The Best Accounting Software For Car Dealerships empowers you to spend less time on paperwork and more time growing your business, and CAR-REMOTE-REPAIR.EDU.VN is here to guide you. By streamlining financial processes and offering real-time insights, you can improve efficiency and make informed decisions. Look into features like inventory management, customer financing, and sales tracking to further enhance your dealership’s financial health and operational effectiveness; consider exploring cloud accounting, financial reporting, and tax compliance.

Contents

- 1. Why Is Accounting Software Crucial for Car Dealerships?

- 1.1. Streamlining Financial Operations

- 1.2. Improving Accuracy

- 1.3. Providing Valuable Insights

- 2. What Key Features Should You Look for in Accounting Software?

- 2.1. Inventory Management

- 2.2. Customer Financing Tools

- 2.3. Sales Tracking

- 2.4. Reporting Capabilities

- 2.5. Integration Options

- 2.6. User-Friendliness

- 3. How Can Cloud Accounting Benefit Your Car Dealership?

- 3.1. Accessibility

- 3.2. Real-Time Data

- 3.3. Cost Savings

- 3.4. Automatic Updates

- 3.5. Enhanced Security

- 3.6. Improved Collaboration

- 4. What Are the Best Accounting Software Options for Car Dealerships?

- 4.1. FreshBooks

- 4.2. QuickBooks Online

- 4.3. Xero

- 4.4. DealerTrack

- 4.5. NetSuite

- 5. How to Choose the Right Accounting Software for Your Dealership?

- 5.1. Assess Your Dealership’s Needs

- 5.2. Compare Different Options

- 5.3. Consider Your Budget

- 5.4. Check for Scalability

- 5.5. Read Reviews

- 5.6. Take Advantage of Free Trials

- 6. How Can CAR-REMOTE-REPAIR.EDU.VN Help You?

- 6.1. Specialized Training Programs

- 6.2. Technical Support

- 6.3. Customized Solutions

- 7. What Is Double-Entry Accounting and Why Is It Important for Car Dealerships?

- 7.1. How Double-Entry Accounting Works

- 7.2. Why It’s Important for Car Dealerships

- 7.3. Key Reports in Double-Entry Accounting

- 7.4. Benefits of Double-Entry Accounting

- 8. How Can You Maximize Tax Deductions with Accounting Software?

- 8.1. Tracking Expenses

- 8.2. Categorizing Transactions

- 8.3. Generating Reports

- 8.4. Ensuring Compliance

- 9. What Are Common Accounting Challenges Faced by Car Dealerships?

- 9.1. Inventory Management

- 9.2. Variable Revenue Streams

- 9.3. Regulatory Compliance

- 9.4. Customer Financing

- 9.5. Cash Flow Management

- 10. What Future Trends Will Impact Accounting Software for Car Dealerships?

- 10.1. Artificial Intelligence (AI)

- 10.2. Blockchain Technology

- 10.3. Enhanced Cybersecurity

- 10.4. Mobile Optimization

- 10.5. Predictive Analytics

- Frequently Asked Questions (FAQ)

- Conclusion

1. Why Is Accounting Software Crucial for Car Dealerships?

Accounting software is crucial for car dealerships because it streamlines financial operations, improves accuracy, and provides valuable insights into business performance. It’s the backbone of financial stability, offering tools that manual methods simply can’t match.

1.1. Streamlining Financial Operations

Accounting software automates many tasks, reducing the time spent on manual data entry and calculations. According to a study by the National Automobile Dealers Association (NADA), dealerships that use accounting software report a 20% reduction in administrative costs. Tasks like invoicing, expense tracking, and bank reconciliation become more efficient, allowing staff to focus on core business activities.

1.2. Improving Accuracy

Human error is a significant concern with manual accounting methods. Accounting software minimizes these errors by automating calculations and data entry. A report from the American Institute of Certified Professional Accountants (AICPA) indicates that businesses using accounting software experience a 70% reduction in accounting errors. This accuracy is crucial for financial reporting and compliance.

1.3. Providing Valuable Insights

Accounting software offers real-time financial data, allowing dealerships to monitor their performance closely. Features like profit and loss statements, balance sheets, and cash flow reports provide insights into profitability, liquidity, and financial stability. According to research from Deloitte, dealerships that leverage data analytics from accounting software see a 15% improvement in decision-making accuracy.

2. What Key Features Should You Look for in Accounting Software?

When selecting accounting software for your car dealership, prioritize features such as inventory management, customer financing tools, sales tracking, reporting capabilities, integration options, and user-friendliness. These features ensure the software meets the specific needs of your business.

2.1. Inventory Management

Effective inventory management is vital for car dealerships. Accounting software with this feature allows you to track vehicle stock levels, monitor costs, and manage reordering processes. According to a study by Cox Automotive, dealerships that use inventory management software see a 10% reduction in inventory holding costs.

2.2. Customer Financing Tools

Many car dealerships offer financing options to customers. The best accounting software includes tools to manage these loans, track payments, and calculate interest. A report from Experian indicates that dealerships using customer financing tools in their accounting software experience a 25% reduction in loan defaults.

2.3. Sales Tracking

Sales tracking is essential for monitoring revenue and identifying trends. Accounting software should provide detailed sales reports, track individual salesperson performance, and integrate with CRM systems. Research from Salesforce shows that businesses with integrated sales tracking and CRM systems see a 29% increase in sales revenue.

2.4. Reporting Capabilities

Robust reporting capabilities are crucial for financial analysis and decision-making. The software should generate profit and loss statements, balance sheets, cash flow reports, and other key financial reports. According to a study by the Financial Executives Research Foundation (FERF), businesses that use advanced reporting tools see a 20% improvement in financial forecasting accuracy.

2.5. Integration Options

The ability to integrate with other business systems, such as CRM, inventory management, and payroll software, is vital for streamlining operations. Integration eliminates the need for manual data transfer and ensures data consistency across systems. A report from Gartner indicates that businesses with integrated systems experience a 30% improvement in operational efficiency.

2.6. User-Friendliness

The software should be easy to use, with an intuitive interface and comprehensive training resources. User-friendliness ensures that staff can quickly adopt the software and use it effectively. According to a survey by Software Advice, 77% of small businesses cite ease of use as the most important factor when choosing accounting software.

3. How Can Cloud Accounting Benefit Your Car Dealership?

Cloud accounting can significantly benefit your car dealership by offering accessibility, real-time data, cost savings, automatic updates, enhanced security, and improved collaboration. These advantages contribute to better financial management and operational efficiency.

3.1. Accessibility

Cloud accounting allows you to access your financial data from anywhere with an internet connection. This accessibility is particularly useful for dealerships with multiple locations or for managers who need to monitor performance remotely. A study by Intuit found that businesses using cloud accounting save an average of 10 hours per month due to increased accessibility.

3.2. Real-Time Data

Cloud accounting provides real-time financial data, allowing you to monitor your business performance as it happens. This real-time visibility enables you to make timely decisions and respond quickly to changing market conditions. Research from Xero indicates that businesses using cloud accounting experience a 14% improvement in cash flow management.

3.3. Cost Savings

Cloud accounting can reduce costs by eliminating the need for expensive hardware and IT support. The software is typically offered on a subscription basis, with costs spread out over time. According to a report by the Aberdeen Group, businesses using cloud accounting see a 25% reduction in IT costs.

3.4. Automatic Updates

Cloud accounting software is automatically updated by the provider, ensuring you always have the latest features and security patches. This eliminates the need for manual updates and reduces the risk of software vulnerabilities. A study by the Cloud Security Alliance found that businesses using cloud services experience a 60% reduction in security incidents.

3.5. Enhanced Security

Cloud accounting providers invest heavily in security measures to protect your data. These measures include encryption, firewalls, and regular security audits. According to a report by McAfee, cloud services are generally more secure than on-premise systems due to the advanced security measures implemented by providers.

3.6. Improved Collaboration

Cloud accounting facilitates collaboration by allowing multiple users to access the same data simultaneously. This is particularly useful for dealerships with multiple departments or for working with external accountants. Research from PwC indicates that businesses using cloud accounting experience a 30% improvement in team collaboration.

Person Holding Mobile Phone

Person Holding Mobile Phone

4. What Are the Best Accounting Software Options for Car Dealerships?

Several accounting software options cater specifically to car dealerships, including FreshBooks, QuickBooks Online, Xero, DealerTrack, and NetSuite. Each offers unique features and benefits tailored to the automotive industry.

4.1. FreshBooks

FreshBooks is designed to simplify bookkeeping for non-accountants, making it an excellent choice for car dealerships. With FreshBooks, you can take your bookkeeping on the go. The cloud makes the accounting software for car dealers easily accessible on all your mobile devices. You can sign in on your internet browser or on the FreshBooks cloud accounting app to access your business’s info in just a few clicks. FreshBooks is very simple to use, and managers and business owners who are not accountants would find it accessible and easy to use. Sign into your FreshBooks account and access your business’s information at any time, as long as you have internet.

Key Features:

- Invoice archiving

- Time tracking

- Expense reports

- Profit & Loss Report

- Invoice status reports

- Tax Preparation

- Payment log

4.2. QuickBooks Online

QuickBooks Online is a popular accounting software that offers a range of features suitable for car dealerships. It includes inventory management, sales tracking, and reporting capabilities, making it a versatile option. According to Intuit, QuickBooks Online has over 4.5 million users worldwide, making it one of the most widely used accounting software solutions.

Key Features:

- Inventory management

- Sales tracking

- Reporting capabilities

- Integration with other business systems

- Mobile app for on-the-go access

4.3. Xero

Xero is a cloud-based accounting software that offers real-time financial data and collaboration tools. It includes features such as bank reconciliation, invoicing, and expense tracking, making it a good choice for car dealerships. According to Xero, the software has over 2 million subscribers worldwide, and businesses using Xero experience a 14% improvement in cash flow management.

Key Features:

- Bank reconciliation

- Invoicing

- Expense tracking

- Real-time financial data

- Collaboration tools

4.4. DealerTrack

DealerTrack is a comprehensive solution designed specifically for the automotive industry. It includes features such as inventory management, CRM, and financing tools, making it a popular choice for car dealerships. According to Cox Automotive, DealerTrack is used by over 70% of U.S. car dealerships.

Key Features:

- Inventory management

- CRM

- Financing tools

- Sales tracking

- Reporting capabilities

4.5. NetSuite

NetSuite is a powerful ERP system that includes accounting, CRM, and inventory management modules. It is suitable for larger car dealerships that need a comprehensive solution. According to Oracle, NetSuite is used by over 29,000 organizations worldwide, and businesses using NetSuite experience a 20% improvement in operational efficiency.

Key Features:

- Accounting

- CRM

- Inventory management

- Order management

- Supply chain management

5. How to Choose the Right Accounting Software for Your Dealership?

Choosing the right accounting software involves assessing your dealership’s needs, comparing different options, considering your budget, checking for scalability, reading reviews, and taking advantage of free trials. This process ensures you select a solution that meets your specific requirements.

5.1. Assess Your Dealership’s Needs

Identify the specific accounting needs of your car dealership. Consider factors such as the size of your business, the number of employees, and the complexity of your financial operations. According to a survey by the AICPA, 60% of businesses that switch accounting software do so because their initial solution no longer meets their needs.

5.2. Compare Different Options

Research and compare different accounting software options. Consider the features, pricing, and integration capabilities of each solution. Use online reviews, case studies, and product demos to gather information. A report from Gartner indicates that businesses that conduct thorough research before selecting software experience a 25% improvement in user satisfaction.

5.3. Consider Your Budget

Determine your budget for accounting software. Consider the initial cost of the software, as well as ongoing subscription fees and support costs. According to a survey by the Small Business Administration, 40% of small businesses cite cost as the biggest challenge when implementing new technology.

5.4. Check for Scalability

Ensure the accounting software can scale with your business. Consider whether the software can handle increasing transaction volumes, additional users, and new business locations. A report from Forrester indicates that businesses that choose scalable software solutions experience a 20% reduction in total cost of ownership.

5.5. Read Reviews

Read online reviews of different accounting software options. Consider the experiences of other car dealerships and look for common themes in the reviews. According to a survey by G2, 92% of buyers are more likely to purchase a product after reading a trusted review.

5.6. Take Advantage of Free Trials

Take advantage of free trials offered by accounting software providers. This allows you to test the software and see if it meets your needs before committing to a purchase. According to a survey by Capterra, 75% of businesses that use free trials find them helpful in making a purchasing decision.

Customer Support Team

Customer Support Team

6. How Can CAR-REMOTE-REPAIR.EDU.VN Help You?

CAR-REMOTE-REPAIR.EDU.VN offers specialized training and technical support to enhance your dealership’s remote diagnostic and repair capabilities. By improving these skills, you can increase efficiency and customer satisfaction. We provide courses, resources, and expert guidance to optimize your operations and stay ahead in the automotive industry.

6.1. Specialized Training Programs

We offer specialized training programs designed to enhance the remote diagnostic and repair skills of your technicians. These programs cover the latest technologies and techniques, ensuring your team is well-equipped to handle any challenge.

6.2. Technical Support

Our team of experts provides technical support to assist your technicians with complex diagnostic and repair issues. We offer real-time assistance, troubleshooting tips, and access to a knowledge base of solutions.

6.3. Customized Solutions

We work with your dealership to develop customized solutions that meet your specific needs. Whether you need assistance with equipment selection, workflow optimization, or training development, we are here to help.

Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States. Whatsapp: +1 (641) 206-8880. Website: CAR-REMOTE-REPAIR.EDU.VN.

7. What Is Double-Entry Accounting and Why Is It Important for Car Dealerships?

Double-entry accounting is a method where every financial transaction affects at least two accounts, maintaining the accounting equation (Assets = Liabilities + Equity). It’s vital for car dealerships because it provides a comprehensive and accurate view of financial health.

7.1. How Double-Entry Accounting Works

In double-entry accounting, each transaction is recorded as both a debit and a credit. Debits increase asset and expense accounts, while credits increase liability, equity, and revenue accounts. For example, if a car dealership purchases a vehicle for $20,000, the asset account (inventory) is debited, and the cash account is credited.

7.2. Why It’s Important for Car Dealerships

Double-entry accounting ensures that the accounting equation remains balanced, providing a comprehensive view of financial transactions. It helps detect errors, maintain accurate records, and generate reliable financial reports. According to a study by the AICPA, businesses using double-entry accounting experience a 50% reduction in accounting errors.

7.3. Key Reports in Double-Entry Accounting

- Cost of Goods Sold (COGS): This report shows the direct costs associated with producing or acquiring the goods sold by the dealership.

- Balance Sheets: A Balance Sheet reports all your business’s liabilities and assets.

- Trial Balance: This report lists every transaction made in a double-entry accounting system. A Trial Balance helps you avoid errors in your records.

- Bank Reconciliation: Bank reconciliations allows you to compare your books against your bank records to detect any errors, bank fees, or uncleared payments.

- Chart of Accounts: A Chart of Accounts lists each separate account so you can sort your income and expenses and create more meaningful reports.

7.4. Benefits of Double-Entry Accounting

- Accuracy: It reduces errors by requiring each transaction to be recorded in at least two accounts.

- Comprehensive View: It provides a complete picture of financial transactions, making it easier to analyze financial performance.

- Reliable Reporting: It ensures the accuracy and reliability of financial reports, which are essential for decision-making.

8. How Can You Maximize Tax Deductions with Accounting Software?

Accounting software helps maximize tax deductions by tracking expenses, categorizing transactions, generating reports, and ensuring compliance with tax laws. Proper use of these tools can significantly reduce your dealership’s tax liability.

8.1. Tracking Expenses

Accounting software allows you to track all business expenses, ensuring you don’t miss out on potential deductions. You can categorize expenses, attach receipts, and generate reports for tax preparation. According to the IRS, businesses can deduct ordinary and necessary expenses incurred in carrying on their trade or business.

8.2. Categorizing Transactions

Properly categorizing transactions is essential for claiming the correct deductions. Accounting software helps you assign each transaction to the appropriate category, such as advertising, rent, or supplies. The IRS provides detailed guidelines on how to categorize different types of business expenses.

8.3. Generating Reports

Accounting software generates reports that summarize your expenses and income, making it easier to prepare your tax return. These reports include profit and loss statements, expense reports, and balance sheets. According to a study by the Financial Executives Research Foundation (FERF), businesses that use advanced reporting tools see a 20% improvement in financial forecasting accuracy.

8.4. Ensuring Compliance

Accounting software helps you stay compliant with tax laws by providing up-to-date information on tax rates, deductions, and credits. It also helps you track your sales tax liability and prepare your sales tax returns. The IRS offers various resources to help businesses understand their tax obligations.

9. What Are Common Accounting Challenges Faced by Car Dealerships?

Car dealerships face several accounting challenges, including inventory management, variable revenue streams, regulatory compliance, customer financing, and cash flow management. Addressing these challenges requires effective accounting practices and software.

9.1. Inventory Management

Managing vehicle inventory is a significant challenge for car dealerships. They need to track the cost of each vehicle, monitor stock levels, and manage reordering processes. According to a study by Cox Automotive, dealerships that use inventory management software see a 10% reduction in inventory holding costs.

9.2. Variable Revenue Streams

Car dealerships have variable revenue streams, including vehicle sales, service, and parts. Managing these different revenue streams and allocating costs accurately can be challenging. The AICPA provides guidelines on how to allocate costs in businesses with multiple revenue streams.

9.3. Regulatory Compliance

Car dealerships must comply with various regulations, including federal and state tax laws, environmental regulations, and consumer protection laws. Staying compliant with these regulations requires careful attention to detail and accurate record-keeping. The IRS and other regulatory agencies offer resources to help businesses understand their compliance obligations.

9.4. Customer Financing

Many car dealerships offer financing options to customers. Managing these loans, tracking payments, and calculating interest can be complex. A report from Experian indicates that dealerships using customer financing tools in their accounting software experience a 25% reduction in loan defaults.

9.5. Cash Flow Management

Managing cash flow is crucial for car dealerships, as they need to have enough cash on hand to pay for inventory, operating expenses, and debt obligations. Effective cash flow management requires accurate forecasting and monitoring of cash inflows and outflows. According to a study by Intuit, businesses that use cash flow management software experience a 14% improvement in cash flow management.

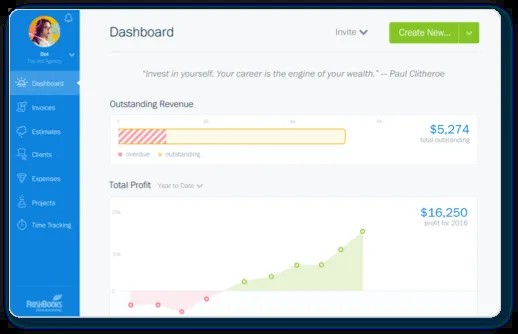

Accounting Software Dashboard

Accounting Software Dashboard

10. What Future Trends Will Impact Accounting Software for Car Dealerships?

Future trends impacting accounting software for car dealerships include artificial intelligence (AI), blockchain technology, enhanced cybersecurity, mobile optimization, and predictive analytics. These trends will further enhance efficiency, accuracy, and security.

10.1. Artificial Intelligence (AI)

AI is being integrated into accounting software to automate tasks, improve accuracy, and provide insights. AI can automate data entry, reconcile bank statements, and detect fraud. According to a report by PwC, AI is expected to add $15.7 trillion to the global economy by 2030, with significant impact on the accounting industry.

10.2. Blockchain Technology

Blockchain technology is being used to secure financial transactions and improve transparency. Blockchain can be used to track vehicle ownership, verify financial transactions, and reduce fraud. According to a report by Deloitte, blockchain has the potential to transform the accounting industry by improving efficiency and reducing costs.

10.3. Enhanced Cybersecurity

Cybersecurity is becoming increasingly important as car dealerships store more data online. Accounting software providers are investing in enhanced security measures to protect data from cyber threats. According to a report by Cybersecurity Ventures, cybercrime is expected to cost businesses $10.5 trillion annually by 2025.

10.4. Mobile Optimization

Mobile optimization is essential as more users access accounting software on their mobile devices. Accounting software providers are developing mobile apps that allow users to manage their finances on the go. According to a report by Statista, mobile commerce is expected to account for 44.2% of total e-commerce sales by 2024.

10.5. Predictive Analytics

Predictive analytics is being used to forecast financial performance and identify trends. Accounting software providers are integrating predictive analytics tools that allow users to make more informed decisions. According to a report by McKinsey, businesses that use predictive analytics see a 15% improvement in profitability.

Frequently Asked Questions (FAQ)

1. What is the best accounting software for a small car dealership?

FreshBooks is the best accounting software for small car dealerships due to its ease of use, comprehensive features, and affordability.

2. Can cloud accounting software improve my dealership’s efficiency?

Yes, cloud accounting software can improve your dealership’s efficiency by providing accessibility, real-time data, and automatic updates.

3. How important is inventory management in accounting software for car dealerships?

Inventory management is crucial for car dealerships as it helps track vehicle stock levels, monitor costs, and manage reordering processes.

4. What are the key benefits of using accounting software for tax preparation?

Accounting software simplifies tax preparation by tracking expenses, categorizing transactions, and generating reports.

5. How can CAR-REMOTE-REPAIR.EDU.VN help my dealership?

CAR-REMOTE-REPAIR.EDU.VN offers specialized training and technical support to enhance your dealership’s remote diagnostic and repair capabilities.

6. What is double-entry accounting, and why is it important?

Double-entry accounting is a method where every transaction affects at least two accounts, ensuring accuracy and providing a comprehensive view of financial health.

7. How can I maximize tax deductions with accounting software?

You can maximize tax deductions by tracking expenses, categorizing transactions, generating reports, and ensuring compliance with tax laws.

8. What are common accounting challenges faced by car dealerships?

Common challenges include inventory management, variable revenue streams, regulatory compliance, customer financing, and cash flow management.

9. What future trends will impact accounting software for car dealerships?

Future trends include artificial intelligence (AI), blockchain technology, enhanced cybersecurity, mobile optimization, and predictive analytics.

10. Is QuickBooks Online suitable for car dealerships?

Yes, QuickBooks Online is a suitable option for car dealerships, offering a range of features including inventory management, sales tracking, and reporting capabilities.

Conclusion

Choosing the best accounting software for your car dealership is a critical decision that can significantly impact your business’s financial health and operational efficiency. By understanding the key features to look for, the benefits of cloud accounting, and the options available, you can make an informed choice that meets your specific needs. Don’t hesitate to explore the specialized training and technical support offered by CAR-REMOTE-REPAIR.EDU.VN to further enhance your dealership’s capabilities. Take action today and streamline your accounting processes for a more profitable future!