Accounting Software For Car Dealerships helps streamline financial operations, ensuring accuracy and compliance, and CAR-REMOTE-REPAIR.EDU.VN offers insights into selecting the right tools. With the right car dealership accounting software, you can efficiently manage finances, track inventory, and improve overall business performance, all while minimizing errors and saving time. Let’s explore how automotive accounting software can revolutionize your dealership.

Contents

- 1. Why Is Accounting Software Important for Car Dealerships?

- 1.1. Streamlining Financial Operations

- 1.2. Ensuring Compliance and Accuracy

- 1.3. Real-Time Financial Insights

- 1.4. Managing Inventory Effectively

- 1.5. Enhancing Decision-Making

- 2. What Are the Key Features to Look for in Accounting Software for Car Dealerships?

- 2.1. Inventory Management

- 2.2. CRM Integration

- 2.3. Multi-Location Support

- 2.4. Reporting Capabilities

- 2.5. Integration with Other Systems

- 3. How Can Accounting Software Improve Inventory Management at Car Dealerships?

- 3.1. Real-Time Inventory Tracking

- 3.2. Automated Inventory Valuation

- 3.3. Seamless DMS Integration

- 3.4. Optimized Ordering Process

- 3.5. Better Reporting and Analysis

- 4. What Are the Benefits of Integrating CRM with Accounting Software for Car Dealerships?

- 4.1. Enhanced Customer Service

- 4.2. Streamlined Sales Processes

- 4.3. Accurate Financial Reporting

- 4.4. Enhanced Marketing ROI

- 4.5. Improved Inventory Management

- 5. How Does Accounting Software Help Car Dealerships Manage Multiple Locations?

- 5.1. Consolidated Financial Reporting

- 5.2. Intercompany Transaction Management

- 5.3. Centralized Control

- 5.4. Enhanced Reporting Capabilities

- 5.5. Improved Compliance

- 6. What Role Does Reporting Play in Effective Car Dealership Accounting Software?

- 6.1. Financial Performance Analysis

- 6.2. Inventory Management Insights

- 6.3. Customer Behavior Analysis

- 6.4. Operational Efficiency Analysis

- 6.5. Compliance Reporting

- 7. How to Choose the Right Accounting Software for Your Car Dealership

- 7.1. Assess Your Dealership’s Specific Needs

- 7.2. Evaluate Software Features and Capabilities

- 7.3. Consider Scalability and Cost

- 7.4. Check for Integration Capabilities

- 7.5. Read Reviews and Get Recommendations

- 8. Common Mistakes to Avoid When Implementing Accounting Software for Car Dealerships

- 8.1. Inadequate Training

- 8.2. Insufficient Data Migration Planning

- 8.3. Neglecting Customization Options

- 8.4. Poor Change Management

- 8.5. Inadequate Testing

- 9. How Does CAR-REMOTE-REPAIR.EDU.VN Enhance Automotive Accounting Practices?

- 9.1. Specialized Training Programs

- 9.2. Remote Support Services

- 9.3. Customized Solutions

- 9.4. Industry Best Practices

- 9.5. Continuous Improvement

- 10. Frequently Asked Questions (FAQs) About Accounting Software for Car Dealerships

- 10.1. What is accounting software for car dealerships?

- 10.2. Why do car dealerships need specialized accounting software?

- 10.3. What are the key features of accounting software for car dealerships?

- 10.4. How does accounting software improve inventory management?

- 10.5. What are the benefits of integrating CRM with accounting software?

- 10.6. Can accounting software help manage multiple dealership locations?

- 10.7. What role does reporting play in effective car dealership accounting software?

- 10.8. How do I choose the right accounting software for my car dealership?

- 10.9. What are common mistakes to avoid when implementing accounting software?

- 10.10. How does CAR-REMOTE-REPAIR.EDU.VN enhance automotive accounting practices?

1. Why Is Accounting Software Important for Car Dealerships?

Accounting software is crucial for car dealerships because it automates financial tasks, reduces errors, and provides real-time insights into business performance. Accounting software helps car dealerships manage inventory, track sales, and ensure compliance with financial regulations, leading to better decision-making and profitability. According to a study by the National Automobile Dealers Association (NADA), dealerships using integrated accounting systems experience a 15% reduction in accounting errors.

1.1. Streamlining Financial Operations

Accounting software automates many of the manual tasks involved in financial management, such as data entry, reconciliation, and reporting. By automating these processes, dealerships can reduce the time and resources spent on accounting, allowing staff to focus on more strategic activities. The efficiency gains also minimize the risk of human error, ensuring more accurate financial records.

For example, instead of manually entering sales data into spreadsheets, accounting software can automatically import this information from the dealership’s sales system. This not only saves time but also reduces the likelihood of data entry errors.

1.2. Ensuring Compliance and Accuracy

The automotive industry is subject to numerous financial regulations and compliance requirements. Accounting software helps dealerships stay compliant by providing tools for tracking transactions, managing taxes, and generating accurate financial reports. This reduces the risk of penalties and audits, while also ensuring that the dealership is operating in accordance with industry standards.

Accounting software can automatically calculate sales tax on each vehicle sale, ensuring that the correct amount is collected and reported to the relevant authorities. This feature is particularly valuable for dealerships operating in multiple states, where tax rates may vary.

1.3. Real-Time Financial Insights

Accounting software provides real-time visibility into a dealership’s financial performance. With up-to-date financial data, managers can make informed decisions about pricing, inventory management, and resource allocation. This level of insight is essential for optimizing profitability and maintaining a competitive edge in the market.

Dealerships can use accounting software to track key performance indicators (KPIs) such as gross profit margin, inventory turnover, and customer acquisition cost. By monitoring these metrics in real-time, managers can identify trends and take corrective action as needed.

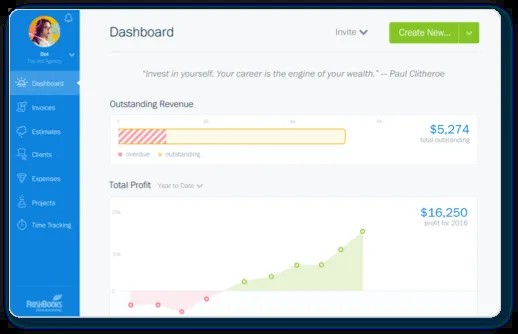

Dealership Accounting Software Dashboard

Dealership Accounting Software Dashboard

1.4. Managing Inventory Effectively

Effective inventory management is vital for car dealerships, as it directly impacts profitability and customer satisfaction. Accounting software integrates with inventory management systems to provide real-time tracking of vehicle stock, parts, and accessories. This enables dealerships to optimize inventory levels, minimize carrying costs, and avoid stockouts.

For example, accounting software can automatically update inventory records when a vehicle is sold, ensuring that the dealership always has an accurate view of available stock. This also helps in forecasting future demand and making informed purchasing decisions.

1.5. Enhancing Decision-Making

With accurate and timely financial data, dealership managers can make better decisions across all areas of the business. From pricing and marketing strategies to staffing and investment decisions, accounting software provides the insights needed to drive growth and profitability.

Managers can use accounting software to analyze sales data, identify top-performing vehicles, and adjust pricing accordingly. This helps in maximizing revenue and optimizing inventory turnover.

2. What Are the Key Features to Look for in Accounting Software for Car Dealerships?

When selecting accounting software for a car dealership, prioritize features like inventory management, CRM integration, multi-location support, and robust reporting capabilities. The right accounting system will automate tasks, improve accuracy, and provide valuable insights into your dealership’s financial performance. According to a 2024 report by Automotive Management Online, 75% of dealerships that adopted specialized accounting software saw an improvement in financial reporting accuracy.

2.1. Inventory Management

- Real-Time Tracking: Look for software that provides real-time updates on inventory levels, ensuring you know exactly what vehicles and parts are in stock.

- Automated Valuation: Choose software that automates inventory valuation methods like FIFO (First-In, First-Out) or weighted average to maintain accurate records.

- Integration with DMS: Ensure seamless integration with your Dealership Management System (DMS) for streamlined inventory updates and sales data.

Real-time tracking helps in minimizing discrepancies and managing stock efficiently, while automated valuation ensures compliance with accounting standards. Integration with DMS provides a unified platform for managing all dealership operations.

2.2. CRM Integration

- Customer Data Synchronization: Opt for software that synchronizes customer data between your CRM and accounting systems to provide a holistic view of each customer’s interactions and transactions.

- Sales Performance Tracking: Select software that tracks sales performance by linking sales data from the CRM to accounting records, enabling better sales analysis.

- Marketing ROI: Ensure the software can measure the ROI of marketing campaigns by tracking leads and conversions generated through various marketing channels.

Customer data synchronization improves customer service and enhances sales strategies. Tracking sales performance helps in identifying top-performing salespersons and optimizing sales processes. Measuring marketing ROI allows for better allocation of marketing resources.

2.3. Multi-Location Support

- Consolidated Reporting: Choose software that consolidates financial data from multiple dealership locations into a single, unified report.

- Intercompany Transactions: Look for software that handles intercompany transactions seamlessly, ensuring accurate accounting across all locations.

- Centralized Management: Ensure the software allows for centralized management of accounting processes, reducing redundancies and improving control.

Consolidated reporting provides a comprehensive view of the dealership’s overall financial health. Handling intercompany transactions accurately prevents errors and ensures compliance. Centralized management streamlines accounting processes and improves efficiency.

2.4. Reporting Capabilities

- Customizable Reports: Opt for software that offers customizable reporting options to tailor reports to your specific business needs.

- Financial Statement Generation: Select software that automatically generates key financial statements like income statements, balance sheets, and cash flow statements.

- KPI Dashboards: Ensure the software provides KPI dashboards that track critical performance metrics in real-time, enabling proactive decision-making.

Customizable reports help in analyzing data according to specific requirements. Financial statement generation ensures compliance and provides a clear picture of financial performance. KPI dashboards facilitate real-time monitoring of key metrics, enabling timely corrective actions.

2.5. Integration with Other Systems

- Payroll Integration: Look for software that integrates with payroll systems to streamline payroll processing and ensure accurate labor cost tracking.

- Banking Integration: Choose software that integrates with banking systems to automate bank reconciliations and improve cash management.

- Tax Compliance: Ensure the software is updated with the latest tax regulations and integrates with tax preparation software for seamless tax filing.

Payroll integration reduces manual effort and ensures accurate payroll processing. Banking integration improves cash management and reduces reconciliation errors. Tax compliance ensures adherence to regulatory requirements and simplifies tax filing.

Car Dealership Accounting Software Integration

Car Dealership Accounting Software Integration

3. How Can Accounting Software Improve Inventory Management at Car Dealerships?

Accounting software enhances inventory management at car dealerships by providing real-time tracking, automated valuation, and seamless integration with DMS, leading to improved accuracy and cost savings. According to a study by Deloitte, dealerships that implement integrated accounting and inventory systems see a 20% reduction in inventory holding costs.

3.1. Real-Time Inventory Tracking

- Immediate Updates: Accounting software offers immediate updates on inventory levels, ensuring dealerships always have an accurate count of vehicles, parts, and accessories.

- Reduced Discrepancies: By tracking inventory in real-time, discrepancies between physical counts and recorded data are minimized, leading to more accurate financial reporting.

- Improved Stock Control: Real-time tracking enables better stock control, preventing overstocking and stockouts, and optimizing inventory levels to meet customer demand.

Immediate updates provide a clear view of available stock, while reduced discrepancies improve the reliability of inventory data. Improved stock control ensures optimal inventory levels, minimizing costs and maximizing customer satisfaction.

3.2. Automated Inventory Valuation

- Consistent Valuation: Accounting software automates inventory valuation methods like FIFO (First-In, First-Out) or weighted average, ensuring consistent and accurate valuation of inventory assets.

- Reduced Errors: Automation reduces the risk of manual errors in inventory valuation, leading to more reliable financial statements and tax reporting.

- Compliance with Standards: Automated valuation ensures compliance with accounting standards and regulations, minimizing the risk of penalties and audits.

Consistent valuation provides a stable basis for financial reporting, while reduced errors improve the accuracy of financial data. Compliance with standards ensures adherence to regulatory requirements and prevents potential liabilities.

3.3. Seamless DMS Integration

- Streamlined Updates: Accounting software integrates seamlessly with Dealership Management Systems (DMS), streamlining the process of updating inventory records and sales data.

- Unified Platform: Integration provides a unified platform for managing all dealership operations, eliminating the need for manual data entry and reducing the risk of errors.

- Enhanced Efficiency: Streamlined updates and a unified platform enhance efficiency, allowing staff to focus on more strategic activities and improving overall productivity.

Streamlined updates minimize manual effort and improve the accuracy of data transfer, while a unified platform provides a comprehensive view of all dealership operations. Enhanced efficiency leads to improved productivity and cost savings.

3.4. Optimized Ordering Process

- Demand Forecasting: Accounting software analyzes historical sales data to forecast future demand, enabling dealerships to optimize their ordering process and maintain adequate stock levels.

- Automated Reordering: Automated reordering features trigger purchase orders when inventory levels fall below predefined thresholds, preventing stockouts and ensuring timely replenishment.

- Reduced Carrying Costs: By optimizing the ordering process, dealerships can reduce carrying costs associated with excess inventory, improving profitability and cash flow.

Demand forecasting helps in making informed purchasing decisions, while automated reordering ensures timely replenishment of stock. Reduced carrying costs improve profitability and cash flow, enhancing the dealership’s financial health.

3.5. Better Reporting and Analysis

- Inventory Turnover Reports: Accounting software generates inventory turnover reports that track how quickly inventory is sold, providing insights into the efficiency of inventory management.

- Slow-Moving Inventory: Reports identify slow-moving inventory, allowing dealerships to take proactive measures to reduce carrying costs and free up valuable storage space.

- Profitability Analysis: Profitability analysis tools help dealerships evaluate the profitability of different inventory items, enabling better pricing and marketing strategies.

Inventory turnover reports provide insights into the efficiency of inventory management, while identification of slow-moving inventory helps in reducing carrying costs. Profitability analysis enables better pricing and marketing strategies, maximizing revenue and profitability.

Inventory Management with Accounting Software

Inventory Management with Accounting Software

4. What Are the Benefits of Integrating CRM with Accounting Software for Car Dealerships?

Integrating CRM with accounting software for car dealerships enhances customer service, streamlines sales processes, and provides a holistic view of customer interactions and transactions. According to a report by HubSpot, businesses that integrate CRM and accounting systems see a 25% increase in sales productivity.

4.1. Enhanced Customer Service

- Comprehensive Customer View: Integration provides a comprehensive view of each customer’s interactions, purchase history, and financial transactions, enabling more personalized and effective customer service.

- Improved Communication: Sales and service teams have access to real-time financial data, allowing them to address customer inquiries and resolve issues more efficiently.

- Increased Customer Satisfaction: Enhanced customer service leads to increased customer satisfaction, fostering long-term relationships and repeat business.

A comprehensive customer view enables personalized service, while improved communication enhances responsiveness. Increased customer satisfaction fosters loyalty and drives repeat business.

4.2. Streamlined Sales Processes

- Automated Data Entry: Integration automates data entry between CRM and accounting systems, reducing manual effort and minimizing the risk of errors.

- Efficient Sales Tracking: Sales teams can track leads, opportunities, and sales performance directly within the CRM, with financial data automatically updated in the accounting system.

- Faster Sales Cycle: Streamlined sales processes lead to a faster sales cycle, enabling dealerships to close more deals and generate more revenue.

Automated data entry reduces manual effort, while efficient sales tracking provides real-time visibility into sales performance. A faster sales cycle increases revenue and improves overall efficiency.

4.3. Accurate Financial Reporting

- Real-Time Financial Data: Integration ensures that financial data is updated in real-time, providing accurate and up-to-date financial reporting.

- Reduced Errors: Automated data transfer reduces the risk of errors in financial reporting, leading to more reliable financial statements.

- Improved Decision-Making: Accurate financial reporting enables better decision-making, allowing managers to make informed choices about pricing, marketing, and resource allocation.

Real-time financial data provides a clear picture of financial performance, while reduced errors improve the accuracy of financial statements. Improved decision-making leads to better business outcomes and enhanced profitability.

4.4. Enhanced Marketing ROI

- Tracking Marketing Campaigns: Integration allows dealerships to track the effectiveness of marketing campaigns by linking leads and conversions generated through various marketing channels to financial data in the accounting system.

- Measuring ROI: Dealerships can measure the ROI of marketing campaigns by comparing marketing expenses to the revenue generated from leads and conversions tracked in the CRM.

- Optimized Marketing Spend: By measuring ROI, dealerships can optimize their marketing spend, allocating resources to the most effective marketing channels and campaigns.

Tracking marketing campaigns provides insights into campaign performance, while measuring ROI enables better resource allocation. Optimized marketing spend increases efficiency and maximizes the impact of marketing efforts.

4.5. Improved Inventory Management

- Sales Forecasting: Integration allows for better sales forecasting by analyzing historical sales data in the CRM and linking it to inventory levels in the accounting system.

- Optimized Inventory Levels: Improved sales forecasting enables dealerships to optimize inventory levels, minimizing carrying costs and preventing stockouts.

- Increased Profitability: By optimizing inventory levels, dealerships can increase profitability and improve overall financial performance.

Sales forecasting helps in making informed purchasing decisions, while optimized inventory levels reduce costs and prevent stockouts. Increased profitability enhances the dealership’s financial health and drives long-term success.

5. How Does Accounting Software Help Car Dealerships Manage Multiple Locations?

Accounting software assists car dealerships in managing multiple locations by providing consolidated reporting, intercompany transaction management, and centralized control. According to a survey by CFO Research, 60% of multi-location businesses improved financial reporting accuracy by using centralized accounting systems.

5.1. Consolidated Financial Reporting

- Unified Reporting: Accounting software consolidates financial data from all dealership locations into a single, unified report, providing a comprehensive view of the organization’s financial performance.

- Real-Time Data: Consolidated reporting provides real-time data, enabling managers to monitor the financial health of each location and the organization as a whole.

- Improved Decision-Making: With a unified view of financial data, managers can make informed decisions about resource allocation, pricing, and investment strategies.

Unified reporting simplifies financial analysis, while real-time data ensures that decisions are based on the most current information. Improved decision-making leads to better business outcomes and enhanced profitability.

5.2. Intercompany Transaction Management

- Automated Transactions: Accounting software automates the recording and tracking of intercompany transactions, ensuring accurate accounting across all locations.

- Elimination of Errors: Automation reduces the risk of manual errors in intercompany transaction management, leading to more reliable financial data.

- Compliance with Standards: Automated transaction management ensures compliance with accounting standards and regulations, minimizing the risk of penalties and audits.

Automated transactions reduce manual effort, while elimination of errors improves the accuracy of financial data. Compliance with standards ensures adherence to regulatory requirements and prevents potential liabilities.

5.3. Centralized Control

- Standardized Processes: Accounting software enables the standardization of accounting processes across all dealership locations, improving efficiency and consistency.

- Centralized Management: Centralized management allows for greater control over financial operations, ensuring that all locations adhere to the same accounting policies and procedures.

- Reduced Redundancies: Centralized control reduces redundancies in accounting processes, minimizing costs and improving overall efficiency.

Standardized processes improve efficiency and consistency, while centralized management ensures adherence to accounting policies. Reduced redundancies minimize costs and improve overall efficiency.

5.4. Enhanced Reporting Capabilities

- Customized Reports: Accounting software offers customizable reporting options, allowing managers to tailor reports to their specific needs and track key performance indicators (KPIs) across all locations.

- Comparative Analysis: Comparative analysis tools enable managers to compare financial performance across different locations, identifying best practices and areas for improvement.

- Profitability Analysis: Profitability analysis tools help managers evaluate the profitability of each location, enabling better resource allocation and pricing strategies.

Customized reports provide targeted insights, while comparative analysis identifies best practices and areas for improvement. Profitability analysis enables better resource allocation and pricing strategies, maximizing revenue and profitability.

5.5. Improved Compliance

- Tax Compliance: Accounting software helps ensure tax compliance across all locations, automating the calculation and reporting of sales taxes and other relevant taxes.

- Audit Trails: Audit trails provide a detailed record of all financial transactions, making it easier to comply with regulatory requirements and respond to audits.

- Data Security: Accounting software offers robust data security features, protecting sensitive financial information from unauthorized access and cyber threats.

Tax compliance ensures adherence to regulatory requirements, while audit trails facilitate compliance and simplify the audit process. Data security protects sensitive financial information, minimizing the risk of data breaches and financial losses.

6. What Role Does Reporting Play in Effective Car Dealership Accounting Software?

Reporting is crucial in effective car dealership accounting software as it provides insights into financial performance, inventory management, and customer behavior. According to a study by Ventana Research, organizations that leverage reporting and analytics effectively are 77% more likely to achieve their business goals.

6.1. Financial Performance Analysis

- Income Statements: Accounting software generates income statements that provide a detailed overview of a dealership’s revenue, expenses, and profitability over a specific period.

- Balance Sheets: Balance sheets provide a snapshot of a dealership’s assets, liabilities, and equity at a specific point in time, enabling managers to assess the organization’s financial health.

- Cash Flow Statements: Cash flow statements track the movement of cash both into and out of a dealership, providing insights into the organization’s liquidity and ability to meet its financial obligations.

Income statements provide insights into profitability, while balance sheets assess financial health. Cash flow statements track liquidity and the ability to meet financial obligations.

6.2. Inventory Management Insights

- Inventory Turnover Reports: Accounting software generates inventory turnover reports that track how quickly inventory is sold, providing insights into the efficiency of inventory management.

- Slow-Moving Inventory: Reports identify slow-moving inventory, allowing dealerships to take proactive measures to reduce carrying costs and free up valuable storage space.

- Inventory Valuation: Reports provide accurate inventory valuation, ensuring compliance with accounting standards and regulations.

Inventory turnover reports assess the efficiency of inventory management, while identification of slow-moving inventory helps in reducing carrying costs. Accurate inventory valuation ensures compliance and prevents potential liabilities.

6.3. Customer Behavior Analysis

- Sales Reports: Accounting software generates sales reports that track sales performance by product, customer, and location, providing insights into customer preferences and buying patterns.

- Customer Profitability: Reports analyze customer profitability, identifying the most valuable customers and enabling targeted marketing efforts.

- Customer Segmentation: Customer segmentation reports group customers based on various criteria, enabling dealerships to tailor their marketing and sales strategies to specific customer segments.

Sales reports track sales performance and buying patterns, while customer profitability analysis identifies the most valuable customers. Customer segmentation enables targeted marketing and sales strategies.

6.4. Operational Efficiency Analysis

- Expense Reports: Accounting software generates expense reports that track expenses by category, department, and location, providing insights into operational efficiency and cost control.

- Budget vs. Actual Reports: Reports compare actual expenses to budgeted amounts, enabling managers to identify variances and take corrective action as needed.

- Key Performance Indicators (KPIs): KPI dashboards track critical performance metrics in real-time, providing a quick overview of operational efficiency and identifying areas for improvement.

Expense reports track operational efficiency and cost control, while budget vs. actual reports identify variances and enable corrective action. KPI dashboards provide a quick overview of operational efficiency and identify areas for improvement.

6.5. Compliance Reporting

- Tax Reports: Accounting software generates tax reports that automate the calculation and reporting of sales taxes and other relevant taxes, ensuring compliance with regulatory requirements.

- Audit Trails: Audit trails provide a detailed record of all financial transactions, making it easier to comply with regulatory requirements and respond to audits.

- Financial Statement Compliance: Reports ensure compliance with accounting standards and regulations, minimizing the risk of penalties and audits.

Tax reports automate tax calculation and reporting, while audit trails facilitate compliance and simplify the audit process. Financial statement compliance ensures adherence to regulatory requirements and prevents potential liabilities.

7. How to Choose the Right Accounting Software for Your Car Dealership

Choosing the right accounting software for your car dealership involves assessing your specific needs, evaluating software features, and considering scalability and cost. According to a survey by Software Advice, 78% of businesses that switch to new accounting software report improved efficiency and accuracy.

7.1. Assess Your Dealership’s Specific Needs

- Identify Key Requirements: Start by identifying the key accounting requirements of your dealership, such as inventory management, CRM integration, multi-location support, and reporting capabilities.

- Evaluate Current Processes: Evaluate your current accounting processes to identify pain points and areas for improvement.

- Consider Future Growth: Consider the future growth plans of your dealership and ensure that the accounting software can scale to meet your evolving needs.

Identifying key requirements ensures that the software meets your specific needs, while evaluating current processes helps in identifying pain points and areas for improvement. Considering future growth ensures that the software can scale to meet your evolving needs.

7.2. Evaluate Software Features and Capabilities

- Inventory Management: Look for software that provides real-time tracking, automated valuation, and seamless integration with your DMS.

- CRM Integration: Ensure the software integrates with your CRM system to provide a holistic view of customer interactions and transactions.

- Multi-Location Support: If you have multiple locations, choose software that offers consolidated reporting, intercompany transaction management, and centralized control.

- Reporting Capabilities: Evaluate the reporting capabilities of the software, ensuring that it can generate the reports you need to monitor financial performance, inventory management, and customer behavior.

Inventory management features improve accuracy and efficiency, while CRM integration enhances customer service. Multi-location support streamlines operations for dealerships with multiple locations, and robust reporting capabilities provide valuable insights into business performance.

7.3. Consider Scalability and Cost

- Scalability: Choose software that can scale to meet the growing needs of your dealership, with the ability to add users, locations, and features as needed.

- Cost: Evaluate the total cost of ownership, including initial purchase price, implementation costs, ongoing maintenance fees, and training expenses.

- Return on Investment (ROI): Assess the potential return on investment (ROI) of the software by comparing the cost to the expected benefits, such as improved efficiency, reduced errors, and increased profitability.

Scalability ensures that the software can meet your evolving needs, while cost should be evaluated in terms of total cost of ownership. Assessing ROI helps in justifying the investment and ensuring that the software delivers tangible benefits.

7.4. Check for Integration Capabilities

- DMS Integration: Verify that the accounting software integrates seamlessly with your Dealership Management System (DMS) to streamline data updates and eliminate manual entry.

- CRM Integration: Ensure the software integrates with your CRM system to provide a holistic view of customer interactions and financial transactions.

- Third-Party Integrations: Check for integrations with other third-party applications, such as payroll systems, banking systems, and tax preparation software.

DMS integration streamlines data updates, while CRM integration enhances customer service. Third-party integrations expand the functionality of the software and improve overall efficiency.

7.5. Read Reviews and Get Recommendations

- Online Reviews: Read online reviews and testimonials from other car dealerships to get insights into the strengths and weaknesses of different accounting software options.

- Industry Recommendations: Seek recommendations from industry peers, consultants, and associations to identify the best accounting software for your specific needs.

- Vendor References: Ask vendors for customer references and contact those references to learn about their experiences with the software.

Online reviews provide valuable insights, while industry recommendations offer expert guidance. Vendor references provide real-world perspectives from other users of the software.

8. Common Mistakes to Avoid When Implementing Accounting Software for Car Dealerships

When implementing accounting software for car dealerships, avoid inadequate training, insufficient data migration planning, and neglecting customization options to ensure a smooth transition. According to a report by Panorama Consulting Solutions, 67% of ERP (Enterprise Resource Planning) implementations, which include accounting software, experience cost overruns due to poor planning and execution.

8.1. Inadequate Training

- Insufficient Training: Failing to provide adequate training to staff on how to use the new accounting software can lead to errors, inefficiencies, and resistance to change.

- Lack of Ongoing Support: Insufficient ongoing support can leave staff struggling to resolve issues and maximize the benefits of the software.

- Ignoring User Feedback: Ignoring user feedback can result in the software not being used effectively and valuable insights being missed.

Insufficient training leads to errors and inefficiencies, while lack of ongoing support leaves staff struggling to resolve issues. Ignoring user feedback can result in the software not being used effectively.

8.2. Insufficient Data Migration Planning

- Poor Data Cleansing: Failing to cleanse and validate data before migration can result in inaccurate financial reporting and compliance issues.

- Incomplete Data Migration: Incomplete data migration can leave gaps in historical records and disrupt ongoing operations.

- Lack of Data Backup: Not backing up data before migration can result in data loss and significant disruption to the business.

Poor data cleansing leads to inaccurate financial reporting, while incomplete data migration disrupts ongoing operations. Lack of data backup can result in data loss and significant disruption to the business.

8.3. Neglecting Customization Options

- Ignoring Customization: Failing to customize the software to meet the specific needs of your dealership can result in inefficiencies and missed opportunities.

- Over-Customization: Over-customizing the software can make it difficult to maintain and upgrade, increasing costs and reducing flexibility.

- Lack of Planning: Insufficient planning for customization can result in unnecessary complexity and integration issues.

Ignoring customization can result in inefficiencies, while over-customization can make the software difficult to maintain. Lack of planning for customization can result in unnecessary complexity.

8.4. Poor Change Management

- Lack of Communication: Failing to communicate the benefits of the new software to staff can lead to resistance to change and decreased morale.

- Insufficient Stakeholder Involvement: Insufficient stakeholder involvement can result in the software not meeting the needs of key users and departments.

- Ignoring Resistance: Ignoring resistance to change can undermine the implementation process and reduce the chances of success.

Lack of communication leads to resistance to change, while insufficient stakeholder involvement results in the software not meeting the needs of key users. Ignoring resistance undermines the implementation process.

8.5. Inadequate Testing

- Insufficient Testing: Failing to thoroughly test the software before going live can result in errors, inefficiencies, and disruptions to the business.

- Lack of User Acceptance Testing: Lack of user acceptance testing can result in the software not meeting the needs of end-users and departments.

- Ignoring Test Results: Ignoring test results can result in unresolved issues and increased risk of failure.

Insufficient testing leads to errors and inefficiencies, while lack of user acceptance testing results in the software not meeting the needs of end-users. Ignoring test results increases the risk of failure.

9. How Does CAR-REMOTE-REPAIR.EDU.VN Enhance Automotive Accounting Practices?

CAR-REMOTE-REPAIR.EDU.VN enhances automotive accounting practices by offering specialized training and remote support, ensuring dealerships maximize the benefits of their accounting software and improve financial management. By providing tailored solutions, CAR-REMOTE-REPAIR.EDU.VN helps dealerships overcome challenges and achieve greater efficiency and accuracy in their accounting processes.

9.1. Specialized Training Programs

CAR-REMOTE-REPAIR.EDU.VN offers specialized training programs designed to help automotive dealerships effectively use accounting software. These programs cover key areas such as inventory management, CRM integration, multi-location support, and reporting capabilities. By providing in-depth training, CAR-REMOTE-REPAIR.EDU.VN ensures that dealership staff are well-equipped to leverage the full potential of their accounting software.

9.2. Remote Support Services

CAR-REMOTE-REPAIR.EDU.VN provides remote support services to assist dealerships with any issues or challenges they may encounter while using their accounting software. This includes troubleshooting, data migration assistance, and customization support. Remote support ensures that dealerships can quickly resolve any problems and maintain smooth accounting operations.

Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States

WhatsApp: +1 (641) 206-8880

Website: CAR-REMOTE-REPAIR.EDU.VN

9.3. Customized Solutions

CAR-REMOTE-REPAIR.EDU.VN offers customized solutions tailored to the specific needs of automotive dealerships. This includes assistance with software selection, implementation, and customization. By providing tailored solutions, CAR-REMOTE-REPAIR.EDU.VN helps dealerships optimize their accounting processes and achieve greater efficiency and accuracy.

9.4. Industry Best Practices

CAR-REMOTE-REPAIR.EDU.VN promotes industry best practices in automotive accounting, ensuring that dealerships are using the most effective and efficient methods. This includes guidance on data management, financial reporting, and compliance. By adhering to industry best practices, dealerships can improve their financial performance and minimize the risk of errors and penalties.

9.5. Continuous Improvement

CAR-REMOTE-REPAIR.EDU.VN focuses on continuous improvement, regularly updating its training programs and support services to reflect the latest advancements in accounting software and industry trends. This ensures that dealerships always have access to the most current and effective solutions.

10. Frequently Asked Questions (FAQs) About Accounting Software for Car Dealerships

10.1. What is accounting software for car dealerships?

Accounting software for car dealerships is a specialized tool designed to manage the financial operations of auto dealerships, including inventory tracking, sales management, and compliance reporting. It helps streamline financial processes, reduce errors, and provide real-time insights into business performance.

10.2. Why do car dealerships need specialized accounting software?

Car dealerships require specialized accounting software due to the complexities of managing vehicle inventory, tracking sales transactions, and complying with automotive industry regulations. Standard accounting software may not offer the specific features needed to efficiently handle these unique challenges.

10.3. What are the key features of accounting software for car dealerships?

Key features include inventory management, CRM integration, multi-location support, robust reporting capabilities, and integration with other systems such as DMS and payroll.

10.4. How does accounting software improve inventory management?

Accounting software improves inventory management by providing real-time tracking, automated valuation, and seamless integration with DMS, leading to improved accuracy and cost savings.

10.5. What are the benefits of integrating CRM with accounting software?

Integrating CRM with accounting software enhances customer service, streamlines sales processes, and provides a holistic view of customer interactions and transactions.

10.6. Can accounting software help manage multiple dealership locations?

Yes, accounting software can help manage multiple locations by providing consolidated reporting, intercompany transaction management, and centralized control.

10.7. What role does reporting play in effective car dealership accounting software?

Reporting is crucial as it provides insights into financial performance, inventory management, and customer behavior, enabling better decision-making.

10.8. How do I choose the right accounting software for my car dealership?

To choose the right software, assess your specific needs, evaluate software features, consider scalability and cost, check for integration capabilities, and read reviews and get recommendations.

10.9. What are common mistakes to avoid when implementing accounting software?

Common mistakes include inadequate training, insufficient data migration planning, and neglecting customization options.

10.10. How does CAR-REMOTE-REPAIR.EDU.VN enhance automotive accounting practices?

CAR-REMOTE-REPAIR.EDU.VN enhances automotive accounting practices by offering specialized training and remote support, ensuring dealerships maximize the benefits of their accounting software and improve financial management.

By understanding the importance of accounting software and how to effectively implement and use it, car dealerships can significantly improve their financial management and achieve greater success in the competitive automotive industry. Consider exploring the training programs and remote support services offered by CAR-REMOTE-REPAIR.EDU.VN to further enhance your dealership’s accounting practices.