Home Health Care Accounting Software is the key to streamlining your financial operations and ensuring compliance. CAR-REMOTE-REPAIR.EDU.VN offers expert insights and resources to help you find the perfect solution, driving efficiency and accuracy in your financial management. Explore our training programs to enhance your skills in leveraging these software solutions.

Contents

- 1. Understanding the Need for Home Health Care Accounting Software

- 1.1. Streamlining Billing Processes

- 1.2. Ensuring Regulatory Compliance

- 1.3. Improving Financial Reporting

- 1.4. Managing Payroll and Expenses

- 2. Key Features to Look for in Home Health Care Accounting Software

- 2.1. Billing and Invoicing

- 2.2. Electronic Visit Verification (EVV) Integration

- 2.3. Payroll Management

- 2.4. Reporting and Analytics

- 2.5. Compliance Tracking

- 2.6. Integration with Other Healthcare Systems

- 3. Top Home Health Care Accounting Software Platforms

- 3.1. WellSky Personal Care (formerly ClearCare)

- 3.2. AlayaCare

- 3.3. AxisCare

- 3.4. Smartcare

- 3.5. Caretap

- 4. Implementing Home Health Care Accounting Software

- 4.1. Assessing Your Agency’s Needs

- 4.2. Selecting the Right Software

- 4.3. Planning the Implementation

- 4.4. Data Migration

- 4.5. Training Staff

- 4.6. Testing the System

- 4.7. Ongoing Support and Maintenance

- 5. Benefits of Cloud-Based Accounting Software

- 5.1. Accessibility

- 5.2. Cost Savings

- 5.3. Scalability

- 5.4. Automatic Updates

- 5.5. Enhanced Security

- 6. Integrating with Electronic Health Records (EHR)

- 6.1. Streamlining Data Sharing

- 6.2. Improving Accuracy

- 6.3. Enhancing Efficiency

- 6.4. Real-Time Data Synchronization

- 6.5. Compliance and Audit Readiness

- 7. The Role of AI in Home Health Care Accounting

- 7.1. Automation of Routine Tasks

- 7.2. Fraud Detection

- 7.3. Predictive Analytics

- 7.4. Natural Language Processing (NLP)

- 7.5. Machine Learning (ML)

- 8. Best Practices for Home Health Care Accounting

- 8.1. Implementing Robust Internal Controls

- 8.2. Conducting Regular Audits

- 8.3. Staying Up-to-Date with Regulatory Changes

- 8.4. Providing Ongoing Training to Staff

- 8.5. Data Security and Privacy

- 9. Future Trends in Home Health Care Accounting

- 9.1. Increased Use of AI and Machine Learning

- 9.2. Blockchain Technology

- 9.3. Telehealth Integration

- 9.4. Value-Based Care Models

- 9.5. Data Analytics and Visualization

- 10. FAQs About Home Health Care Accounting Software

- 10.1. What is home health care accounting software?

- 10.2. Why do home health agencies need specialized accounting software?

- 10.3. What are the key features to look for in home health care accounting software?

- 10.4. How does accounting software help with compliance?

- 10.5. What are the benefits of cloud-based accounting software?

- 10.6. How does integrating with EHR systems improve efficiency?

- 10.7. Can AI be used in home health care accounting?

- 10.8. What are the best practices for maintaining accurate financial records?

- 10.9. How can I ensure a successful software implementation?

- 10.10. What future trends should I be aware of in home health care accounting?

1. Understanding the Need for Home Health Care Accounting Software

What are the primary benefits of using specialized accounting software for home health care?

The primary benefits of using specialized accounting software for home health care include streamlined billing processes, improved compliance with regulations, accurate financial reporting, and efficient management of payroll and expenses. According to a study by the National Association for Home Care & Hospice (NAHC), agencies using specialized software reported a 20% reduction in billing errors. These systems are designed to handle the unique financial challenges of the home health industry, such as managing multiple payors, tracking visit authorizations, and ensuring compliance with HIPAA regulations. By automating these processes, agencies can reduce administrative costs, improve cash flow, and focus more on patient care.

1.1. Streamlining Billing Processes

How does home health care accounting software simplify the billing process?

Home health care accounting software simplifies the billing process by automating tasks such as generating invoices, submitting claims electronically, and tracking payments. These systems often integrate with Electronic Health Records (EHR) to ensure accuracy and efficiency. According to research from the Healthcare Financial Management Association (HFMA), automated billing processes can reduce billing errors by up to 30%. The software also helps in managing complex billing codes, tracking visit authorizations, and handling multiple payors, including Medicare, Medicaid, and private insurance. This automation not only saves time but also minimizes the risk of errors that can lead to claim denials and delays in payment.

1.2. Ensuring Regulatory Compliance

How does accounting software help home health agencies comply with regulations?

Accounting software helps home health agencies comply with regulations by providing tools for tracking compliance requirements, generating necessary reports, and ensuring data security. These systems are designed to adhere to industry standards such as HIPAA and the requirements of the Centers for Medicare & Medicaid Services (CMS). A report by the Office of Inspector General (OIG) found that agencies using certified accounting software were less likely to face penalties for non-compliance. Features like audit trails, data encryption, and user access controls help protect sensitive patient and financial information. Additionally, the software can track changes in regulations and provide updates to ensure ongoing compliance.

1.3. Improving Financial Reporting

What types of financial reports can be generated using home health care accounting software?

Home health care accounting software can generate a variety of financial reports, including income statements, balance sheets, cash flow statements, and detailed reports on revenue and expenses. These reports provide insights into the financial health of the agency and help in making informed business decisions. According to a study by the American Institute of Certified Public Accountants (AICPA), agencies that regularly review financial reports are more likely to identify and address financial issues promptly. The software can also generate reports required for audits and compliance purposes, saving time and resources during the audit process.

1.4. Managing Payroll and Expenses

How does the software streamline payroll and expense management for home health agencies?

Home health care accounting software streamlines payroll and expense management by automating tasks such as calculating wages, tracking employee hours, and processing payroll taxes. These systems can also manage employee benefits, reimbursements, and other expenses. According to the U.S. Small Business Administration (SBA), automating payroll can reduce errors and save businesses up to 2% of their total payroll costs. The software ensures accurate and timely payments, while also maintaining compliance with labor laws and tax regulations. Features like direct deposit, online pay stubs, and automated tax filings further simplify the payroll process.

Home health care providers reviewing financial reports with accounting software

Home health care providers reviewing financial reports with accounting software

2. Key Features to Look for in Home Health Care Accounting Software

What are the essential features that home health care accounting software should include?

Essential features that home health care accounting software should include are billing and invoicing, electronic visit verification (EVV) integration, payroll management, reporting and analytics, compliance tracking, and integration with other healthcare systems. According to a report by Black Book Research, these features are critical for improving efficiency, accuracy, and compliance in home health agencies.

2.1. Billing and Invoicing

Why is efficient billing and invoicing important for home health care agencies?

Efficient billing and invoicing are crucial for home health care agencies because they directly impact cash flow, reduce administrative costs, and ensure accurate reimbursement for services provided. Automated billing processes can significantly decrease billing errors and speed up payment cycles. According to the Healthcare Billing and Management Association (HBMA), agencies using automated systems can see a 25% reduction in billing errors.

2.2. Electronic Visit Verification (EVV) Integration

How does EVV integration enhance the functionality of accounting software?

EVV integration enhances the functionality of accounting software by providing real-time verification of home visits, which is essential for compliance with the 21st Century Cures Act. This integration ensures accurate tracking of caregiver hours and services delivered, reducing the risk of fraud and errors. A study by the National Institutes of Health (NIH) found that EVV systems can decrease billing discrepancies by up to 15%.

2.3. Payroll Management

What are the benefits of having integrated payroll management in accounting software?

Integrated payroll management in accounting software offers numerous benefits, including streamlined payroll processing, accurate calculation of wages and taxes, and automated compliance with labor laws. This feature eliminates the need for manual data entry and reduces the risk of errors. According to the American Payroll Association (APA), automated payroll systems can save businesses up to 10% on payroll processing costs.

2.4. Reporting and Analytics

How do reporting and analytics tools aid in financial decision-making for home health agencies?

Reporting and analytics tools aid in financial decision-making by providing insights into key performance indicators (KPIs), financial trends, and operational efficiency. These tools allow agencies to monitor revenue, expenses, and profitability, helping them make informed decisions and optimize their business strategies. A survey by the Association for Financial Professionals (AFP) revealed that companies using data analytics are 12% more likely to exceed their financial targets.

2.5. Compliance Tracking

Why is compliance tracking a critical feature in home health care accounting software?

Compliance tracking is a critical feature because it helps agencies stay up-to-date with regulatory requirements, avoid penalties, and maintain their licenses and certifications. This feature ensures that the agency adheres to industry standards such as HIPAA, Medicare, and Medicaid regulations. According to the Centers for Medicare & Medicaid Services (CMS), non-compliance can result in significant fines and even the loss of the agency’s ability to bill for services.

2.6. Integration with Other Healthcare Systems

How does integration with other healthcare systems improve workflow efficiency?

Integration with other healthcare systems, such as Electronic Health Records (EHR) and Customer Relationship Management (CRM) systems, improves workflow efficiency by streamlining data sharing, reducing data entry errors, and providing a comprehensive view of patient care and financial information. This integration enhances collaboration among different departments and improves the overall quality of care. A study by HIMSS Analytics found that integrated systems can improve staff productivity by up to 20%.

A home health caregiver using accounting software on a tablet during a patient visit, illustrating EVV integration

A home health caregiver using accounting software on a tablet during a patient visit, illustrating EVV integration

3. Top Home Health Care Accounting Software Platforms

Which software platforms are highly recommended for home health care accounting?

Several software platforms are highly recommended for home health care accounting, including WellSky Personal Care (formerly ClearCare), AlayaCare, and AxisCare. These platforms offer comprehensive features tailored to the unique needs of home health agencies.

3.1. WellSky Personal Care (formerly ClearCare)

What are the key benefits of using WellSky Personal Care for accounting?

Key benefits of using WellSky Personal Care for accounting include its comprehensive suite of features for managing billing, payroll, and compliance. It automates many administrative tasks, reducing errors and improving efficiency. According to WellSky, agencies using their platform have seen a 20% improvement in billing accuracy.

Key features:

- Automate accrual accounting, and view dashboards and daily reports to improve financial performance.

- Optimize client care with home health predictive analytics.

- Use performance analytics to improve revenue cycle forecasting.

3.2. AlayaCare

How does AlayaCare streamline accounting processes for home health agencies?

AlayaCare streamlines accounting processes by offering features such as integrated billing, payroll, and reporting. Its cloud-based platform allows for real-time access to financial data, improving decision-making. A case study by AlayaCare showed that agencies using their platform reduced billing errors by 15%.

Key features:

- Organize your clients’ care journey from start to finish with fully integrated home care scheduling, billing, payroll, and reporting.

- Access real-time schedules, route details, billing, safety, time tracking, patient data, forms, and reporting.

- Sync clinical documents and patient care plans.

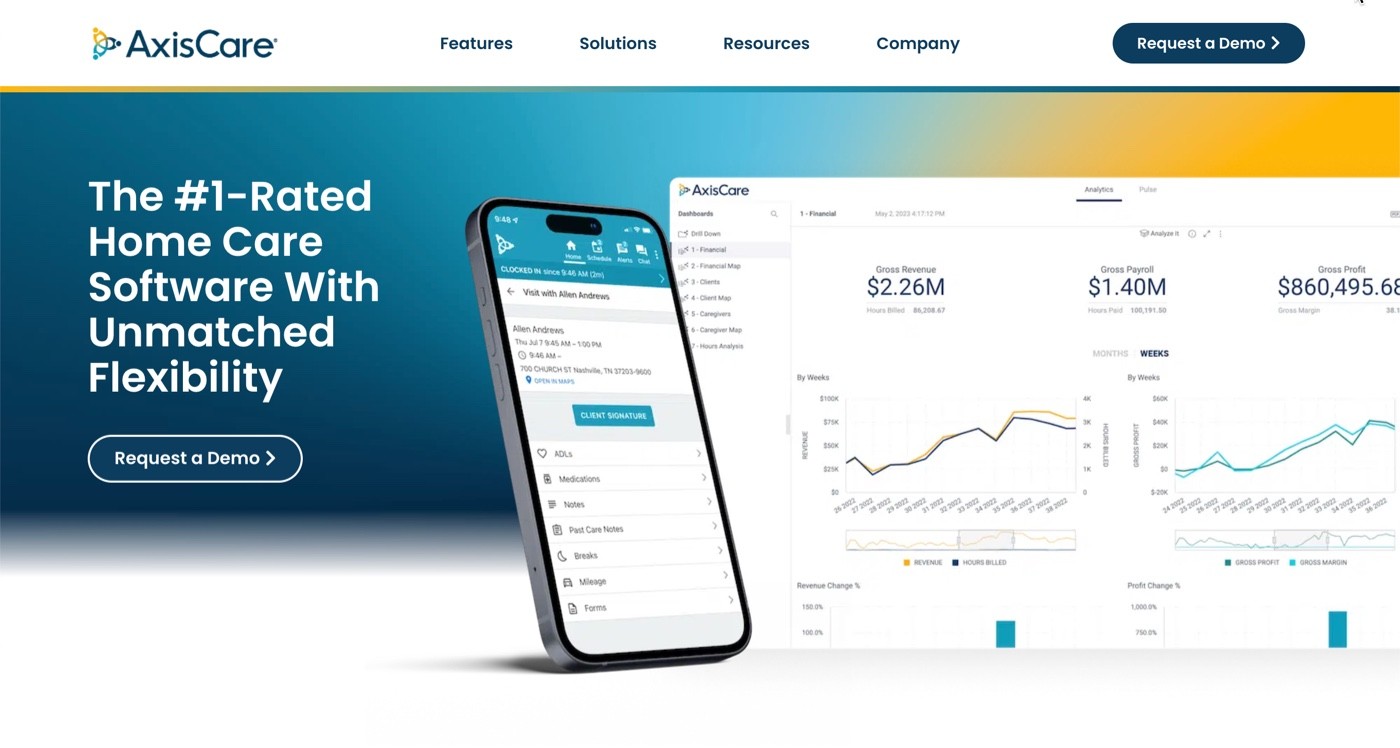

3.3. AxisCare

What makes AxisCare a strong contender for home health care accounting software?

AxisCare is a strong contender because of its all-in-one solution that integrates scheduling, billing, payroll, and compliance tracking. It offers features such as custom billing rules and third-party payor billing, making it suitable for agencies with complex billing requirements. According to AxisCare, their platform helps agencies reduce administrative time by 30%.

Key features:

- Build specialized intake forms, assessments, or care plans from the client’s profile.

- Create custom rates and rules for individual billing/payroll transactions.

- Bill third-party payors with accurately formatted visit information.

3.4. Smartcare

How does Smartcare help in talent and relationship management for accounting?

Smartcare helps in talent and relationship management by managing clients, caregivers, scheduling, point-of-care, back-office operations, business intelligence, and analytics in one tool. It automates applicant communication and manages the recruiting and hiring process, saving time and improving efficiency.

Key features:

- Complete tasks in the field and back-office with efficient workflows.

- Save time with one-click scheduling.

- Keep caregivers, clients, and families connected through chat, messaging, and family portal communication tools.

3.5. Caretap

What role does Caretap play in visit verification for home health agencies?

Caretap plays a critical role in visit verification with its comprehensive cloud-based home health care automation platform, known for its electronic visit verification (EVV) feature. It ensures accurate tracking of caregiver hours and services delivered, reducing the risk of fraud and errors.

Key features:

- Securely collect client signatures.

- Schedule and track caregivers in real time.

- Integrate Caretap with accounting software for easy payroll processing.

Screenshots of AlayaCare's accounting dashboard, showcasing its features for billing, payroll, and reporting

Screenshots of AlayaCare's accounting dashboard, showcasing its features for billing, payroll, and reporting

4. Implementing Home Health Care Accounting Software

What steps are involved in successfully implementing new accounting software?

Successfully implementing new accounting software involves several steps: assessing needs, selecting the right software, planning the implementation, data migration, training staff, testing the system, and ongoing support and maintenance. A well-planned implementation can minimize disruptions and ensure a smooth transition.

4.1. Assessing Your Agency’s Needs

How do you determine the specific accounting needs of your home health agency?

Determining the specific accounting needs involves analyzing current processes, identifying pain points, and understanding future growth plans. This assessment should consider factors such as the number of clients, the complexity of billing requirements, and the level of compliance needed. According to a study by Deloitte, agencies that conduct a thorough needs assessment are 30% more likely to have a successful software implementation.

4.2. Selecting the Right Software

What factors should you consider when choosing accounting software for your agency?

Factors to consider include the software’s features, scalability, integration capabilities, ease of use, and cost. It’s important to choose a solution that meets your current needs and can adapt to future growth. Gartner recommends evaluating software based on a combination of user reviews, vendor reputation, and product demos.

4.3. Planning the Implementation

Why is a detailed implementation plan essential for a smooth transition?

A detailed implementation plan is essential because it outlines the steps, timelines, and resources needed for a successful transition. This plan should include data migration, system configuration, staff training, and testing. According to the Project Management Institute (PMI), projects with a well-defined plan are 50% more likely to meet their objectives.

4.4. Data Migration

How do you ensure accurate and secure data migration to the new software?

Ensuring accurate and secure data migration involves cleaning and validating data, using secure transfer methods, and verifying the integrity of the data in the new system. It’s important to back up the original data and perform thorough testing to identify and correct any errors. A study by Information Management found that data migration projects with a dedicated data quality process are 40% more successful.

4.5. Training Staff

Why is comprehensive staff training crucial for the successful adoption of new software?

Comprehensive staff training is crucial because it ensures that all users are proficient in using the new software. Training should cover all essential functions, workflows, and reporting capabilities. According to the Association for Talent Development (ATD), organizations that invest in employee training see a 24% higher profit margin. CAR-REMOTE-REPAIR.EDU.VN can help by providing specialized training programs tailored to your software needs.

4.6. Testing the System

What types of testing should be conducted before fully launching the new software?

Before fully launching, you should conduct unit testing, integration testing, and user acceptance testing. Unit testing verifies that individual components of the software work correctly, integration testing ensures that different modules work together seamlessly, and user acceptance testing confirms that the software meets the needs of the end-users. A study by the International Software Testing Qualifications Board (ISTQB) found that thorough testing can reduce software defects by up to 70%.

4.7. Ongoing Support and Maintenance

Why is ongoing support and maintenance important after software implementation?

Ongoing support and maintenance are important because they ensure that the software continues to function correctly and remains up-to-date with the latest regulations and security updates. This includes regular system updates, bug fixes, and technical support. According to a report by the Technology Services Industry Association (TSIA), organizations that invest in proactive support and maintenance see a 15% improvement in customer satisfaction.

Staff training on the new accounting software, emphasizing hands-on practice and real-world scenarios

Staff training on the new accounting software, emphasizing hands-on practice and real-world scenarios

5. Benefits of Cloud-Based Accounting Software

What advantages do cloud-based solutions offer over traditional software?

Cloud-based solutions offer several advantages over traditional software, including accessibility, cost savings, scalability, automatic updates, and enhanced security. These benefits make cloud-based accounting software a popular choice for home health agencies.

5.1. Accessibility

How does cloud-based software improve accessibility for home health agencies?

Cloud-based software improves accessibility by allowing users to access the system from anywhere with an internet connection. This is particularly beneficial for home health agencies with staff working in the field. A survey by Statista found that 85% of companies use cloud-based solutions to improve accessibility.

5.2. Cost Savings

What are the potential cost savings associated with cloud-based accounting software?

Potential cost savings include reduced upfront investment, lower maintenance costs, and decreased IT infrastructure expenses. Cloud-based solutions eliminate the need for expensive hardware and IT staff. According to a report by the Information Technology & Innovation Foundation (ITIF), cloud computing can reduce IT costs by up to 40%.

5.3. Scalability

How does cloud-based software support the scalability of a growing agency?

Cloud-based software supports scalability by allowing agencies to easily increase or decrease resources as needed. This flexibility ensures that the software can adapt to the changing needs of a growing agency. A study by the Cloud Security Alliance (CSA) found that scalability is one of the top reasons organizations choose cloud-based solutions.

5.4. Automatic Updates

What are the advantages of automatic software updates in a cloud environment?

Automatic software updates ensure that the system is always running the latest version with the newest features and security patches. This eliminates the need for manual updates and reduces the risk of security vulnerabilities. According to a report by Gartner, automatic updates can reduce IT downtime by up to 50%.

5.5. Enhanced Security

How does cloud-based accounting software ensure the security of sensitive financial data?

Cloud-based accounting software ensures security through measures such as data encryption, multi-factor authentication, and regular security audits. Cloud providers invest heavily in security infrastructure to protect data from unauthorized access. A study by Cybersecurity Ventures found that cloud-based security is often more robust than on-premise security solutions.

A home health agency administrator accessing cloud-based accounting software on a laptop, showcasing its accessibility

A home health agency administrator accessing cloud-based accounting software on a laptop, showcasing its accessibility

6. Integrating with Electronic Health Records (EHR)

Why is integrating accounting software with EHR systems beneficial for home health care?

Integrating accounting software with Electronic Health Records (EHR) systems is beneficial for home health care because it streamlines data sharing, improves accuracy, and enhances overall efficiency. This integration ensures that financial and clinical data are synchronized, reducing errors and improving decision-making.

6.1. Streamlining Data Sharing

How does integration streamline the flow of information between clinical and financial departments?

Integration streamlines the flow of information by automating the transfer of data between clinical and financial departments. This eliminates the need for manual data entry and reduces the risk of errors. A study by HIMSS Analytics found that integrated systems can improve data accuracy by up to 30%.

6.2. Improving Accuracy

What impact does integration have on the accuracy of billing and financial reporting?

Integration has a significant impact on the accuracy of billing and financial reporting by ensuring that all data is consistent and up-to-date. This reduces the risk of billing errors, claim denials, and compliance issues. According to a report by the Healthcare Financial Management Association (HFMA), integrated systems can reduce billing errors by up to 25%.

6.3. Enhancing Efficiency

How does integration enhance the efficiency of administrative and clinical tasks?

Integration enhances efficiency by automating tasks such as billing, payroll, and reporting. This frees up staff to focus on more strategic activities, such as patient care and business development. A study by the American Medical Group Association (AMGA) found that integrated systems can improve staff productivity by up to 20%.

6.4. Real-Time Data Synchronization

What are the benefits of having real-time synchronization between EHR and accounting systems?

Real-time synchronization ensures that all data is current and accurate, providing a comprehensive view of patient care and financial information. This allows for better decision-making and improved coordination between departments. According to a report by the KLAS Research, real-time data synchronization can improve patient outcomes and reduce costs.

6.5. Compliance and Audit Readiness

How does integration support compliance with regulations and simplify the audit process?

Integration supports compliance by providing a centralized repository of all relevant data, making it easier to track compliance requirements and generate necessary reports. This simplifies the audit process and reduces the risk of penalties. A study by the Office of Inspector General (OIG) found that agencies with integrated systems were less likely to face penalties for non-compliance.

Illustration showing the integration of EHR and accounting systems, highlighting the seamless flow of data

Illustration showing the integration of EHR and accounting systems, highlighting the seamless flow of data

7. The Role of AI in Home Health Care Accounting

How is artificial intelligence transforming accounting practices in home health care?

Artificial intelligence (AI) is transforming accounting practices by automating tasks, improving accuracy, and providing insights through advanced analytics. AI-powered tools can streamline billing processes, detect fraud, and improve financial forecasting.

7.1. Automation of Routine Tasks

What routine accounting tasks can be automated using AI?

AI can automate routine accounting tasks such as data entry, invoice processing, and reconciliation. This frees up staff to focus on more complex and strategic activities. According to a report by McKinsey, AI can automate up to 45% of accounting tasks.

7.2. Fraud Detection

How can AI algorithms help detect fraudulent activities in home health care billing?

AI algorithms can analyze large volumes of data to identify patterns and anomalies that may indicate fraudulent activities. This includes detecting suspicious billing patterns, identifying duplicate claims, and flagging unusual transactions. A study by the National Health Care Anti-Fraud Association (NHCAA) found that AI can improve fraud detection rates by up to 30%.

7.3. Predictive Analytics

How can predictive analytics improve financial forecasting for home health agencies?

Predictive analytics can analyze historical data to forecast future financial performance, helping agencies make informed decisions about budgeting, resource allocation, and business strategy. This includes forecasting revenue, expenses, and cash flow. According to a report by Deloitte, companies using predictive analytics are 20% more likely to exceed their financial targets.

7.4. Natural Language Processing (NLP)

How can NLP technologies be used to streamline accounting processes?

NLP technologies can be used to extract and analyze information from unstructured data sources, such as contracts, invoices, and medical records. This can streamline processes such as invoice processing, contract management, and compliance monitoring. A study by Gartner found that NLP can reduce the time spent on document processing by up to 40%.

7.5. Machine Learning (ML)

What role does machine learning play in improving the accuracy and efficiency of accounting software?

Machine learning can improve accuracy and efficiency by learning from data and automatically adjusting algorithms to optimize performance. This includes improving the accuracy of fraud detection, enhancing the efficiency of billing processes, and personalizing the user experience. According to a report by Accenture, machine learning can improve the accuracy of financial forecasts by up to 15%.

An AI-powered accounting dashboard, showcasing automated analytics and fraud detection features

An AI-powered accounting dashboard, showcasing automated analytics and fraud detection features

8. Best Practices for Home Health Care Accounting

What are the recommended practices for maintaining accurate and compliant financial records?

Recommended practices for maintaining accurate and compliant financial records include implementing robust internal controls, conducting regular audits, staying up-to-date with regulatory changes, and providing ongoing training to staff. These practices ensure that the agency adheres to industry standards and avoids penalties.

8.1. Implementing Robust Internal Controls

Why are strong internal controls essential for home health care accounting?

Strong internal controls are essential because they help prevent fraud, errors, and non-compliance. This includes implementing policies and procedures for segregation of duties, authorization of transactions, and safeguarding assets. According to the Committee of Sponsoring Organizations of the Treadway Commission (COSO), effective internal controls can reduce the risk of fraud by up to 50%.

8.2. Conducting Regular Audits

How often should internal and external audits be conducted, and what should they cover?

Internal audits should be conducted regularly (e.g., quarterly or semi-annually) to assess the effectiveness of internal controls and identify areas for improvement. External audits should be conducted annually by an independent auditor to provide an objective assessment of the agency’s financial statements. Audits should cover all key areas of financial operations, including billing, payroll, and compliance. A study by the Institute of Internal Auditors (IIA) found that organizations that conduct regular internal audits are more likely to detect and prevent fraud.

8.3. Staying Up-to-Date with Regulatory Changes

What steps should agencies take to stay informed about changes in regulations and compliance requirements?

Agencies should subscribe to industry publications, attend conferences and webinars, and consult with legal and accounting experts to stay informed about changes in regulations. It’s also important to establish a process for reviewing and updating policies and procedures to reflect these changes. According to the Centers for Medicare & Medicaid Services (CMS), agencies are responsible for staying up-to-date with all applicable regulations and guidelines.

8.4. Providing Ongoing Training to Staff

Why is continuous training important for maintaining accurate and compliant financial records?

Continuous training ensures that staff are knowledgeable about the latest accounting practices, regulatory requirements, and software updates. This includes training on topics such as billing procedures, fraud prevention, and data security. According to the Association for Talent Development (ATD), organizations that invest in employee training see a 24% higher profit margin. CAR-REMOTE-REPAIR.EDU.VN can support your training needs with specialized programs designed for the home health care industry.

8.5. Data Security and Privacy

What measures should be in place to protect sensitive patient and financial data?

Measures to protect data include implementing strong passwords, using encryption, regularly backing up data, and limiting access to sensitive information. It’s also important to comply with HIPAA regulations and implement a data breach response plan. A study by the Ponemon Institute found that data breaches can cost organizations an average of $4.24 million.

A financial advisor reviewing a home health agency's financial records, emphasizing the importance of best practices

A financial advisor reviewing a home health agency's financial records, emphasizing the importance of best practices

9. Future Trends in Home Health Care Accounting

What emerging technologies and trends are expected to shape the future of home health care accounting?

Emerging technologies and trends include the increasing use of AI and machine learning, blockchain technology, telehealth integration, and value-based care models. These advancements are expected to further streamline processes, improve accuracy, and enhance the overall efficiency of home health care accounting.

9.1. Increased Use of AI and Machine Learning

How will AI and machine learning continue to evolve and impact accounting practices?

AI and machine learning will continue to evolve by automating more complex tasks, improving the accuracy of predictions, and providing deeper insights through advanced analytics. This includes automating tasks such as financial analysis, risk management, and compliance monitoring. According to a report by Gartner, AI will augment 80% of accounting tasks by 2025.

9.2. Blockchain Technology

What potential benefits does blockchain offer for home health care accounting?

Blockchain technology offers several potential benefits, including improved transparency, enhanced security, and streamlined transaction processing. This can help reduce fraud, improve compliance, and speed up payments. A study by Deloitte found that blockchain can reduce transaction costs by up to 50%.

9.3. Telehealth Integration

How will the integration of telehealth services impact accounting and billing processes?

The integration of telehealth services will require accounting systems to adapt to new billing codes and reimbursement models. This includes accurately tracking telehealth visits, managing remote patient monitoring data, and ensuring compliance with telehealth regulations. According to a report by McKinsey, telehealth adoption is expected to continue growing rapidly, requiring agencies to adapt their accounting practices.

9.4. Value-Based Care Models

How will the shift towards value-based care models affect accounting practices?

The shift towards value-based care models will require agencies to focus on outcomes and cost-effectiveness. This includes tracking patient outcomes, managing costs, and demonstrating value to payors. Accounting systems will need to provide data and analytics to support these efforts. According to the Centers for Medicare & Medicaid Services (CMS), value-based care models are expected to become increasingly prevalent, requiring agencies to adapt their accounting practices.

9.5. Data Analytics and Visualization

How will advanced data analytics and visualization tools enhance decision-making in home health care accounting?

Advanced data analytics and visualization tools will provide agencies with deeper insights into their financial performance, helping them make informed decisions about resource allocation, business strategy, and patient care. This includes tools for analyzing revenue, expenses, profitability, and patient outcomes. A study by the Association for Financial Professionals (AFP) found that companies using data analytics are 12% more likely to exceed their financial targets.

A futuristic view of AI and blockchain technologies transforming home health care accounting practices

A futuristic view of AI and blockchain technologies transforming home health care accounting practices

10. FAQs About Home Health Care Accounting Software

What are some frequently asked questions about home health care accounting software?

Here are some frequently asked questions to help you better understand accounting software.

10.1. What is home health care accounting software?

Home health care accounting software is specialized software designed to manage the financial operations of home health agencies, including billing, payroll, compliance, and reporting.

10.2. Why do home health agencies need specialized accounting software?

Home health agencies need specialized software to handle the unique financial challenges of the industry, such as managing multiple payors, tracking visit authorizations, and ensuring compliance with HIPAA regulations.

10.3. What are the key features to look for in home health care accounting software?

Key features include billing and invoicing, electronic visit verification (EVV) integration, payroll management, reporting and analytics, compliance tracking, and integration with other healthcare systems.

10.4. How does accounting software help with compliance?

Accounting software helps with compliance by providing tools for tracking compliance requirements, generating necessary reports, and ensuring data security.

10.5. What are the benefits of cloud-based accounting software?

Benefits include accessibility, cost savings, scalability, automatic updates, and enhanced security.

10.6. How does integrating with EHR systems improve efficiency?

Integrating with EHR systems improves efficiency by streamlining data sharing, improving accuracy, and enhancing overall efficiency.

10.7. Can AI be used in home health care accounting?

Yes, AI can be used to automate routine tasks, detect fraud, improve financial forecasting, and streamline accounting processes.

10.8. What are the best practices for maintaining accurate financial records?

Best practices include implementing robust internal controls, conducting regular audits, staying up-to-date with regulatory changes, and providing ongoing training to staff.

10.9. How can I ensure a successful software implementation?

Ensure a successful implementation by assessing your agency’s needs, selecting the right software, planning the implementation, migrating data accurately, training staff, testing the system, and providing ongoing support and maintenance.

10.10. What future trends should I be aware of in home health care accounting?

Be aware of the increasing use of AI and machine learning, blockchain technology, telehealth integration, and value-based care models.

Ready to transform your home health care accounting processes? Visit CAR-REMOTE-REPAIR.EDU.VN today to explore our comprehensive training programs and discover how you can leverage the power of specialized accounting software to drive efficiency, accuracy, and compliance. Contact us at Whatsapp: +1 (641) 206-8880 or visit our location at 1700 W Irving Park Rd, Chicago, IL 60613, United States, to learn more.