The best accounting software for preschool day cares simplifies billing and financial management, ensuring accurate tracking of income and expenses. CAR-REMOTE-REPAIR.EDU.VN offers insights and solutions to streamline your financial operations. Embrace automation and cloud-based accessibility to efficiently manage your preschool or daycare’s finances with childcare accounting, tuition management, and financial reporting tools.

Contents

- 1. Why Is Accounting Software Essential for Preschool Day Cares?

- 2. What Are the Key Features to Look for in Accounting Software for Day Cares?

- 3. What Are Some Top Accounting Software Options for Preschool Day Cares?

- 3.1. QuickBooks Online

- 3.2. Xero

- 3.3. FreshBooks

- 3.4. Procare Solutions

- 3.5. ChildcareCRM

- 4. How Does Tuition Billing Work in Accounting Software for Day Cares?

- 5. What Are the Benefits of Using Online Payment Solutions for Day Care Tuition?

- 6. How Can Expense Tracking Help Day Cares Manage Their Finances?

- 7. What Financial Reports Are Essential for Day Care Management?

- 8. How Can Day Cares Ensure Compliance with Accounting Regulations?

- 9. What Is the Role of Payroll Management in Day Care Accounting?

- 10. How Can Cloud-Based Accounting Software Benefit Preschool Day Cares?

- 11. What Are the Integration Capabilities of Accounting Software with Other Day Care Management Tools?

- 12. How Can Day Cares Use Accounting Software to Improve Budgeting?

- 13. What Strategies Can Day Cares Employ to Minimize Accounting Errors?

- 14. How Does Accounting Software Help in Preparing for Tax Season?

- 15. What Are the Best Practices for Setting Up Accounting Software for a New Day Care?

- 16. How Can Day Cares Use Accounting Software to Track and Manage Grants?

- 17. What Role Does Depreciation Play in Day Care Accounting?

- 18. How Can Day Cares Manage Fixed Assets Using Accounting Software?

- 19. What Are the Advantages of Using Mobile Accounting Apps for Day Cares?

- 20. How Can Day Cares Ensure Data Security and Privacy with Accounting Software?

- 21. Can Accounting Software Help With Managing Food Program Finances in Day Cares?

- 22. How Can Day Cares Track Parent Co-pays and Subsidies Using Accounting Software?

- 23. How Does Accounting Software Assist With Reporting to Government Agencies?

- 24. What Are the Considerations for Choosing Accounting Software for a Multi-Location Day Care?

- 25. How Can Day Cares Use Accounting Software to Track Revenue by Program or Service?

- 26. How Can CAR-REMOTE-REPAIR.EDU.VN Assist With Your Day Care’s Accounting Needs?

- 27. What Are the Long-Term Benefits of Investing in Quality Accounting Software for Day Cares?

- FAQ: Accounting Software for Preschool Day Cares

- Q1: What makes accounting software a necessity for preschool day cares?

- Q2: What key features should I look for in accounting software for my daycare?

- Q3: Which accounting software options are highly recommended for preschool day cares?

- Q4: How does accounting software simplify tuition billing for day cares?

- Q5: What are the advantages of using online payment solutions for day care tuition payments?

- Q6: How can expense tracking improve financial management in my day care?

- Q7: What financial reports are crucial for effectively managing a day care business?

- Q8: How can day cares ensure they comply with all relevant accounting regulations?

- Q9: How does cloud-based accounting software benefit preschool day cares specifically?

- Q10: Can accounting software really streamline grant management for day cares?

1. Why Is Accounting Software Essential for Preschool Day Cares?

Accounting software is crucial for preschool day cares as it automates financial processes, reduces errors, and provides real-time insights into financial performance. Managing a preschool or daycare involves handling various financial tasks such as tuition billing, expense tracking, payroll, and financial reporting. Accounting software streamlines these processes, ensuring accuracy and efficiency. According to a study by the National Association for the Education of Young Children (NAEYC), effective financial management is a key factor in the sustainability and success of early childhood education programs.

- Automation: Automates repetitive tasks like invoicing and expense tracking.

- Accuracy: Reduces manual errors in financial records.

- Real-time Insights: Provides up-to-date financial information for better decision-making.

2. What Are the Key Features to Look for in Accounting Software for Day Cares?

When selecting accounting software for your daycare, consider features like tuition billing, expense tracking, payroll management, reporting, and integration with other tools. These features ensure efficient financial management and compliance.

- Tuition Billing: Automates invoicing and payment reminders.

- Expense Tracking: Categorizes and monitors expenses to manage budgets.

- Payroll Management: Handles employee salaries, taxes, and benefits.

- Reporting: Generates financial statements for analysis and compliance.

- Integration: Connects with other tools like CRM and payment gateways for streamlined operations.

3. What Are Some Top Accounting Software Options for Preschool Day Cares?

Several accounting software options are tailored for preschool day cares, including QuickBooks Online, Xero, FreshBooks, and specialized childcare management software like Procare Solutions or ChildcareCRM. These platforms offer features designed to streamline financial tasks and enhance overall efficiency.

3.1. QuickBooks Online

QuickBooks Online is a popular choice due to its comprehensive features and scalability. It supports tuition billing, expense tracking, payroll management, and robust reporting, making it suitable for growing daycares.

3.2. Xero

Xero offers a user-friendly interface and strong accounting capabilities, including automated bank reconciliation and financial reporting. It integrates with various third-party apps to extend functionality.

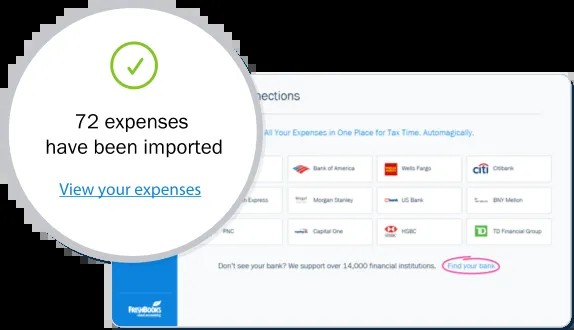

3.3. FreshBooks

FreshBooks is known for its invoicing and time-tracking features, ideal for managing tuition payments and hourly billing. It also offers expense tracking and basic accounting reports.

3.4. Procare Solutions

Procare Solutions specializes in childcare management, providing features like tuition billing, attendance tracking, and parent communication tools, along with accounting integrations.

3.5. ChildcareCRM

ChildcareCRM focuses on customer relationship management for daycares, offering tools for lead management, enrollment tracking, and automated billing, with accounting system integrations.

4. How Does Tuition Billing Work in Accounting Software for Day Cares?

Tuition billing features in accounting software automate the invoicing process, send payment reminders, and track tuition payments. This ensures timely payments and reduces administrative workload.

- Automated Invoicing: Generates and sends invoices automatically on a recurring basis.

- Payment Reminders: Sends automated reminders to parents about upcoming or overdue payments.

- Payment Tracking: Records and tracks payments, providing a clear overview of outstanding balances.

- Online Payments: Integrates with payment gateways to enable online payments for parents’ convenience.

5. What Are the Benefits of Using Online Payment Solutions for Day Care Tuition?

Online payment solutions offer numerous benefits, including faster payments, reduced administrative work, improved cash flow, and enhanced convenience for parents. According to a report by the U.S. Department of Health and Human Services, utilizing technology to streamline administrative tasks can significantly improve the efficiency of childcare programs.

- Faster Payments: Online payments are processed quickly, improving cash flow.

- Reduced Admin: Automates payment collection and reconciliation, reducing manual effort.

- Improved Cash Flow: Timely payments improve the predictability of income.

- Convenience for Parents: Parents can pay tuition anytime, anywhere, using their preferred method.

6. How Can Expense Tracking Help Day Cares Manage Their Finances?

Expense tracking allows day cares to monitor and categorize expenses, manage budgets, and identify areas for cost savings. Proper expense tracking is crucial for maintaining financial health and compliance.

- Categorization: Classifies expenses into categories for better analysis (e.g., supplies, rent, utilities).

- Budget Management: Compares actual expenses against budgeted amounts to identify variances.

- Cost Savings: Identifies areas where costs can be reduced or optimized.

- Tax Compliance: Ensures accurate records for tax deductions and compliance.

7. What Financial Reports Are Essential for Day Care Management?

Essential financial reports for day care management include profit and loss statements, balance sheets, cash flow statements, and budget vs. actual reports. These reports provide insights into financial performance and aid in decision-making.

- Profit and Loss (P&L) Statement: Summarizes revenues, costs, and expenses to determine profitability over a period.

- Balance Sheet: Shows assets, liabilities, and equity at a specific point in time, providing a snapshot of financial position.

- Cash Flow Statement: Tracks the movement of cash in and out of the business, indicating liquidity and solvency.

- Budget vs. Actual Report: Compares budgeted amounts to actual results, highlighting variances and areas for improvement.

8. How Can Day Cares Ensure Compliance with Accounting Regulations?

Day cares can ensure compliance with accounting regulations by maintaining accurate records, following accounting standards, and seeking professional advice. Regular audits and reviews can also help identify and address any compliance issues.

- Accurate Record-Keeping: Maintain detailed and organized financial records.

- Accounting Standards: Adhere to Generally Accepted Accounting Principles (GAAP) or other relevant standards.

- Professional Advice: Consult with accountants or financial advisors to ensure compliance.

- Regular Audits: Conduct periodic internal or external audits to identify and correct errors.

9. What Is the Role of Payroll Management in Day Care Accounting?

Payroll management involves calculating employee wages, withholding taxes, and managing benefits. Efficient payroll management ensures compliance with labor laws and accurate compensation for staff.

- Wage Calculation: Accurately calculates wages based on hours worked and pay rates.

- Tax Withholding: Withholds and remits federal, state, and local taxes.

- Benefits Management: Manages employee benefits such as health insurance and retirement plans.

- Compliance: Ensures compliance with labor laws and reporting requirements.

10. How Can Cloud-Based Accounting Software Benefit Preschool Day Cares?

Cloud-based accounting software offers accessibility, collaboration, data security, and automatic updates. It allows day care operators to manage finances from anywhere and ensures data is securely stored and backed up.

- Accessibility: Access financial data from any device with an internet connection.

- Collaboration: Allows multiple users to access and work on the same data simultaneously.

- Data Security: Provides secure data storage and backup to protect against data loss.

- Automatic Updates: Automatically updates software to the latest version, reducing IT overhead.

11. What Are the Integration Capabilities of Accounting Software with Other Day Care Management Tools?

Accounting software can integrate with other day care management tools, such as CRM systems, attendance trackers, and parent communication platforms. This integration streamlines operations and improves data flow.

- CRM Systems: Integrates with CRM systems for lead management and enrollment tracking.

- Attendance Trackers: Connects with attendance tracking systems to automate billing based on attendance.

- Parent Communication Platforms: Syncs with parent communication platforms for seamless communication and billing updates.

- Payment Gateways: Integrates with payment gateways to process online payments securely.

12. How Can Day Cares Use Accounting Software to Improve Budgeting?

Day cares can use accounting software to create and manage budgets, track expenses, and compare actual results against budgeted amounts. This helps in effective financial planning and decision-making.

- Budget Creation: Create detailed budgets for various expense categories.

- Expense Tracking: Monitor actual expenses against budgeted amounts.

- Variance Analysis: Identify and analyze variances between budgeted and actual results.

- Forecasting: Use historical data to forecast future financial performance.

13. What Strategies Can Day Cares Employ to Minimize Accounting Errors?

To minimize accounting errors, day cares should implement internal controls, reconcile accounts regularly, and provide training to staff. Accurate and consistent practices ensure reliable financial data.

- Internal Controls: Implement controls such as segregation of duties and authorization limits.

- Regular Reconciliation: Reconcile bank accounts, credit card statements, and other accounts regularly.

- Staff Training: Provide training to staff on proper accounting procedures.

- Software Automation: Utilize software features to automate and validate data entry.

14. How Does Accounting Software Help in Preparing for Tax Season?

Accounting software simplifies tax preparation by organizing financial data, generating tax reports, and ensuring compliance with tax laws. This reduces the time and effort required for tax filing.

- Data Organization: Organizes financial data in a structured format for easy access.

- Tax Reports: Generates tax-related reports such as income statements and expense summaries.

- Tax Compliance: Ensures compliance with tax laws and regulations.

- Integration with Tax Software: Integrates with tax software to streamline the filing process.

15. What Are the Best Practices for Setting Up Accounting Software for a New Day Care?

Setting up accounting software for a new day care involves defining chart of accounts, configuring billing settings, and integrating with bank accounts. Proper setup ensures accurate financial tracking from the start.

- Define Chart of Accounts: Create a chart of accounts that reflects the day care’s specific financial activities.

- Configure Billing Settings: Set up billing cycles, payment terms, and late payment policies.

- Integrate with Bank Accounts: Connect bank accounts for automated transaction importing.

- Train Staff: Provide training to staff on how to use the software effectively.

16. How Can Day Cares Use Accounting Software to Track and Manage Grants?

Accounting software helps day cares track and manage grants by allocating funds to specific projects, monitoring expenses, and generating grant-specific reports. This ensures compliance with grant requirements.

- Fund Allocation: Allocate grant funds to specific projects or expense categories.

- Expense Monitoring: Track expenses related to grant-funded projects.

- Grant Reporting: Generate reports showing how grant funds were used.

- Compliance Tracking: Ensure compliance with grant requirements and reporting deadlines.

17. What Role Does Depreciation Play in Day Care Accounting?

Depreciation is the allocation of the cost of an asset over its useful life. In day care accounting, it accounts for the wear and tear of assets like furniture, equipment, and vehicles, impacting financial statements and tax liabilities.

- Asset Valuation: Reflects the decreasing value of assets over time.

- Financial Statements: Impacts the profit and loss statement and balance sheet.

- Tax Implications: Affects taxable income and potential tax deductions.

- Accurate Reporting: Provides a more accurate view of the day care’s financial health.

18. How Can Day Cares Manage Fixed Assets Using Accounting Software?

Day cares can manage fixed assets using accounting software by recording asset purchases, tracking depreciation, and managing disposals. This ensures accurate accounting and reporting of fixed assets.

- Asset Recording: Record the purchase of fixed assets, including cost, date, and description.

- Depreciation Tracking: Calculate and track depreciation expense over the asset’s life.

- Disposal Management: Record the disposal of assets, including sale price and any gain or loss.

- Reporting: Generate reports showing the value and depreciation of fixed assets.

19. What Are the Advantages of Using Mobile Accounting Apps for Day Cares?

Mobile accounting apps offer convenience, real-time access, and efficient expense tracking. Day care operators can manage finances on the go, upload receipts, and monitor financial performance from anywhere.

- Convenience: Manage finances from any location using a smartphone or tablet.

- Real-Time Access: Access up-to-date financial data in real-time.

- Expense Tracking: Upload receipts and track expenses on the go.

- Mobile Payments: Process payments and send invoices from a mobile device.

20. How Can Day Cares Ensure Data Security and Privacy with Accounting Software?

Day cares can ensure data security and privacy by choosing reputable software, implementing strong passwords, and regularly backing up data. Compliance with data protection regulations is also essential.

- Reputable Software: Choose accounting software with robust security features.

- Strong Passwords: Use strong, unique passwords and update them regularly.

- Data Backup: Regularly back up financial data to a secure location.

- Compliance: Comply with data protection regulations such as GDPR or CCPA.

21. Can Accounting Software Help With Managing Food Program Finances in Day Cares?

Yes, accounting software can help manage food program finances by tracking food-related expenses, managing reimbursements, and generating necessary reports. This ensures compliance with food program regulations.

- Expense Tracking: Categorize and track all food-related expenses, including purchases and inventory.

- Reimbursement Management: Track reimbursements received from food programs and reconcile them with expenses.

- Reporting: Generate reports that detail food program finances, aiding in compliance and audits.

- Compliance: Ensure that all financial activities adhere to the specific regulations of the food program.

22. How Can Day Cares Track Parent Co-pays and Subsidies Using Accounting Software?

Accounting software can track parent co-pays and subsidies by creating individual parent accounts, recording payments from both parents and subsidy providers, and generating reports on outstanding balances. This ensures accurate and transparent financial management.

- Individual Accounts: Create separate accounts for each parent to track co-pays and subsidies.

- Payment Recording: Record payments received from both parents and subsidy providers.

- Balance Reporting: Generate reports showing outstanding balances and payment histories.

- Subsidy Compliance: Ensure all subsidy payments are correctly allocated and compliant with subsidy regulations.

23. How Does Accounting Software Assist With Reporting to Government Agencies?

Accounting software assists with reporting to government agencies by organizing financial data in a standardized format, generating required reports, and ensuring compliance with reporting deadlines. This simplifies the reporting process and reduces the risk of errors.

- Standardized Data: Organize financial data according to government reporting standards.

- Report Generation: Generate necessary reports such as income statements and balance sheets.

- Deadline Compliance: Ensure that all reports are submitted on time to avoid penalties.

- Audit Readiness: Maintain accurate and detailed records to facilitate audits by government agencies.

24. What Are the Considerations for Choosing Accounting Software for a Multi-Location Day Care?

When choosing accounting software for a multi-location day care, consider centralized financial management, inter-location transactions, and consolidated reporting. The software should support the complexity of managing finances across multiple locations.

- Centralized Management: Choose software that allows for centralized financial management across all locations.

- Inter-Location Transactions: Ensure the software can handle transactions between different locations.

- Consolidated Reporting: Generate consolidated financial reports that provide an overview of the entire organization.

- Scalability: Select software that can scale to accommodate future growth and expansion.

25. How Can Day Cares Use Accounting Software to Track Revenue by Program or Service?

Day cares can use accounting software to track revenue by program or service by categorizing income sources, allocating payments to specific programs, and generating revenue reports. This provides insights into the profitability of each program or service.

- Income Categorization: Categorize income sources according to the specific programs or services offered.

- Payment Allocation: Allocate payments to the relevant programs or services.

- Revenue Reporting: Generate reports that show revenue earned by each program or service.

- Profitability Analysis: Analyze the profitability of different programs or services to inform decision-making.

26. How Can CAR-REMOTE-REPAIR.EDU.VN Assist With Your Day Care’s Accounting Needs?

CAR-REMOTE-REPAIR.EDU.VN offers expert guidance and resources to help day cares optimize their accounting practices. Our training programs provide detailed knowledge on utilizing accounting software effectively, ensuring accurate financial management and compliance.

- Expert Guidance: Benefit from our extensive knowledge in day care financial management.

- Training Programs: Access detailed training on accounting software usage, ensuring compliance and accuracy.

- Optimized Practices: Learn to optimize accounting processes for enhanced efficiency and better financial outcomes.

27. What Are the Long-Term Benefits of Investing in Quality Accounting Software for Day Cares?

Investing in quality accounting software offers long-term benefits such as improved financial accuracy, increased efficiency, better decision-making, and enhanced compliance. These benefits contribute to the overall sustainability and success of the day care.

- Financial Accuracy: Ensure precise and reliable financial data for informed decision-making.

- Increased Efficiency: Streamline financial processes, saving time and resources.

- Better Decision-Making: Gain access to real-time financial insights for strategic planning.

- Enhanced Compliance: Stay compliant with accounting regulations and reporting requirements.

By addressing these questions, preschool day cares can make informed decisions about selecting and implementing accounting software, leading to improved financial management and overall operational efficiency.

FreshBooks Application

FreshBooks Application

Alt Text: FreshBooks accounting software interface displaying automated bank transaction import, streamlining expense tracking for small businesses.

Investing in the right accounting software is a game-changer for preschool day cares, enhancing financial management and ensuring compliance.

Ready to transform your day care’s financial management? Visit CAR-REMOTE-REPAIR.EDU.VN today to explore our training programs and learn how to optimize your accounting practices with expert guidance. Contact us at Whatsapp: +1 (641) 206-8880 or visit us at 1700 W Irving Park Rd, Chicago, IL 60613, United States, and take the first step towards financial excellence. Embrace a future of streamlined finances, empowered decision-making, and sustainable growth.

FAQ: Accounting Software for Preschool Day Cares

Q1: What makes accounting software a necessity for preschool day cares?

Accounting software is vital for preschool day cares because it automates financial tasks, minimizes errors, and offers real-time financial insights. This allows administrators to focus on providing quality care instead of getting bogged down in paperwork.

Q2: What key features should I look for in accounting software for my daycare?

Look for features such as automated tuition billing, comprehensive expense tracking, efficient payroll management, detailed financial reporting, and seamless integration with other management tools.

Q3: Which accounting software options are highly recommended for preschool day cares?

Top options include QuickBooks Online, Xero, FreshBooks, Procare Solutions, and ChildcareCRM, each offering unique benefits tailored to the specific needs of child care facilities.

Q4: How does accounting software simplify tuition billing for day cares?

Accounting software automates the invoicing process, sends timely payment reminders, and accurately tracks all tuition payments, ensuring consistent and reliable income.

Q5: What are the advantages of using online payment solutions for day care tuition payments?

Online payment solutions offer faster payment processing, reduced administrative tasks, improved cash flow, and increased convenience for parents, streamlining the entire payment process.

Q6: How can expense tracking improve financial management in my day care?

Effective expense tracking helps categorize and monitor all expenses, manage budgets more efficiently, and identify potential cost savings, leading to better financial control.

Q7: What financial reports are crucial for effectively managing a day care business?

Essential reports include profit and loss statements, balance sheets, cash flow statements, and budget vs. actual reports, providing a clear picture of your day care’s financial performance and health.

Q8: How can day cares ensure they comply with all relevant accounting regulations?

Ensure compliance by maintaining meticulous records, adhering to accounting standards, seeking advice from financial professionals, and conducting regular internal audits.

Q9: How does cloud-based accounting software benefit preschool day cares specifically?

Cloud-based software offers anytime access, facilitates collaboration among staff, ensures robust data security, and provides automatic updates, making financial management more flexible and efficient.

Q10: Can accounting software really streamline grant management for day cares?

Yes, accounting software can streamline grant management by helping allocate funds, track expenses, and generate grant-specific reports, ensuring full compliance and proper utilization of funds.

These FAQs will help you better understand how accounting software can benefit your preschool day care.