Securing your automotive career in today’s rapidly evolving technological landscape means understanding and mitigating risks from compromised funding system software; CAR-REMOTE-REPAIR.EDU.VN offers specialized training to help you master these skills. This involves staying updated on current digital solutions, remote repair tools, and diagnostic methods to maintain proficiency and protect your livelihood. Explore expert insights and proactive strategies to safeguard your automotive career.

Contents

- 1. Why is Understanding “Career Securing Applications from Compromised Funding System Software” Critical for Automotive Professionals?

- 1.1 How Can Compromised Software Affect My Automotive Career?

- 1.2 What Are the Real-World Examples of Automotive Businesses Impacted by Funding Software Compromises?

- 1.3 How Does CAR-REMOTE-REPAIR.EDU.VN Help Automotive Professionals Secure Their Careers?

- 2. What are the Primary Threats to Funding System Software in the Automotive Industry?

- 2.1 What is Ransomware and How Does it Target Automotive Funding Systems?

- 2.2 How Do Phishing Scams Exploit Automotive Professionals to Gain Access?

- 2.3 What Role Do Insider Threats Play in Compromising Funding Software?

- 2.4 Why are Unpatched Software Vulnerabilities a Major Risk?

- 2.5 How Can Regular Security Audits Help Identify These Threats?

- 3. What are the Key Steps to Protect Automotive Funding System Software?

- 3.1 What Cybersecurity Measures Should Automotive Businesses Implement?

- 3.2 Why is Regular Software Updating Crucial for Security?

- 3.3 How Can Employee Training Programs Enhance Security?

- 3.4 What Should a Comprehensive Incident Response Plan Include?

- 3.5 How Can CAR-REMOTE-REPAIR.EDU.VN Assist in Developing These Security Strategies?

- 4. How Can Automotive Technicians Enhance Their Skills to Secure Funding Systems?

- 4.1 What Cybersecurity Certifications are Valuable for Automotive Technicians?

- 4.2 How Can Technicians Learn About Network Security Specific to Dealerships?

- 4.3 What Data Protection Measures Should Technicians Understand?

- 4.4 How Does CAR-REMOTE-REPAIR.EDU.VN Tailor Training for Automotive Technicians?

- 4.5 Can Remote Diagnostics Play a Role in Securing Funding Systems?

- 5. What Technologies Help Secure Funding System Software in the Automotive Sector?

- 5.1 How Do Advanced Firewalls Protect Funding Systems?

- 5.2 What are the Benefits of Intrusion Detection Systems?

- 5.3 How Does Data Encryption Safeguard Sensitive Information?

- 5.4 What are the Advantages of Secure Remote Access Tools?

- 5.5 How Can CAR-REMOTE-REPAIR.EDU.VN Help Implement These Technologies?

- 6. What Are the Legal and Compliance Requirements for Protecting Funding System Software?

- 6.1 What is the Gramm-Leach-Bliley Act (GLBA)?

- 6.2 How Does the California Consumer Privacy Act (CCPA) Impact Automotive Businesses?

- 6.3 What is the Payment Card Industry Data Security Standard (PCI DSS)?

- 6.4 What Penalties Can Automotive Businesses Face for Non-Compliance?

- 6.5 How Can CAR-REMOTE-REPAIR.EDU.VN Help Ensure Compliance?

- 7. How Does Vendor Security Management Affect Funding System Security?

- 7.1 Why is Vendor Risk Assessment Important?

- 7.2 What Security Requirements Should Be Included in Vendor Contracts?

- 7.3 How Can Automotive Businesses Monitor Vendor Compliance?

- 7.4 What Steps Should Be Taken if a Vendor Experiences a Security Breach?

- 7.5 How Can CAR-REMOTE-REPAIR.EDU.VN Assist with Vendor Security Management?

- 8. How Can Cloud Security Practices Safeguard Funding System Software?

- 8.1 What are the Benefits of Using Cloud-Based Funding Systems?

- 8.2 How Does Data Encryption in the Cloud Protect Sensitive Data?

- 8.3 What Access Controls Should Be Implemented in Cloud Environments?

- 8.4 How Can Automotive Businesses Ensure the Security of Their Cloud Providers?

- 8.5 How Can CAR-REMOTE-REPAIR.EDU.VN Assist with Cloud Security?

- 9. How Does Incident Response Planning Secure Automotive Careers?

- 9.1 What are the Key Components of an Incident Response Plan?

- 9.2 How Can Regular Testing of the Incident Response Plan Improve Security?

- 9.3 What Steps Should Be Taken Immediately After a Security Breach?

- 9.4 How Can Automotive Businesses Learn from Past Security Incidents?

- 9.5 How Can CAR-REMOTE-REPAIR.EDU.VN Assist with Incident Response Planning?

- 10. What is the Future of Securing Funding System Software in the Automotive Industry?

- 10.1 How Can AI Enhance Security Measures?

- 10.2 What Role Can Blockchain Play in Securing Funding Systems?

- 10.3 How Does Advanced Threat Intelligence Help Prevent Attacks?

- 10.4 What Emerging Technologies Will Impact Funding System Security?

- 10.5 How Can CAR-REMOTE-REPAIR.EDU.VN Prepare Automotive Professionals for These Changes?

- FAQ: Securing Automotive Careers from Compromised Funding System Software

- 1. What is considered compromised funding system software?

- 2. How can I tell if my dealership’s funding system is compromised?

- 3. What steps should I take if I suspect a compromise?

- 4. How often should we update our funding system software?

- 5. What are the best practices for securing passwords in automotive businesses?

- 6. How can employee training improve our security posture?

- 7. What is the role of firewalls in protecting funding systems?

- 8. How does data encryption protect sensitive financial data?

- 9. What are the legal requirements for protecting customer data?

- 10. How can CAR-REMOTE-REPAIR.EDU.VN help secure our funding system software?

1. Why is Understanding “Career Securing Applications from Compromised Funding System Software” Critical for Automotive Professionals?

It’s critical because compromised funding system software can disrupt dealership operations, impact technician pay, and damage career prospects; therefore, grasping its implications is essential for job security. This understanding enables automotive professionals to proactively identify and address potential threats, ensuring the stability and security of their careers.

1.1 How Can Compromised Software Affect My Automotive Career?

Compromised software impacts your career through delayed payments, inaccurate financial records, and potential job losses due to operational disruptions. Dealerships rely on funding systems to process transactions, manage inventory, and compensate employees. When these systems are compromised, it can lead to significant financial discrepancies, distrust among employees, and ultimately, a negative impact on job security.

1.2 What Are the Real-World Examples of Automotive Businesses Impacted by Funding Software Compromises?

Several automotive businesses have faced severe consequences due to funding software compromises, including financial losses and reputational damage. For example, in 2023, a major dealership group experienced a ransomware attack on its funding system, leading to a two-week delay in employee payments and significant customer service disruptions. According to a report by the National Automobile Dealers Association (NADA), such incidents are increasingly common, emphasizing the need for robust cybersecurity measures.

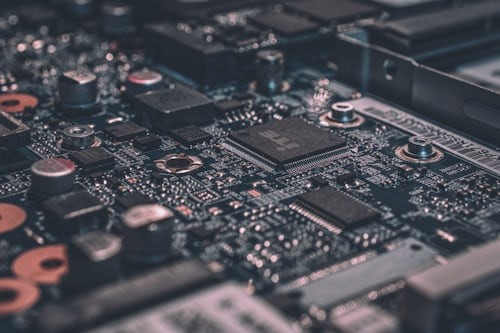

Automotive cyber security

Automotive cyber security

1.3 How Does CAR-REMOTE-REPAIR.EDU.VN Help Automotive Professionals Secure Their Careers?

CAR-REMOTE-REPAIR.EDU.VN provides specialized training programs focused on cybersecurity in the automotive industry, including modules on identifying and mitigating risks from compromised funding systems. These programs equip technicians, service managers, and dealership owners with the knowledge and skills to protect their businesses and careers. Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States. Whatsapp: +1 (641) 206-8880.

2. What are the Primary Threats to Funding System Software in the Automotive Industry?

The primary threats include ransomware attacks, phishing scams, insider threats, and unpatched software vulnerabilities, all of which can compromise funding system integrity. Automotive businesses are particularly vulnerable due to their complex IT infrastructure and reliance on third-party software.

2.1 What is Ransomware and How Does it Target Automotive Funding Systems?

Ransomware is a type of malicious software that encrypts data and demands a ransom for its release, often targeting automotive funding systems to disrupt operations. Cybercriminals may exploit vulnerabilities in the system’s software or gain access through phishing attacks, locking critical financial data and causing significant delays and financial losses.

2.2 How Do Phishing Scams Exploit Automotive Professionals to Gain Access?

Phishing scams trick automotive professionals into revealing sensitive information like passwords or financial details, often used to infiltrate funding systems. These scams frequently come in the form of emails that appear to be from trusted sources, such as suppliers or internal management, leading employees to unwittingly compromise security.

2.3 What Role Do Insider Threats Play in Compromising Funding Software?

Insider threats, whether malicious or unintentional, can significantly compromise funding software; for example, a disgruntled employee might intentionally sabotage the system, or an unaware employee might inadvertently expose sensitive data. Implementing strict access controls and regular audits helps mitigate these risks.

Data breaches

Data breaches

2.4 Why are Unpatched Software Vulnerabilities a Major Risk?

Unpatched software vulnerabilities represent a major risk because they provide cybercriminals with known entry points into funding systems. Software vendors regularly release patches to fix security flaws, but if these updates are not promptly applied, the system remains vulnerable to exploitation.

2.5 How Can Regular Security Audits Help Identify These Threats?

Regular security audits are vital for identifying vulnerabilities, assessing risks, and ensuring compliance with security standards, which helps protect funding systems. According to a study by Verizon, organizations that conduct regular security audits are significantly less likely to experience data breaches.

3. What are the Key Steps to Protect Automotive Funding System Software?

Key steps include implementing strong cybersecurity measures, regularly updating software, training employees, and developing a comprehensive incident response plan to safeguard funding software. These measures are essential for maintaining the integrity and security of financial operations.

3.1 What Cybersecurity Measures Should Automotive Businesses Implement?

Automotive businesses should implement multi-factor authentication, firewalls, intrusion detection systems, and encryption to protect funding system software. Multi-factor authentication adds an extra layer of security by requiring users to verify their identity through multiple channels, such as a password and a code sent to their mobile device.

3.2 Why is Regular Software Updating Crucial for Security?

Regularly updating software is crucial because updates often include patches for newly discovered security vulnerabilities, keeping systems protected from known threats. Staying current with updates helps to prevent cybercriminals from exploiting weaknesses in outdated software.

3.3 How Can Employee Training Programs Enhance Security?

Employee training programs enhance security by educating staff about phishing scams, password security, and safe computing practices, thereby reducing the risk of human error. Training should be ongoing and tailored to the specific threats facing the automotive industry.

3.4 What Should a Comprehensive Incident Response Plan Include?

A comprehensive incident response plan should include steps for identifying, containing, eradicating, and recovering from security incidents, ensuring minimal disruption to operations. The plan should also outline communication protocols for notifying stakeholders, including employees, customers, and regulatory bodies.

3.5 How Can CAR-REMOTE-REPAIR.EDU.VN Assist in Developing These Security Strategies?

CAR-REMOTE-REPAIR.EDU.VN offers specialized training and consulting services to help automotive businesses develop and implement robust cybersecurity strategies. Their experts can assess your current security posture, identify vulnerabilities, and recommend tailored solutions to protect your funding system software. Website: CAR-REMOTE-REPAIR.EDU.VN.

4. How Can Automotive Technicians Enhance Their Skills to Secure Funding Systems?

Technicians can enhance their skills by pursuing specialized training in cybersecurity, learning about network security, and understanding data protection measures relevant to automotive funding systems. This specialized knowledge will enable them to better protect sensitive information and maintain the integrity of financial operations.

4.1 What Cybersecurity Certifications are Valuable for Automotive Technicians?

Valuable certifications include CompTIA Security+, Certified Ethical Hacker (CEH), and Certified Information Systems Security Professional (CISSP), which demonstrate a strong understanding of cybersecurity principles. These certifications provide technicians with the credentials needed to effectively protect automotive funding systems.

4.2 How Can Technicians Learn About Network Security Specific to Dealerships?

Technicians can learn about network security through online courses, industry conferences, and training programs offered by CAR-REMOTE-REPAIR.EDU.VN, focusing on the unique challenges faced by dealerships. These resources provide practical knowledge and skills for securing dealership networks.

4.3 What Data Protection Measures Should Technicians Understand?

Technicians should understand encryption, access control, data backup, and recovery procedures to protect sensitive financial data within funding systems. These measures ensure that data is protected both in transit and at rest, and that it can be recovered in the event of a security incident.

4.4 How Does CAR-REMOTE-REPAIR.EDU.VN Tailor Training for Automotive Technicians?

CAR-REMOTE-REPAIR.EDU.VN tailors training by offering hands-on labs, real-world case studies, and expert instruction focused on the specific cybersecurity needs of automotive technicians. Their programs address the unique challenges faced in the automotive industry, providing practical skills and knowledge that can be immediately applied on the job. Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States.

4.5 Can Remote Diagnostics Play a Role in Securing Funding Systems?

Yes, remote diagnostics can play a role by identifying vulnerabilities in funding systems and ensuring that security updates are properly installed, thereby enhancing overall security. Remote diagnostics allow technicians to monitor systems in real-time, detect anomalies, and proactively address potential threats.

5. What Technologies Help Secure Funding System Software in the Automotive Sector?

Technologies include advanced firewalls, intrusion detection systems, data encryption, and secure remote access tools, all designed to protect sensitive financial data. These technologies provide multiple layers of defense against cyber threats.

5.1 How Do Advanced Firewalls Protect Funding Systems?

Advanced firewalls monitor network traffic, block unauthorized access, and prevent malicious software from infiltrating funding systems. They can also be configured to identify and block specific types of attacks, such as SQL injection and cross-site scripting.

5.2 What are the Benefits of Intrusion Detection Systems?

Intrusion detection systems (IDS) identify and alert administrators to suspicious activity, allowing for timely intervention and preventing data breaches. An IDS can analyze network traffic, system logs, and user behavior to detect anomalies that may indicate a security incident.

5.3 How Does Data Encryption Safeguard Sensitive Information?

Data encryption transforms readable data into an unreadable format, protecting it from unauthorized access during transmission and storage, which is critical for securing sensitive financial details. Encryption ensures that even if data is intercepted, it cannot be deciphered without the appropriate decryption key.

5.4 What are the Advantages of Secure Remote Access Tools?

Secure remote access tools enable technicians to access and manage funding systems remotely, while ensuring that connections are encrypted and authenticated, minimizing the risk of unauthorized access. These tools provide a secure and efficient way to perform maintenance, troubleshoot issues, and apply updates from any location.

5.5 How Can CAR-REMOTE-REPAIR.EDU.VN Help Implement These Technologies?

CAR-REMOTE-REPAIR.EDU.VN provides expert guidance on selecting, implementing, and maintaining these technologies, ensuring that automotive businesses have the right tools to protect their funding systems. Their consulting services include system assessments, technology recommendations, and ongoing support to help you stay ahead of cyber threats. Website: CAR-REMOTE-REPAIR.EDU.VN.

6. What Are the Legal and Compliance Requirements for Protecting Funding System Software?

Requirements include adhering to the Gramm-Leach-Bliley Act (GLBA), the California Consumer Privacy Act (CCPA), and the Payment Card Industry Data Security Standard (PCI DSS) to ensure the protection of sensitive financial data. Compliance with these regulations is essential for avoiding legal penalties and maintaining customer trust.

6.1 What is the Gramm-Leach-Bliley Act (GLBA)?

The GLBA requires financial institutions to protect consumers’ private information, including implementing security measures to safeguard data and notifying customers of privacy practices. Automotive dealerships that offer financing or other financial services are subject to GLBA requirements.

6.2 How Does the California Consumer Privacy Act (CCPA) Impact Automotive Businesses?

The CCPA grants California residents the right to know what personal information is collected about them, the right to delete personal information, and the right to opt-out of the sale of their personal information, impacting how automotive businesses handle customer data. Automotive businesses must comply with CCPA requirements if they collect and process personal information of California residents.

6.3 What is the Payment Card Industry Data Security Standard (PCI DSS)?

PCI DSS is a set of security standards designed to protect credit card data, requiring businesses that process credit card payments to implement and maintain specific security controls. Compliance with PCI DSS is essential for preventing credit card fraud and maintaining a secure payment environment.

6.4 What Penalties Can Automotive Businesses Face for Non-Compliance?

Penalties for non-compliance include fines, legal action, and reputational damage, which can significantly impact the financial stability and customer relationships of automotive businesses. Regulatory bodies such as the FTC and state attorneys general can impose significant fines for data breaches and violations of privacy laws.

6.5 How Can CAR-REMOTE-REPAIR.EDU.VN Help Ensure Compliance?

CAR-REMOTE-REPAIR.EDU.VN offers training programs and consulting services to help automotive businesses understand and comply with relevant legal and compliance requirements, ensuring data protection and avoiding penalties. Their experts can conduct compliance assessments, develop policies and procedures, and provide ongoing support to help you maintain compliance. Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States.

7. How Does Vendor Security Management Affect Funding System Security?

Effective vendor security management is critical because third-party vendors often have access to sensitive data, making them potential entry points for cyberattacks; therefore, it’s essential to thoroughly vet vendors and monitor their security practices. Automotive businesses rely on numerous vendors for software, hardware, and IT services, making vendor security management a critical component of overall cybersecurity.

7.1 Why is Vendor Risk Assessment Important?

Vendor risk assessment identifies potential security vulnerabilities in third-party services, allowing businesses to proactively address risks and ensure that vendors meet security standards. This assessment should be conducted before engaging with a vendor and periodically throughout the relationship.

7.2 What Security Requirements Should Be Included in Vendor Contracts?

Vendor contracts should include requirements for data encryption, access controls, incident response, and compliance with relevant regulations, ensuring that vendors protect sensitive data. Contracts should also include provisions for regular security audits and the right for the business to terminate the contract if security requirements are not met.

7.3 How Can Automotive Businesses Monitor Vendor Compliance?

Automotive businesses can monitor compliance through regular audits, security assessments, and reviewing vendor security reports, ensuring that vendors adhere to agreed-upon security standards. Ongoing monitoring is essential for detecting and addressing potential security issues in a timely manner.

7.4 What Steps Should Be Taken if a Vendor Experiences a Security Breach?

If a vendor experiences a breach, automotive businesses should immediately assess the impact, contain the breach, notify affected parties, and review vendor security practices to prevent future incidents. It’s also important to have a plan in place for transitioning to an alternative vendor if necessary.

7.5 How Can CAR-REMOTE-REPAIR.EDU.VN Assist with Vendor Security Management?

CAR-REMOTE-REPAIR.EDU.VN offers consulting services to help automotive businesses develop and implement effective vendor security management programs, ensuring that third-party risks are properly managed. Their services include vendor risk assessments, contract reviews, and ongoing monitoring support to help you maintain a secure supply chain. Website: CAR-REMOTE-REPAIR.EDU.VN.

8. How Can Cloud Security Practices Safeguard Funding System Software?

Implementing strong cloud security practices, such as data encryption, access controls, and regular security audits, is vital for protecting cloud-based funding systems. As more automotive businesses migrate their funding systems to the cloud, ensuring robust security is essential for maintaining data integrity and preventing breaches.

8.1 What are the Benefits of Using Cloud-Based Funding Systems?

Cloud-based funding systems offer scalability, cost savings, and improved accessibility, allowing automotive businesses to manage financial operations efficiently and securely. Cloud-based systems also offer enhanced disaster recovery capabilities and automatic software updates.

8.2 How Does Data Encryption in the Cloud Protect Sensitive Data?

Data encryption in the cloud protects sensitive data by transforming it into an unreadable format, ensuring that even if the cloud environment is compromised, the data remains secure. Encryption should be implemented both in transit and at rest to provide comprehensive protection.

8.3 What Access Controls Should Be Implemented in Cloud Environments?

Access controls should restrict access to authorized users, using multi-factor authentication and role-based permissions to prevent unauthorized access to funding system data. Regular reviews of access rights are essential to ensure that only those who need access have it.

8.4 How Can Automotive Businesses Ensure the Security of Their Cloud Providers?

Businesses can ensure security by selecting reputable cloud providers with robust security certifications, conducting regular security assessments, and implementing strong data protection measures. It’s also important to understand the cloud provider’s security responsibilities and ensure that they align with the business’s security requirements.

8.5 How Can CAR-REMOTE-REPAIR.EDU.VN Assist with Cloud Security?

CAR-REMOTE-REPAIR.EDU.VN offers consulting services to help automotive businesses implement and manage cloud security practices, ensuring that cloud-based funding systems are properly protected. Their experts can assess your cloud environment, recommend security measures, and provide ongoing support to help you maintain a secure cloud presence. Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States.

9. How Does Incident Response Planning Secure Automotive Careers?

Incident response planning helps minimize the impact of security breaches, protecting automotive careers by ensuring business continuity and maintaining trust with customers and stakeholders. A well-prepared incident response plan enables businesses to quickly and effectively respond to security incidents, minimizing disruption and potential damage.

9.1 What are the Key Components of an Incident Response Plan?

Key components include identification, containment, eradication, recovery, and lessons learned, ensuring a systematic approach to managing security incidents. The plan should also include communication protocols, roles and responsibilities, and escalation procedures.

9.2 How Can Regular Testing of the Incident Response Plan Improve Security?

Regular testing helps identify gaps in the plan, ensures that staff are prepared to respond effectively, and improves the overall security posture of the business. Testing can include tabletop exercises, simulations, and live drills.

9.3 What Steps Should Be Taken Immediately After a Security Breach?

Immediately after a breach, businesses should contain the incident, assess the impact, notify relevant parties, and initiate recovery procedures to minimize damage and restore operations. Containment may involve isolating affected systems, changing passwords, and implementing additional security measures.

9.4 How Can Automotive Businesses Learn from Past Security Incidents?

By conducting a thorough post-incident review, businesses can identify root causes, improve security measures, and prevent similar incidents from occurring in the future. The review should involve all relevant stakeholders and result in actionable recommendations.

9.5 How Can CAR-REMOTE-REPAIR.EDU.VN Assist with Incident Response Planning?

CAR-REMOTE-REPAIR.EDU.VN offers consulting services to help automotive businesses develop and implement robust incident response plans, ensuring they are prepared to handle security incidents effectively. Their experts can assess your current preparedness, develop a tailored plan, and provide training to your staff. Website: CAR-REMOTE-REPAIR.EDU.VN.

10. What is the Future of Securing Funding System Software in the Automotive Industry?

The future involves increased use of AI-driven security solutions, blockchain technology, and advanced threat intelligence to proactively protect funding system software from evolving cyber threats. As the automotive industry becomes more connected and reliant on digital systems, the need for advanced security solutions will continue to grow.

10.1 How Can AI Enhance Security Measures?

AI can analyze vast amounts of data to detect anomalies, predict potential threats, and automate security responses, enhancing the effectiveness of security measures. AI-driven security solutions can also learn from past incidents and adapt to new threats.

10.2 What Role Can Blockchain Play in Securing Funding Systems?

Blockchain can enhance security by providing a tamper-proof ledger of transactions, ensuring data integrity and preventing fraud in funding systems. Blockchain technology can also be used to secure supply chains and manage digital identities.

10.3 How Does Advanced Threat Intelligence Help Prevent Attacks?

Advanced threat intelligence provides real-time information about emerging threats, allowing businesses to proactively defend against attacks and stay ahead of cybercriminals. Threat intelligence can be gathered from a variety of sources, including security vendors, government agencies, and industry peers.

10.4 What Emerging Technologies Will Impact Funding System Security?

Emerging technologies such as quantum computing and edge computing will impact funding system security by introducing new challenges and opportunities for protecting sensitive data. Quantum computing could potentially break current encryption methods, while edge computing could increase the attack surface.

10.5 How Can CAR-REMOTE-REPAIR.EDU.VN Prepare Automotive Professionals for These Changes?

CAR-REMOTE-REPAIR.EDU.VN prepares automotive professionals by offering training programs on emerging technologies and cybersecurity trends, ensuring they have the skills and knowledge to secure funding systems in the future. Their programs are constantly updated to reflect the latest threats and technologies, providing you with the most relevant and up-to-date information. Website: CAR-REMOTE-REPAIR.EDU.VN.

Securing your career in the automotive industry requires a proactive approach to cybersecurity, and CAR-REMOTE-REPAIR.EDU.VN is here to help you every step of the way. With comprehensive training programs and expert consulting services, you can protect your business, your data, and your future. Don’t wait for a security breach to threaten your livelihood – invest in your cybersecurity skills today.

Take action now! Visit CAR-REMOTE-REPAIR.EDU.VN or contact us at +1 (641) 206-8880 to learn more about our specialized training and consulting services. Secure your automotive career with the expertise and support you need. Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States. Learn about Automotive Digital Solutions, Remote Repair Tools, and Diagnostic Methods.

FAQ: Securing Automotive Careers from Compromised Funding System Software

1. What is considered compromised funding system software?

Compromised funding system software is software that has been infiltrated by malware, subjected to unauthorized access, or has vulnerabilities exploited by cybercriminals, leading to potential data breaches or operational disruptions.

2. How can I tell if my dealership’s funding system is compromised?

Signs of compromise include unusual system behavior, unauthorized access attempts, unexplained data loss, and alerts from security software indicating malware or intrusions.

3. What steps should I take if I suspect a compromise?

Immediately disconnect the affected system from the network, notify your IT security team, and initiate your incident response plan to contain and investigate the breach.

4. How often should we update our funding system software?

Software updates should be applied as soon as they are released by the vendor to patch security vulnerabilities and protect against known threats.

5. What are the best practices for securing passwords in automotive businesses?

Best practices include using strong, unique passwords, implementing multi-factor authentication, and regularly changing passwords to prevent unauthorized access.

6. How can employee training improve our security posture?

Employee training educates staff about phishing scams, safe computing practices, and data protection measures, reducing the risk of human error and insider threats.

7. What is the role of firewalls in protecting funding systems?

Firewalls monitor network traffic, block unauthorized access, and prevent malicious software from infiltrating funding systems, providing a critical layer of defense against cyberattacks.

8. How does data encryption protect sensitive financial data?

Data encryption transforms readable data into an unreadable format, protecting it from unauthorized access during transmission and storage, which is critical for securing sensitive financial details.

9. What are the legal requirements for protecting customer data?

Legal requirements include adhering to the Gramm-Leach-Bliley Act (GLBA), the California Consumer Privacy Act (CCPA), and the Payment Card Industry Data Security Standard (PCI DSS) to ensure the protection of sensitive financial data.

10. How can CAR-REMOTE-REPAIR.EDU.VN help secure our funding system software?

CAR-REMOTE-REPAIR.EDU.VN offers specialized training programs, expert consulting services, and ongoing support to help automotive businesses implement and maintain robust cybersecurity measures, protecting their funding system software and securing their careers.