that integrated systems improve data accuracy by 25% and reduce manual data entry by 30%.

3.9. What Are The Benefits Of Integrating Accounting Software With Financial Analysis Tools?

Integrating accounting software with financial analysis tools ensures seamless data flow, reduces errors, and provides a holistic view of financial performance. This integration streamlines financial processes and improves overall efficiency.

3.10. How Does Integration With Inventory Management Systems Improve Operations?

Integration with inventory management systems allows for real-time tracking of parts and supplies, optimizing inventory levels and reducing costs. This integration ensures that franchise owners have accurate information on hand to make informed purchasing decisions.

3.11. What Type Of Benefits Are Obtained Through CRM Integration?

CRM integration provides insights into customer behavior and preferences, enabling franchise owners to tailor their services and marketing efforts. This integration helps in improving customer satisfaction and driving revenue growth.

4. Top Financial Analysis Software Options for Auto Care Franchises

Choosing the right financial analysis software is critical for auto care franchises to effectively manage their finances and drive profitability. Several software options cater specifically to the needs of auto care businesses, offering a range of features and capabilities.

4.1. What Are The Leading Financial Analysis Software Solutions?

Leading financial analysis software solutions include QuickBooks, Xero, Sage Intacct, and specialized auto care software like Shop-Ware and Mitchell 1. These platforms offer robust features tailored to the unique needs of auto care franchises.

4.2. How Does QuickBooks Benefit Auto Care Franchises?

QuickBooks is a popular choice due to its ease of use, comprehensive accounting features, and extensive integration capabilities. According to Intuit, over 80% of small businesses use QuickBooks for their accounting needs.

4.3. What Accounting Features Does QuickBooks Include?

QuickBooks includes features such as invoicing, expense tracking, financial reporting, and payroll management. Its user-friendly interface and extensive support resources make it a suitable option for auto care franchises.

4.4. How Does Xero Compare To Other Financial Analysis Software?

Xero is another popular cloud-based accounting software known for its intuitive interface and strong mobile capabilities. A survey by Xero indicates that its users experience a 35% reduction in accounting-related tasks due to automation features.

4.5. What Integrations Does Xero Offer?

Xero offers integrations with various third-party apps, including CRM systems, inventory management tools, and payment gateways. Its flexibility and scalability make it a good fit for growing auto care franchises.

4.6. What Are The Benefits Of Sage Intacct For Larger Franchises?

Sage Intacct is a more advanced financial management platform designed for larger and more complex franchises. It offers robust features such as multi-entity consolidation, advanced reporting, and revenue recognition.

4.7. What Advanced Reporting Capabilities Does Sage Intacct Provide?

Sage Intacct provides advanced reporting capabilities that enable franchise owners to gain deeper insights into their financial performance. Its scalability and customization options make it a suitable choice for larger auto care franchises.

4.8. What Makes Shop-Ware A Suitable Option For Auto Care Businesses?

Shop-Ware is a specialized software solution tailored specifically for auto care businesses. It offers features such as shop management, customer relationship management, and financial reporting.

4.9. What Management Features Does Shop-Ware Include?

Shop-Ware includes shop management features that streamline operations and improve efficiency. Its integration with accounting software and parts suppliers makes it a comprehensive solution for auto care franchises.

4.10. How Does Mitchell 1 Help In Managing Auto Care Operations?

Mitchell 1 is another specialized software solution that provides diagnostic information, repair procedures, and shop management tools. It helps auto care franchises improve their service quality and operational efficiency.

4.11. What Type Of Diagnostic Information Does Mitchell 1 Provide?

Mitchell 1 provides diagnostic information and repair procedures that help technicians accurately diagnose and repair vehicles. Its integration with financial analysis software allows for seamless tracking of costs and profitability.

5. Implementing Financial Analysis Software in Your Auto Care Franchise

Implementing financial analysis software in your auto care franchise involves careful planning, training, and execution to ensure a smooth transition and maximize the benefits. A structured approach can help franchise owners effectively integrate the new system into their operations.

5.1. What Are The Steps Involved In Implementing Financial Analysis Software?

The steps involved in implementing financial analysis software include assessing your needs, selecting the right software, preparing your data, training your staff, and monitoring performance. Following a structured approach ensures a successful implementation.

5.2. Why Is Assessing Your Needs Important Before Choosing Software?

Assessing your needs is crucial for identifying the specific requirements of your auto care franchise. This assessment helps in selecting software that aligns with your business goals and operational needs.

5.3. What Type Of Questions Should You Ask When Assessing Your Needs?

Questions to consider include: What are your current financial challenges? What KPIs do you need to track? What integrations are required? What is your budget for financial analysis software?

5.4. What Preparations Are Needed Before Migrating Data To The New Software?

Data preparation involves cleaning, organizing, and validating your existing financial data. Ensuring data accuracy is crucial for generating reliable reports and insights from the new software.

5.5. Why Is Data Validation Important?

Data validation helps in identifying and correcting errors in your existing financial data. Accurate data is essential for generating reliable reports and insights from the new software.

5.6. How Can You Train Staff To Use The New Software Effectively?

Training your staff involves providing comprehensive training sessions, creating user manuals, and offering ongoing support. Ensuring that your staff is proficient in using the software is crucial for maximizing its benefits.

5.7. What Type Of Training Methods Should Be Used?

Training methods include hands-on workshops, online tutorials, and one-on-one coaching. Tailoring the training approach to meet the needs of different staff members is essential.

5.8. Why Is Monitoring Performance Important After Implementation?

Monitoring performance after implementation involves tracking key metrics to assess the effectiveness of the new software. Regular monitoring helps in identifying areas for improvement and optimizing the use of the software.

5.9. What Metrics Should Be Tracked To Assess Software Effectiveness?

Metrics to track include time savings, data accuracy, report generation speed, and user satisfaction. These metrics provide insights into the impact of the new software on your operations.

6. Maximizing the Benefits of Financial Analysis Software

Maximizing the benefits of financial analysis software requires continuous effort, strategic utilization, and a commitment to leveraging its capabilities. Auto care franchises can unlock significant value by integrating financial analysis into their daily operations.

6.1. How Can Financial Analysis Software Be Used For Strategic Planning?

Financial analysis software can be used for strategic planning by providing insights into market trends, profitability drivers, and growth opportunities. This information helps franchise owners make informed decisions about resource allocation and strategic initiatives.

6.2. What Is The Role Of Market Trend Analysis?

Market trend analysis helps in identifying emerging trends and potential challenges in the auto care industry. Understanding market trends allows franchise owners to adapt their strategies and stay ahead of the competition.

6.3. How Can Profitability Driver Analysis Help In Decision-Making?

Profitability driver analysis helps in identifying the factors that contribute to profitability, such as service pricing, cost management, and customer retention. Focusing on these drivers can improve overall profitability.

6.4. What Strategies Can Improve Customer Retention?

Strategies to improve customer retention include providing excellent service, offering loyalty programs, and communicating regularly with customers. Loyal customers are more likely to return for future services.

6.5. How Does Regular Financial Review Help In Identifying Issues?

Regular financial review helps in identifying issues such as declining profit margins, increasing costs, and cash flow problems. Addressing these issues promptly can prevent them from escalating.

6.6. What Type Of Reporting Is Essential For Regular Financial Review?

Essential reporting for regular financial review includes income statements, balance sheets, cash flow statements, and KPI dashboards. These reports provide a comprehensive overview of financial performance.

6.7. What Benchmarking Strategies Can Be Used To Improve Performance?

Benchmarking involves comparing your franchise’s performance against industry standards and best practices. Identifying areas where your franchise lags behind can highlight opportunities for improvement.

6.8. How Can Performance Be Compared Against Industry Standards?

Performance can be compared against industry standards by using data from industry associations, market research reports, and competitor analysis. This comparison provides insights into your franchise’s relative performance.

6.9. Why Is Continuous Improvement Important For Long-Term Success?

Continuous improvement is essential for long-term success because it helps in adapting to changing market conditions and staying ahead of the competition. Implementing a culture of continuous improvement ensures that your franchise remains competitive.

6.10. What Strategies Can Improve Employee Engagement?

Strategies to improve employee engagement include providing opportunities for professional development, recognizing and rewarding employee contributions, and fostering a positive work environment. Engaged employees are more productive and contribute to better customer service.

7. Training and Support for Financial Analysis Software

Training and support are vital components of successfully implementing and utilizing financial analysis software in auto care franchises. Proper training ensures that staff can effectively use the software, while ongoing support addresses any issues and optimizes performance.

7.1. What Training Resources Are Available For Financial Analysis Software?

Training resources available for financial analysis software include online tutorials, user manuals, webinars, and in-person training sessions. Choosing the right training approach depends on the software and the needs of your staff.

7.2. How Do Online Tutorials Help In Learning Software?

Online tutorials provide step-by-step instructions and demonstrations of how to use the software. These tutorials can be accessed at any time, making them a convenient learning resource.

7.3. What Information Should Be Included In User Manuals?

User manuals should include detailed instructions on how to perform various tasks, troubleshoot common issues, and customize settings. Clear and concise user manuals help staff quickly find the information they need.

7.4. What Are The Benefits Of Attending Webinars?

Attending webinars provides opportunities to learn from experts, ask questions, and interact with other users. Webinars can cover a range of topics, from basic software functionality to advanced reporting techniques.

7.5. How Do In-Person Training Sessions Benefit Auto Care Franchises?

In-person training sessions provide hands-on experience and personalized instruction. These sessions allow staff to learn from experienced trainers and practice using the software in a controlled environment.

7.6. What Type Of Ongoing Support Should Be Provided To Software Users?

Ongoing support should include access to a help desk, technical support, and software updates. Prompt and reliable support ensures that users can address any issues and keep their software running smoothly.

7.7. How Can A Help Desk Assist Software Users?

A help desk provides a central point of contact for users to ask questions, report issues, and request assistance. A well-managed help desk can improve user satisfaction and reduce downtime.

7.8. Why Is Technical Support Important For Financial Analysis Software?

Technical support helps in resolving technical issues such as software bugs, integration problems, and data errors. Prompt technical support minimizes disruptions and ensures that the software functions correctly.

7.9. How Do Software Updates Improve Performance?

Software updates include bug fixes, new features, and performance improvements. Regularly updating the software ensures that users have access to the latest enhancements and security patches.

7.10. What Role Does Vendor Support Play In Software Training?

Vendor support plays a crucial role in providing training, documentation, and technical assistance. Choosing a vendor that offers comprehensive support ensures that you can maximize the benefits of your financial analysis software.

8. Future Trends in Financial Analysis Software for Auto Care Franchises

Future trends in financial analysis software for auto care franchises point towards greater automation, enhanced analytics, and cloud-based solutions. These trends are poised to transform how auto care franchises manage their finances and drive growth.

8.1. What Are The Emerging Trends In Financial Analysis Technology?

Emerging trends in financial analysis technology include artificial intelligence (AI), machine learning (ML), predictive analytics, and blockchain. These technologies are enhancing the capabilities of financial analysis software and providing new insights.

8.2. How Is AI Transforming Financial Analysis?

AI is transforming financial analysis by automating tasks, improving accuracy, and providing intelligent insights. AI-powered software can analyze large datasets, identify patterns, and generate forecasts with greater precision.

8.3. What Role Does Machine Learning Play In Financial Forecasting?

Machine learning algorithms can analyze historical data and identify trends to generate more accurate forecasts. ML-powered software can adapt to changing market conditions and improve the reliability of financial predictions.

8.4. How Does Predictive Analytics Benefit Auto Care Franchises?

Predictive analytics helps auto care franchises anticipate future performance and make proactive decisions. By analyzing historical data and market trends, predictive analytics can forecast demand, optimize pricing, and manage inventory more effectively.

8.5. What Security Benefits Does Blockchain Offer?

Blockchain technology offers enhanced security and transparency for financial transactions. By using a distributed ledger, blockchain can prevent fraud, reduce errors, and improve trust in financial data.

8.6. How Are Cloud-Based Solutions Improving Accessibility?

Cloud-based solutions provide greater accessibility and flexibility for financial analysis software. Cloud-based software can be accessed from any device with an internet connection, making it easier for franchise owners to manage their finances remotely.

8.7. What Are The Cost Savings Associated With Cloud-Based Software?

Cloud-based software eliminates the need for expensive hardware and IT infrastructure, resulting in significant cost savings. Cloud-based solutions also offer scalable pricing models, allowing franchise owners to pay only for what they use.

8.8. What Integrations Can Be Expected In Future Financial Analysis Software?

Future financial analysis software is expected to offer seamless integrations with a wider range of business systems, including IoT devices, telematics systems, and customer engagement platforms. These integrations will provide a more holistic view of business operations.

8.9. How Can Telematics Systems Improve Financial Analysis?

Telematics systems provide data on vehicle performance, maintenance needs, and driving behavior. Integrating telematics data with financial analysis software can help auto care franchises optimize maintenance schedules, reduce costs, and improve customer service.

9. Case Studies: Success Stories of Auto Care Franchises Using Financial Analysis Software

Examining case studies of auto care franchises that have successfully implemented financial analysis software provides valuable insights into the tangible benefits and best practices. These success stories highlight the transformative impact of leveraging financial data effectively.

9.1. What Are Some Notable Success Stories Of Software Implementation?

Notable success stories include auto care franchises that have achieved significant improvements in profitability, efficiency, and customer satisfaction through the use of financial analysis software. These examples demonstrate the potential for positive outcomes.

9.2. How Did One Franchise Improve Profitability With Software?

One franchise improved profitability by using financial analysis software to identify and eliminate unnecessary expenses. By tracking COGS and profit margins, they were able to negotiate better deals with suppliers and optimize pricing strategies.

9.3. How Did Another Franchise Increase Efficiency?

Another franchise increased efficiency by automating financial processes and reducing manual data entry. By integrating their accounting software with their shop management system, they were able to streamline operations and improve productivity.

9.4. What Role Did Data Integration Play In Improving Business?

Data integration played a crucial role in improving business performance by providing a comprehensive view of financial operations. Integrating various systems allowed franchise owners to make more informed decisions and identify opportunities for improvement.

9.5. How Did Some Franchises Improve Customer Satisfaction?

Some franchises improved customer satisfaction by using financial analysis software to track customer feedback and tailor their services. By analyzing customer data, they were able to identify preferences and offer personalized recommendations.

9.6. What Strategies Did They Use To Retain Customers?

Strategies used to retain customers included loyalty programs, personalized communication, and proactive service reminders. By focusing on customer relationships, these franchises were able to build a loyal customer base.

9.7. How Did Some Franchises Optimize Inventory Management?

Some franchises optimized inventory management by using financial analysis software to track parts usage and demand. By analyzing inventory data, they were able to reduce waste, minimize stockouts, and improve cash flow.

9.8. What Cost-Saving Measures Did Franchises Take?

Cost-saving measures included negotiating better deals with suppliers, reducing energy consumption, and optimizing labor schedules. By focusing on cost management, these franchises were able to improve their bottom line.

10. Frequently Asked Questions (FAQs) About Financial Analysis Software for Auto Care Franchises

Addressing frequently asked questions (FAQs) about financial analysis software for auto care franchises can help clarify common concerns and provide valuable information for franchise owners considering implementing these tools.

10.1. What Is Financial Analysis Software?

Financial analysis software is a tool that helps auto care franchises manage and analyze their financial data, track KPIs, and make informed decisions.

10.2. Why Do Auto Care Franchises Need Financial Analysis Software?

Auto care franchises need financial analysis software to streamline operations, improve decision-making, and enhance overall financial performance.

10.3. What Are The Key Features To Look For In Financial Analysis Software?

Key features to look for include real-time reporting, KPI dashboards, budgeting and forecasting tools, and integration capabilities.

10.4. How Much Does Financial Analysis Software Cost?

The cost of financial analysis software varies depending on the features, complexity, and vendor. Prices can range from a few hundred dollars per month to several thousand dollars per year.

10.5. Is It Difficult To Implement Financial Analysis Software?

Implementing financial analysis software can be challenging, but following a structured approach and providing adequate training can ensure a smooth transition.

10.6. How Long Does It Take To See A Return On Investment (ROI)?

The time it takes to see a return on investment (ROI) depends on the effectiveness of the implementation and the extent to which the software is utilized. Many franchises see positive results within a few months.

10.7. Can Financial Analysis Software Help With Tax Compliance?

Yes, financial analysis software can help with tax compliance by providing accurate financial data and generating reports needed for tax filings.

10.8. Is Financial Analysis Software Secure?

Most financial analysis software solutions offer robust security features to protect sensitive data. However, it is important to choose a reputable vendor with strong security protocols.

10.9. Can Financial Analysis Software Integrate With Other Business Systems?

Yes, many financial analysis software solutions offer integrations with other business systems such as accounting software, inventory management systems, and CRM platforms.

10.10. How Can I Get Started With Financial Analysis Software For My Auto Care Franchise?

To get started, assess your needs, research different software options, request demos, and choose a solution that aligns with your business goals and budget.

Financial analysis software is an indispensable tool for auto care franchises aiming to optimize their financial management and achieve sustainable growth. By understanding the key benefits, essential features, and implementation strategies, franchise owners can leverage these tools effectively.

CAR-REMOTE-REPAIR.EDU.VN offers comprehensive training programs to equip you with the knowledge and skills needed to master financial analysis software and drive your auto care franchise towards greater success. Contact us at Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States, Whatsapp: +1 (641) 206-8880, or visit our Website: CAR-REMOTE-REPAIR.EDU.VN to explore our training programs and consulting services.