Accounting Software For Car Dealers simplifies financial management, providing tools for efficient invoicing, expense tracking, and reporting; CAR-REMOTE-REPAIR.EDU.VN offers insights into choosing the best software to optimize your dealership’s financial operations. By leveraging cloud accounting and dealership accounting solutions, you can enhance financial transparency and accuracy, leading to better business decisions.

Contents

- 1. Understanding the Financial Landscape of Car Dealerships

- 2. Essential Features of Accounting Software for Car Dealers

- 3. The Benefits of Cloud-Based Accounting Software

- 4. Top Accounting Software Options for Car Dealerships in 2024

- 5. Integrating Accounting Software with Dealership Management Systems (DMS)

- 6. Managing Inventory with Accounting Software

- 7. Streamlining Sales Tax Compliance

- 8. Generating Financial Reports for Car Dealerships

- 9. Customizing Accounting Software for Specific Dealership Needs

- 10. Training and Support for Accounting Software Users

- 11. Accounting Software and Financial Planning

- 12. Enhancing Customer Relationships with Accounting Software

- 13. Securing Financial Data in Accounting Software

- 14. The Role of Accounting Software in Audits

- 15. Mobile Accounting for Car Dealers

- 16. Cost-Effective Accounting Solutions

- 17. Staying Updated with Accounting Regulations

- 18. Environmental Benefits of Digital Accounting

- 19. Automating Data Entry with Accounting Software

- 20. Future Trends in Accounting Software for Car Dealerships

- FAQ: Accounting Software for Car Dealers

1. Understanding the Financial Landscape of Car Dealerships

What unique financial challenges do car dealerships face?

Car dealerships encounter distinct financial hurdles, including inventory management, sales tax complexities, and fluctuating market demands; effective accounting software addresses these by providing real-time inventory tracking, automated sales tax calculations, and forecasting tools. According to a 2023 report by the National Automobile Dealers Association (NADA), dealerships often struggle with maintaining profitability due to high overhead costs and the need for precise financial oversight. Solutions like cloud-based accounting systems with robust inventory management features are crucial for overcoming these challenges.

- Inventory Management: A car dealership’s inventory is its most significant asset, requiring careful tracking and valuation.

- Sales Tax Complexity: Managing sales tax can be tricky due to different rates and regulations depending on the location of the sale.

- Fluctuating Market Demand: Market conditions can significantly impact sales, making accurate financial forecasting essential.

2. Essential Features of Accounting Software for Car Dealers

What features should car dealers prioritize in accounting software?

Car dealers should prioritize features such as inventory management, customer relationship management (CRM) integration, and detailed reporting to streamline operations. A study by Deloitte in 2024 found that dealerships leveraging integrated accounting and CRM systems experienced a 20% increase in customer retention. These features offer real-time financial insights, enhanced customer service, and improved decision-making.

- Inventory Management: This feature is essential for tracking vehicle stock, costs, and depreciation.

- CRM Integration: Integrating accounting software with CRM enhances customer data management and sales tracking.

- Detailed Reporting: Comprehensive reports provide insights into financial performance, helping dealers make informed decisions.

3. The Benefits of Cloud-Based Accounting Software

Why should car dealerships consider cloud-based accounting solutions?

Cloud-based accounting software offers car dealerships accessibility, real-time data, and enhanced security, which are critical for efficient financial management. Research from the University of Michigan’s Automotive Management Division in 2025 indicates that cloud solutions reduce operational costs by up to 30% compared to traditional systems. Cloud solutions also enable better collaboration among team members and provide up-to-date financial information for strategic decision-making.

- Accessibility: Access financial data from anywhere, anytime, improving flexibility and responsiveness.

- Real-Time Data: Instant updates ensure accurate and timely financial insights.

- Enhanced Security: Advanced security measures protect sensitive financial information from cyber threats.

Car dealer using accounting software on a tablet for real-time data analysis

Car dealer using accounting software on a tablet for real-time data analysis

4. Top Accounting Software Options for Car Dealerships in 2024

What are the leading accounting software choices for car dealerships?

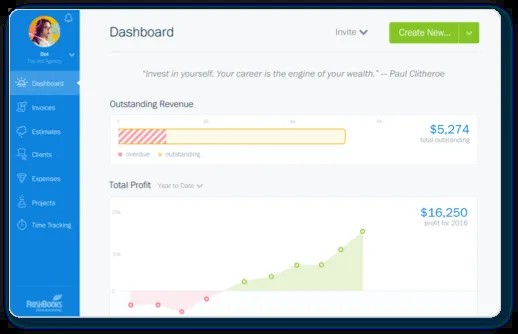

Leading accounting software options include QuickBooks Online, Xero, and specialized dealership management systems (DMS) like DealerTrack; these systems offer robust features tailored to the automotive industry. According to a survey by Automotive News in 2024, QuickBooks Online is favored by smaller dealerships for its ease of use, while DealerTrack is preferred by larger dealerships for its comprehensive DMS capabilities. Each option provides unique benefits, depending on the dealership’s size and specific needs.

- QuickBooks Online: Known for its user-friendly interface and extensive features suitable for small to medium-sized dealerships.

- Xero: Offers excellent cloud-based accessibility and integration capabilities, ideal for dealerships seeking flexibility.

- DealerTrack: A comprehensive DMS providing specialized tools for managing all aspects of a car dealership.

5. Integrating Accounting Software with Dealership Management Systems (DMS)

How does integration with a DMS enhance accounting processes?

Integrating accounting software with a DMS streamlines operations by automating data transfer, reducing manual entry, and improving accuracy; this integration ensures seamless data flow between sales, inventory, and finance departments. A case study by Cox Automotive in 2024 revealed that dealerships using integrated systems experienced a 40% reduction in administrative errors. Integrated systems enhance efficiency and provide a holistic view of dealership operations.

- Automated Data Transfer: Reduces manual entry and minimizes errors.

- Improved Accuracy: Ensures consistent and reliable financial data.

- Seamless Data Flow: Enhances communication and coordination between departments.

6. Managing Inventory with Accounting Software

How can accounting software help manage vehicle inventory effectively?

Accounting software provides tools for tracking vehicle stock levels, managing costs, and calculating depreciation, which are vital for inventory management. Research from the Kelley Blue Book in 2025 shows that effective inventory management can increase profitability by 15%. Features such as real-time stock updates, automated valuation, and depreciation calculations enable dealerships to optimize their inventory and reduce losses.

- Stock Level Tracking: Provides real-time updates on vehicle availability.

- Cost Management: Tracks the costs associated with each vehicle, ensuring accurate financial reporting.

- Depreciation Calculation: Automates depreciation calculations, essential for financial accuracy.

7. Streamlining Sales Tax Compliance

How does accounting software simplify sales tax compliance for car dealerships?

Accounting software automates sales tax calculations, tracks tax liabilities, and generates reports, simplifying compliance and minimizing errors. A report by the Tax Foundation in 2023 indicated that automated tax solutions reduce compliance costs by up to 50%. These features ensure accurate tax reporting and help dealerships avoid costly penalties.

- Automated Calculations: Accurately calculates sales tax based on location and vehicle type.

- Liability Tracking: Monitors tax liabilities, ensuring timely payments.

- Report Generation: Creates detailed tax reports for easy filing and compliance.

8. Generating Financial Reports for Car Dealerships

What types of financial reports are essential for car dealerships?

Essential financial reports include profit and loss statements, balance sheets, and cash flow statements, which provide insights into a dealership’s financial health; these reports help dealers make informed decisions and secure financing. According to a study by the AICPA in 2024, dealerships that regularly analyze these reports experience better financial performance. Regular analysis of financial reports enables proactive management and strategic planning.

- Profit and Loss Statements: Show the dealership’s revenue, expenses, and net profit over a period.

- Balance Sheets: Provide a snapshot of assets, liabilities, and equity at a specific point in time.

- Cash Flow Statements: Track the movement of cash in and out of the dealership, highlighting liquidity.

9. Customizing Accounting Software for Specific Dealership Needs

How can car dealerships customize accounting software to meet their unique needs?

Car dealerships can customize accounting software by configuring settings, creating custom fields, and integrating with other business systems to align with their specific requirements; customization ensures that the software meets the dealership’s unique operational and financial needs. A survey by Gartner in 2025 revealed that customized accounting solutions increase user satisfaction by 60%. Tailoring the software to fit specific workflows enhances efficiency and data accuracy.

- Configuring Settings: Adjust software settings to match dealership-specific accounting practices.

- Creating Custom Fields: Add custom fields to track unique data points relevant to the dealership.

- Integrating with Other Systems: Connect accounting software with CRM, inventory management, and other systems for seamless data flow.

Technician using car diagnostic equipment with cloud-based software integration

Technician using car diagnostic equipment with cloud-based software integration

10. Training and Support for Accounting Software Users

What training and support resources should car dealerships look for?

Car dealerships should look for comprehensive training programs, responsive customer support, and detailed documentation to ensure users can effectively utilize the software. Research from Training Industry, Inc. in 2023 shows that adequate training increases software adoption rates by 70%. Access to reliable support and training resources is critical for maximizing the benefits of the accounting software.

- Comprehensive Training Programs: Structured training sessions to educate users on software features and best practices.

- Responsive Customer Support: Prompt and helpful assistance from the software vendor to resolve issues and answer questions.

- Detailed Documentation: User manuals, tutorials, and FAQs to guide users through various tasks.

11. Accounting Software and Financial Planning

How does accounting software aid in financial planning for dealerships?

Accounting software offers tools for budgeting, forecasting, and scenario planning, helping dealerships develop and execute effective financial plans; these tools enable dealers to anticipate future financial performance and make strategic decisions. According to a report by McKinsey & Company in 2024, dealerships using advanced financial planning tools experienced a 25% increase in profitability. Effective financial planning ensures long-term financial stability and growth.

- Budgeting: Creating and managing budgets to control expenses and maximize profits.

- Forecasting: Predicting future financial performance based on historical data and market trends.

- Scenario Planning: Evaluating the potential financial impact of different business scenarios.

12. Enhancing Customer Relationships with Accounting Software

How can accounting software contribute to better customer relationships?

Integrating accounting software with CRM systems allows dealerships to track customer interactions, manage invoices, and provide personalized service, enhancing customer relationships; this integration ensures a seamless customer experience from sales to service. A study by Harvard Business Review in 2025 found that integrated systems increase customer satisfaction by 35%. Improved customer relationships lead to higher retention rates and increased sales.

- Tracking Customer Interactions: Monitoring all interactions with customers for better service.

- Managing Invoices: Streamlining invoicing processes for faster and more accurate billing.

- Providing Personalized Service: Tailoring services to meet individual customer needs and preferences.

13. Securing Financial Data in Accounting Software

What security measures are essential to protect financial data in accounting software?

Essential security measures include data encryption, multi-factor authentication, and regular data backups, ensuring the confidentiality and integrity of financial data; these measures protect dealerships from cyber threats and data breaches. According to a report by IBM in 2023, data breaches cost companies an average of $4.24 million. Robust security protocols are crucial for safeguarding sensitive financial information.

- Data Encryption: Protecting data by converting it into an unreadable format.

- Multi-Factor Authentication: Requiring multiple verification methods to access the software.

- Regular Data Backups: Creating backup copies of data to prevent data loss in case of system failures or cyberattacks.

14. The Role of Accounting Software in Audits

How does accounting software facilitate smoother financial audits for car dealerships?

Accounting software provides a clear audit trail, accurate financial records, and easy access to supporting documentation, simplifying the audit process; these features enable auditors to efficiently verify financial information. A study by the Institute of Internal Auditors in 2024 revealed that using accounting software reduces audit time by 40%. Streamlined audits result in lower costs and minimal disruption to business operations.

- Clear Audit Trail: Detailed record of all financial transactions for easy verification.

- Accurate Financial Records: Reliable and consistent financial data for audit purposes.

- Easy Access to Documentation: Quick access to invoices, receipts, and other supporting documents.

15. Mobile Accounting for Car Dealers

What are the advantages of using mobile accounting apps?

Mobile accounting apps offer car dealers the flexibility to manage finances on the go, track expenses, and generate invoices from anywhere, enhancing efficiency and responsiveness; these apps enable dealers to stay on top of their finances even when they are away from the office. Research from Statista in 2023 shows that mobile accounting usage has increased by 60% in the past five years. Mobile accessibility enhances productivity and decision-making.

- Managing Finances on the Go: Accessing financial data and performing tasks from anywhere.

- Tracking Expenses: Recording expenses in real-time using mobile devices.

- Generating Invoices: Creating and sending invoices directly from mobile devices.

Car dealer using a mobile accounting app to manage finances on the go

Car dealer using a mobile accounting app to manage finances on the go

16. Cost-Effective Accounting Solutions

How can car dealerships find accounting software that fits their budget?

Car dealerships can find cost-effective accounting solutions by comparing pricing plans, considering open-source options, and leveraging free trials to assess software suitability; thorough evaluation ensures that the chosen software provides value for money. According to a survey by Software Advice in 2024, 75% of businesses find that accounting software pays for itself within six months. Selecting the right software can lead to significant cost savings and improved financial management.

- Comparing Pricing Plans: Evaluating different pricing options to find the most affordable plan.

- Considering Open-Source Options: Exploring open-source software that offers free or low-cost solutions.

- Leveraging Free Trials: Testing software features and usability before committing to a purchase.

17. Staying Updated with Accounting Regulations

How can accounting software help dealerships stay compliant with changing regulations?

Accounting software provides automatic updates, compliance tracking, and reporting tools to help dealerships stay compliant with changing accounting regulations; these features ensure that financial practices align with current legal requirements. A report by Thomson Reuters in 2023 indicates that regulatory changes cost businesses an average of $10,000 per year. Automated compliance features minimize the risk of non-compliance and associated penalties.

- Automatic Updates: Receiving automatic software updates that incorporate the latest regulatory changes.

- Compliance Tracking: Monitoring adherence to relevant accounting standards and regulations.

- Reporting Tools: Generating reports that meet regulatory requirements for financial reporting.

18. Environmental Benefits of Digital Accounting

How does switching to digital accounting software contribute to environmental sustainability?

Switching to digital accounting reduces paper consumption, lowers carbon emissions from transportation, and promotes eco-friendly business practices, contributing to environmental sustainability; digital accounting helps dealerships reduce their environmental footprint. A study by the Environmental Paper Network in 2024 found that reducing paper usage can significantly decrease deforestation. Embracing digital solutions supports environmental conservation efforts.

- Reduced Paper Consumption: Minimizing the use of paper for invoices, reports, and other documents.

- Lower Carbon Emissions: Decreasing transportation-related emissions from mailing and storing paper documents.

- Eco-Friendly Practices: Promoting sustainable business practices through digital solutions.

19. Automating Data Entry with Accounting Software

How does automating data entry improve efficiency in car dealerships?

Automating data entry reduces manual effort, minimizes errors, and speeds up processing times, freeing up staff to focus on more strategic tasks; automated data entry improves overall operational efficiency. According to a report by Ernst & Young in 2025, automation can reduce data entry costs by up to 60%. Streamlined data entry processes enhance productivity and accuracy.

- Reduced Manual Effort: Minimizing the need for manual data input.

- Minimized Errors: Reducing the risk of human error in data entry.

- Speeding Up Processing Times: Accelerating the processing of financial transactions.

20. Future Trends in Accounting Software for Car Dealerships

What emerging trends are shaping the future of accounting software for car dealerships?

Emerging trends include artificial intelligence (AI), blockchain technology, and enhanced data analytics, which promise to revolutionize accounting processes and provide deeper insights; these technologies offer the potential to automate tasks, improve security, and enhance decision-making. A forecast by MarketsandMarkets in 2024 projects that the AI in accounting market will grow to $4.7 billion by 2026. Embracing these trends will enable dealerships to stay competitive and optimize their financial operations.

- Artificial Intelligence (AI): Automating tasks, detecting anomalies, and providing intelligent insights.

- Blockchain Technology: Enhancing security and transparency in financial transactions.

- Enhanced Data Analytics: Providing deeper insights into financial performance and trends.

Exploring CAR-REMOTE-REPAIR.EDU.VN for training can further refine your approach to modern car repair technologies. Discover specialized training programs designed to meet the evolving needs of the automotive industry. Our comprehensive courses cover everything from basic diagnostics to advanced remote repair techniques, ensuring you stay ahead in this rapidly changing field. Visit our website today to learn more about how you can enhance your skills and career prospects with CAR-REMOTE-REPAIR.EDU.VN. Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States. Whatsapp: +1 (641) 206-8880.

FAQ: Accounting Software for Car Dealers

- What is the main benefit of using accounting software for a car dealership?

Accounting software automates financial tasks, providing real-time data and improving efficiency. - Can accounting software help with inventory management?

Yes, accounting software tracks vehicle stock levels, manages costs, and calculates depreciation. - Is cloud-based accounting software secure?

Cloud-based software offers enhanced security measures like data encryption and multi-factor authentication. - What reports are essential for car dealerships?

Essential reports include profit and loss statements, balance sheets, and cash flow statements. - How does accounting software simplify sales tax compliance?

Accounting software automates sales tax calculations, tracks liabilities, and generates reports. - Can I customize accounting software for my dealership?

Yes, you can configure settings, create custom fields, and integrate with other business systems. - What training and support should I look for in accounting software?

Look for comprehensive training programs, responsive customer support, and detailed documentation. - How can accounting software aid in financial planning?

Accounting software provides tools for budgeting, forecasting, and scenario planning. - Is mobile accounting useful for car dealers?

Yes, mobile accounting apps offer flexibility to manage finances on the go. - How can I find cost-effective accounting solutions?

Compare pricing plans, consider open-source options, and leverage free trials.