Accounting Software For Small Car Dealerships is essential for efficient financial management, and CAR-REMOTE-REPAIR.EDU.VN is here to guide you. This software solution streamlines operations, enhances accuracy, and ensures regulatory compliance, providing a comprehensive approach to managing your dealership’s finances, explore its benefits, features, and how it can revolutionize your business, leading to increased profitability and operational efficiency. This article will cover topics such as dealership accounting, auto dealer software, and financial management tools.

Contents

- 1. Understanding the Need for Specialized Accounting Software

- 1.1. Challenges Faced by Small Car Dealerships

- 1.2. How General Accounting Software Falls Short

- 1.3. The Benefits of Specialized Accounting Software

- 2. Key Features to Look For

- 2.1. Inventory Management Tools

- 2.2. Sales Tax Automation

- 2.3. Floorplan Accounting

- 2.4. Customer Financing Management

- 2.5. Comprehensive Reporting

- 3. Top Accounting Software Options for Small Car Dealerships

- 3.1. FreshBooks

- 3.2. QuickBooks Desktop for Dealers

- 3.3. Xero

- 3.4. DealerTrack DMS

- 3.5. NetSuite

- 4. Implementing Accounting Software: A Step-by-Step Guide

- 4.1. Assessing Your Dealership’s Needs

- 4.2. Data Migration Strategies

- 4.3. Training and Support

- 4.4. Customization and Integration

- 4.5. Monitoring and Optimization

- 5. Integrating with Other Dealership Systems

- 5.1. CRM Systems

- 5.2. Inventory Management Systems

- 5.3. Dealer Management Systems (DMS)

- 5.4. Payment Processing Platforms

- 6. The Future of Accounting Software for Car Dealerships

- 6.1. Cloud Computing

- 6.2. Artificial Intelligence (AI)

- 6.3. Blockchain Technology

- 6.4. Mobile Accounting

- 7. Expert Tips for Optimizing Accounting Practices

- 7.1. Regular Reconciliation

- 7.2. Budgeting and Forecasting

- 7.3. Internal Controls

- 7.4. Sales Tax Compliance

- 7.5. Professional Advice

- 8. Real-World Success Stories

- 8.1. Increased Efficiency

- 8.2. Improved Accuracy

- 8.3. Enhanced Compliance

- 8.4. Better Decision-Making

- 9. Common Mistakes to Avoid

- 9.1. Neglecting Needs Assessment

- 9.2. Ignoring Integration Capabilities

- 9.3. Insufficient Training

- 9.4. Overlooking Customization Options

- 9.5. Neglecting Ongoing Support

- 10. FAQs About Accounting Software for Car Dealerships

- 10.1. What is the average cost of accounting software for a small car dealership?

- 10.2. Can I integrate my existing CRM system with new accounting software?

- 10.3. How long does it take to implement accounting software in a car dealership?

- 10.4. Is cloud-based accounting software more secure than on-premises solutions?

- 10.5. What type of training is needed for employees to use the new software effectively?

- 10.6. How often should I reconcile my accounts?

- 10.7. What is floorplan accounting?

- 10.8. How can AI help with accounting tasks?

- 10.9. What are the key features to look for in accounting software for car dealerships?

- 10.10. What are the benefits of using specialized accounting software?

1. Understanding the Need for Specialized Accounting Software

Why is specialized accounting software essential for small car dealerships? Specialized accounting software is essential for small car dealerships because it addresses industry-specific challenges, such as managing vehicle inventory, tracking sales tax, and handling complex financing arrangements. These systems offer features that general accounting software lacks, enabling dealerships to maintain accurate financial records, streamline operations, and ensure regulatory compliance.

1.1. Challenges Faced by Small Car Dealerships

What are the common financial challenges that small car dealerships encounter? Small car dealerships face numerous financial challenges that necessitate specialized accounting solutions.

- Inventory Management: Accurately tracking vehicle inventory, including new and used cars, parts, and accessories, is crucial. This involves monitoring costs, sales prices, and depreciation to optimize profitability.

- Sales Tax Compliance: Car dealerships must navigate complex sales tax regulations, which vary by state and locality. Correctly calculating, collecting, and remitting sales taxes is essential to avoid penalties.

- Financing and Loans: Managing financing arrangements, including customer loans and floorplan financing, requires precise tracking of interest, principal payments, and loan terms.

- Cost Tracking: Monitoring various costs, such as vehicle acquisition, repair, marketing, and administrative expenses, is vital for understanding profitability and making informed business decisions.

- Regulatory Compliance: Car dealerships must comply with federal and state regulations, including those related to sales, financing, and environmental standards.

1.2. How General Accounting Software Falls Short

Why can’t general accounting software meet the specific needs of car dealerships? General accounting software often lacks the specialized features required to manage the unique financial aspects of a car dealership. While general software can handle basic bookkeeping tasks, it typically doesn’t offer features like:

- Vehicle Inventory Management: General accounting software doesn’t provide tools for tracking vehicle-specific information, such as VINs, purchase dates, and repair costs.

- Sales Tax Automation: These systems often lack automated sales tax calculation and reporting capabilities tailored to the automotive industry.

- Floorplan Accounting: General software may not support the specific accounting requirements for floorplan financing, including interest tracking and reconciliation.

- Customer Financing Management: Managing customer loans and leases requires specialized features that general accounting software doesn’t typically include.

- Industry-Specific Reporting: Car dealerships need reports tailored to their industry, such as sales performance by vehicle type and inventory turnover rates.

1.3. The Benefits of Specialized Accounting Software

What advantages do specialized accounting solutions offer to small car dealerships? Specialized accounting solutions offer numerous benefits that address the specific needs of small car dealerships.

- Improved Accuracy: These systems automate many accounting tasks, reducing the risk of errors and ensuring accurate financial records.

- Increased Efficiency: Streamlined workflows and automated processes save time and resources, allowing dealerships to focus on core business activities.

- Better Inventory Management: Specialized software provides tools for tracking vehicle inventory in detail, optimizing stock levels, and reducing carrying costs.

- Enhanced Sales Tax Compliance: Automated sales tax calculation and reporting features ensure compliance with complex tax regulations, minimizing the risk of penalties.

- Simplified Financing Management: These systems support the unique accounting requirements of floorplan and customer financing, simplifying loan tracking and reconciliation.

- Data-Driven Insights: Comprehensive reporting capabilities provide valuable insights into business performance, enabling informed decision-making.

- Compliance with Regulations: Specialized software helps dealerships comply with industry-specific regulations, reducing the risk of legal and financial penalties.

2. Key Features to Look For

What essential features should small car dealerships prioritize when selecting accounting software? When selecting accounting software, small car dealerships should prioritize key features such as inventory management, sales tax automation, floorplan accounting, customer financing management, and comprehensive reporting. These features are essential for addressing the unique financial challenges faced by dealerships and ensuring efficient operations.

2.1. Inventory Management Tools

How can accounting software streamline vehicle inventory management for dealerships? Accounting software can streamline vehicle inventory management for dealerships through features like:

- VIN Tracking: Recording and tracking Vehicle Identification Numbers (VINs) to maintain detailed records of each vehicle.

- Cost Tracking: Monitoring the cost of acquiring and preparing each vehicle for sale, including purchase price, transportation, and repair expenses.

- Sales Price Management: Setting and adjusting sales prices based on market conditions, vehicle condition, and desired profit margins.

- Depreciation Tracking: Calculating and recording depreciation for used vehicles to reflect their declining value over time.

- Inventory Valuation: Determining the value of the dealership’s inventory using methods like FIFO (First-In, First-Out) or weighted average cost.

Vehicle Identification Numbers (VINs)

Vehicle Identification Numbers (VINs)

2.2. Sales Tax Automation

How does automated sales tax calculation and reporting simplify compliance for car dealerships? Automated sales tax calculation and reporting simplify compliance for car dealerships by:

- Automatic Rate Calculation: Using built-in tax tables to automatically calculate sales tax rates based on the location of the sale.

- Tax Collection Tracking: Recording the amount of sales tax collected for each transaction.

- Reporting Capabilities: Generating detailed reports on sales tax collected, broken down by jurisdiction, for easy filing with tax authorities.

- Compliance Updates: Automatically updating tax rates and rules to reflect changes in legislation, ensuring ongoing compliance.

2.3. Floorplan Accounting

What specific accounting features are necessary for managing floorplan financing? Specific accounting features necessary for managing floorplan financing include:

- Interest Tracking: Monitoring interest charges on floorplan loans, which are typically calculated daily based on the outstanding balance.

- Reconciliation Tools: Reconciling floorplan loan balances with lender statements to ensure accuracy and identify discrepancies.

- Curtailment Management: Tracking curtailment payments, which are partial payments made to reduce the loan balance as vehicles are sold.

- Automated Journal Entries: Generating automated journal entries to record interest expenses, curtailment payments, and other floorplan-related transactions.

2.4. Customer Financing Management

How can accounting software assist in managing customer loans and leases? Accounting software can assist in managing customer loans and leases through features like:

- Loan Origination Tracking: Recording the details of each customer loan or lease, including loan amount, interest rate, and payment terms.

- Payment Processing: Processing customer payments and automatically updating loan balances.

- Interest Calculation: Calculating interest earned on customer loans and leases.

- Default Management: Tracking defaulted loans and leases and initiating collection procedures.

2.5. Comprehensive Reporting

What types of reports are most valuable for small car dealerships? The most valuable reports for small car dealerships include:

- Sales Performance Reports: These reports track sales volume, revenue, and profitability by vehicle type, salesperson, and location.

- Inventory Turnover Reports: These reports measure how quickly inventory is sold and replaced, providing insights into inventory management efficiency.

- Profit and Loss (P&L) Statements: P&L statements summarize revenues, expenses, and net income over a specific period, providing an overview of financial performance.

- Balance Sheets: Balance sheets provide a snapshot of a dealership’s assets, liabilities, and equity at a specific point in time.

- Cash Flow Statements: Cash flow statements track the movement of cash into and out of the dealership, providing insights into liquidity and financial stability.

- Tax Reports: These reports summarize taxable income, deductions, and credits for easy tax preparation and filing.

3. Top Accounting Software Options for Small Car Dealerships

What are some of the top accounting software options available for small car dealerships? Several accounting software options cater to the needs of small car dealerships.

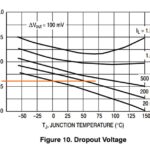

3.1. FreshBooks

Why is FreshBooks a good choice for small car dealerships? FreshBooks is a good choice for small car dealerships because it offers user-friendly features specifically designed for non-accountants, including invoicing, expense tracking, and reporting.

- User-Friendly Interface: FreshBooks features an intuitive interface that makes it easy for dealerships to manage their finances without extensive accounting knowledge.

- Invoicing: FreshBooks simplifies the invoicing process, allowing dealerships to create and send professional invoices quickly and easily.

- Expense Tracking: The software helps dealerships track expenses by categorizing and recording them, making it easier to manage budgets and identify areas for cost savings.

- Reporting: FreshBooks provides a range of reports, including profit and loss statements, sales tax summaries, and expense reports, offering insights into financial performance.

- Mobile App: The FreshBooks mobile app allows dealerships to manage their finances on the go, accessing key features and information from their smartphones or tablets.

FreshBooks Accounting Software

FreshBooks Accounting Software

3.2. QuickBooks Desktop for Dealers

What advantages does QuickBooks Desktop for Dealers offer specifically for the automotive industry? QuickBooks Desktop for Dealers offers advantages specifically for the automotive industry by providing specialized features such as vehicle inventory management, floorplan accounting, and sales tax automation.

- Vehicle Inventory Management: The software allows dealerships to track vehicle inventory in detail, including VINs, purchase dates, and repair costs.

- Floorplan Accounting: QuickBooks Desktop for Dealers supports the unique accounting requirements of floorplan financing, including interest tracking and reconciliation.

- Sales Tax Automation: The software automates sales tax calculation and reporting, ensuring compliance with complex tax regulations.

- Integration with Other QuickBooks Products: QuickBooks Desktop for Dealers integrates seamlessly with other QuickBooks products, such as payroll and payment processing, providing a comprehensive financial management solution.

- Customizable Reporting: The software offers customizable reporting options, allowing dealerships to generate reports tailored to their specific needs and preferences.

3.3. Xero

Why is Xero a popular choice among small businesses, including car dealerships? Xero is a popular choice among small businesses, including car dealerships, because it offers cloud-based accessibility, bank reconciliation, and integration with third-party apps.

- Cloud-Based Accessibility: Xero is a cloud-based accounting solution, allowing dealerships to access their financial data from anywhere with an internet connection.

- Bank Reconciliation: The software automates bank reconciliation, matching transactions with bank statements to ensure accuracy and identify discrepancies.

- Integration with Third-Party Apps: Xero integrates with a wide range of third-party apps, such as CRM and inventory management systems, extending its functionality and providing a comprehensive business management solution.

- User-Friendly Interface: Xero features a user-friendly interface that makes it easy for dealerships to manage their finances, even without extensive accounting knowledge.

- Mobile App: The Xero mobile app allows dealerships to manage their finances on the go, accessing key features and information from their smartphones or tablets.

3.4. DealerTrack DMS

How does DealerTrack DMS cater specifically to the needs of car dealerships? DealerTrack DMS caters specifically to the needs of car dealerships by offering a comprehensive suite of tools for managing sales, finance, inventory, and service operations.

- Sales Management: The software helps dealerships manage the sales process from lead generation to closing, tracking customer interactions, managing pricing, and generating sales contracts.

- Finance Management: DealerTrack DMS supports financing operations, including credit applications, loan processing, and compliance management.

- Inventory Management: The software allows dealerships to track vehicle inventory in detail, including VINs, purchase dates, and repair costs.

- Service Management: DealerTrack DMS helps dealerships manage service operations, including appointment scheduling, repair order management, and parts inventory tracking.

- Reporting: The software provides a range of reports, including sales performance, inventory turnover, and service profitability, offering insights into business performance.

3.5. NetSuite

What makes NetSuite a robust solution for larger car dealerships with complex accounting needs? NetSuite is a robust solution for larger car dealerships with complex accounting needs due to its enterprise-level features, including financial management, supply chain management, and CRM.

- Financial Management: NetSuite offers comprehensive financial management capabilities, including general ledger, accounts payable, accounts receivable, and fixed asset management.

- Supply Chain Management: The software helps dealerships manage their supply chain, including procurement, inventory management, and order fulfillment.

- Customer Relationship Management (CRM): NetSuite includes CRM functionality, allowing dealerships to manage customer interactions, track leads, and improve customer satisfaction.

- Business Intelligence: The software provides advanced business intelligence tools, including dashboards, reports, and analytics, offering insights into business performance.

- Customization: NetSuite is highly customizable, allowing dealerships to tailor the software to their specific needs and preferences.

4. Implementing Accounting Software: A Step-by-Step Guide

What steps should small car dealerships take to implement accounting software effectively? Small car dealerships should follow a structured approach to implement accounting software effectively.

4.1. Assessing Your Dealership’s Needs

How can dealerships identify their specific accounting requirements? Dealerships can identify their specific accounting requirements by:

- Analyzing Current Processes: Evaluating existing accounting processes to identify pain points and areas for improvement.

- Identifying Key Stakeholders: Engaging key stakeholders, such as owners, managers, and accountants, to gather input on their needs and expectations.

- Defining Reporting Requirements: Determining the types of reports needed to track financial performance and make informed business decisions.

- Evaluating Compliance Requirements: Assessing industry-specific compliance requirements, such as sales tax regulations and floorplan financing rules.

- Considering Future Growth: Anticipating future growth and ensuring that the accounting software can scale to meet evolving needs.

4.2. Data Migration Strategies

What are the best practices for migrating data from existing systems to the new accounting software? Best practices for migrating data from existing systems to the new accounting software include:

- Data Cleansing: Cleaning and validating data to ensure accuracy and consistency before migration.

- Data Mapping: Mapping data fields from the old system to the new system to ensure that data is transferred correctly.

- Phased Approach: Migrating data in phases, starting with essential data and gradually adding more over time.

- Testing: Testing the migrated data to ensure that it is accurate and that the new system is functioning correctly.

- Backup: Creating a backup of the existing data before migration to protect against data loss.

4.3. Training and Support

Why is adequate training and ongoing support crucial for successful software adoption? Adequate training and ongoing support are crucial for successful software adoption because they ensure that users understand how to use the software effectively and can resolve any issues that arise.

- Comprehensive Training Programs: Providing comprehensive training programs that cover all aspects of the software, from basic navigation to advanced features.

- Hands-On Training: Offering hands-on training sessions where users can practice using the software under the guidance of experienced trainers.

- Documentation: Providing detailed documentation, including user guides, tutorials, and FAQs, to support users as they learn the software.

- Ongoing Support: Offering ongoing support through phone, email, or online chat to help users resolve issues and answer questions.

- User Feedback: Encouraging user feedback and using it to improve the training and support programs.

4.4. Customization and Integration

How can dealerships customize accounting software to fit their unique operational workflows? Dealerships can customize accounting software to fit their unique operational workflows by:

- Configuring Settings: Adjusting software settings to match their specific business processes and preferences.

- Creating Custom Fields: Adding custom fields to track data that is not included in the standard software.

- Developing Custom Reports: Designing custom reports to provide insights into specific areas of the business.

- Integrating with Other Systems: Integrating the accounting software with other systems, such as CRM and inventory management, to streamline data flow and improve efficiency.

- Using APIs: Using APIs (Application Programming Interfaces) to connect the accounting software with other applications and services.

4.5. Monitoring and Optimization

What metrics should dealerships track to ensure the accounting software is delivering the expected benefits? Dealerships should track metrics such as:

- Efficiency Gains: Measuring the time saved by automating accounting tasks.

- Accuracy Improvements: Tracking the reduction in errors and discrepancies.

- Compliance Rates: Monitoring compliance with sales tax regulations and other industry-specific rules.

- Reporting Insights: Assessing the value of reports in providing insights into financial performance.

- User Satisfaction: Gathering feedback from users to assess their satisfaction with the software and identify areas for improvement.

- Return on Investment (ROI): Calculating the ROI of the accounting software by comparing the costs of implementation and maintenance with the benefits achieved.

5. Integrating with Other Dealership Systems

How does integrating accounting software with other dealership systems enhance overall efficiency and data accuracy? Integrating accounting software with other dealership systems enhances overall efficiency and data accuracy by streamlining data flow, eliminating manual data entry, and providing a unified view of business operations.

5.1. CRM Systems

Why is integrating accounting software with CRM systems beneficial for car dealerships? Integrating accounting software with CRM systems is beneficial for car dealerships because it streamlines the sales process, improves customer service, and provides a unified view of customer data.

- Lead Management: Integrating CRM with accounting software allows dealerships to track leads, manage customer interactions, and convert leads into sales.

- Sales Data Integration: Integrating sales data from CRM into accounting software automates revenue recognition and simplifies sales reporting.

- Customer Payment Tracking: Integrating CRM with accounting software allows dealerships to track customer payments and manage accounts receivable.

- Improved Customer Service: A unified view of customer data enables dealerships to provide better customer service and build stronger relationships.

- Data-Driven Decision-Making: Integrating CRM with accounting software provides valuable insights into sales performance, customer behavior, and marketing effectiveness, enabling data-driven decision-making.

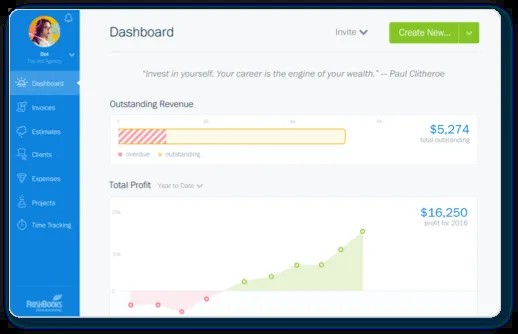

5.2. Inventory Management Systems

How does integrating accounting software with inventory management systems optimize stock control and cost tracking? Integrating accounting software with inventory management systems optimizes stock control and cost tracking by providing real-time visibility into inventory levels, automating inventory valuation, and streamlining the purchasing process.

- Real-Time Inventory Visibility: Integrating inventory management with accounting software provides real-time visibility into inventory levels, allowing dealerships to optimize stock levels and avoid stockouts.

- Automated Inventory Valuation: The software automates inventory valuation, calculating the cost of goods sold and tracking inventory value.

- Streamlined Purchasing: Integrating inventory management with accounting software streamlines the purchasing process, automating purchase orders and tracking vendor invoices.

- Improved Cost Tracking: The software helps dealerships track the cost of acquiring and preparing vehicles for sale, improving cost control and profitability.

- Reduced Errors: Automating data flow between inventory management and accounting software reduces manual data entry and minimizes errors.

Optimize stock control

Optimize stock control

5.3. Dealer Management Systems (DMS)

What are the advantages of using a Dealer Management System (DMS) that integrates accounting functionality? The advantages of using a Dealer Management System (DMS) that integrates accounting functionality include:

- Centralized Data Management: A DMS provides a centralized platform for managing all aspects of the dealership, including sales, finance, inventory, service, and accounting.

- Streamlined Operations: Integrating accounting functionality into the DMS streamlines operations, eliminating the need for separate accounting software.

- Real-Time Visibility: The DMS provides real-time visibility into all areas of the dealership, enabling informed decision-making.

- Improved Efficiency: Automating data flow between different departments improves efficiency and reduces manual data entry.

- Enhanced Compliance: The DMS helps dealerships comply with industry-specific regulations, such as sales tax rules and floorplan financing requirements.

5.4. Payment Processing Platforms

How does integrating accounting software with payment processing platforms streamline payment collection and reconciliation? Integrating accounting software with payment processing platforms streamlines payment collection and reconciliation by:

- Automated Payment Recording: Automatically recording payments in the accounting software when customers pay online or through other electronic methods.

- Real-Time Reconciliation: Reconciling payments with bank statements in real-time, ensuring accuracy and minimizing discrepancies.

- Faster Payment Processing: Speeding up the payment processing cycle, allowing dealerships to receive payments faster.

- Improved Cash Flow: Enhancing cash flow by reducing the time it takes to collect payments.

- Reduced Errors: Automating data flow between payment processing platforms and accounting software reduces manual data entry and minimizes errors.

6. The Future of Accounting Software for Car Dealerships

What emerging trends and technologies are shaping the future of accounting software for car dealerships? Emerging trends and technologies are poised to revolutionize accounting software for car dealerships.

6.1. Cloud Computing

How is cloud computing transforming accounting practices for car dealerships? Cloud computing is transforming accounting practices for car dealerships by:

- Accessibility: Enabling access to financial data from anywhere with an internet connection.

- Collaboration: Facilitating collaboration among employees, accountants, and other stakeholders.

- Scalability: Providing scalability to meet the evolving needs of the dealership.

- Cost Savings: Reducing IT costs by eliminating the need for expensive hardware and software.

- Security: Offering robust security features to protect financial data.

6.2. Artificial Intelligence (AI)

What role will AI play in automating accounting tasks and providing insights? AI will play a significant role in automating accounting tasks and providing insights by:

- Automating Data Entry: Automating the entry of data from invoices, receipts, and other documents.

- Detecting Fraud: Identifying fraudulent transactions and patterns.

- Predicting Cash Flow: Forecasting cash flow based on historical data and market trends.

- Personalizing Reporting: Generating personalized reports tailored to the specific needs of each user.

- Providing Insights: Offering insights into financial performance and identifying opportunities for improvement.

6.3. Blockchain Technology

How can blockchain technology enhance transparency and security in financial transactions? Blockchain technology can enhance transparency and security in financial transactions by:

- Creating Immutable Records: Creating immutable records of all transactions, making it difficult to alter or tamper with data.

- Enhancing Transparency: Providing transparency into financial transactions, allowing dealerships to track the flow of funds and identify potential fraud.

- Improving Security: Securing financial transactions using cryptographic techniques.

- Reducing Costs: Reducing transaction costs by eliminating intermediaries.

- Automating Compliance: Automating compliance with regulatory requirements.

6.4. Mobile Accounting

How does mobile accounting enable car dealerships to manage their finances on the go? Mobile accounting enables car dealerships to manage their finances on the go by:

- Accessing Data from Anywhere: Providing access to financial data from smartphones and tablets.

- Managing Invoices: Creating and sending invoices from mobile devices.

- Tracking Expenses: Recording expenses on the go.

- Monitoring Cash Flow: Monitoring cash flow in real-time.

- Collaborating with Stakeholders: Collaborating with employees, accountants, and other stakeholders from mobile devices.

7. Expert Tips for Optimizing Accounting Practices

What are some expert tips for car dealerships to optimize their accounting practices and financial management? Here are some expert tips to optimize accounting practices.

7.1. Regular Reconciliation

Why is regular reconciliation of bank accounts, floorplan loans, and other financial accounts essential? Regular reconciliation of bank accounts, floorplan loans, and other financial accounts is essential because:

- Accuracy: Verifying the accuracy of financial records.

- Fraud Detection: Identifying potential fraud and errors.

- Compliance: Ensuring compliance with regulatory requirements.

- Cash Management: Managing cash flow effectively.

- Financial Health: Monitoring the financial health of the dealership.

7.2. Budgeting and Forecasting

How can car dealerships use budgeting and forecasting to improve financial planning? Car dealerships can use budgeting and forecasting to improve financial planning by:

- Setting Financial Goals: Establishing clear financial goals and objectives.

- Allocating Resources: Allocating resources effectively to achieve those goals.

- Identifying Risks: Identifying potential risks and opportunities.

- Monitoring Performance: Monitoring performance against the budget and forecast.

- Making Adjustments: Making adjustments as needed to stay on track.

7.3. Internal Controls

What internal controls should car dealerships implement to prevent fraud and errors? Internal controls that car dealerships should implement to prevent fraud and errors:

- Segregation of Duties: Separating duties to prevent one person from having too much control over financial transactions.

- Authorization Limits: Establishing authorization limits for different types of transactions.

- Regular Audits: Conducting regular audits to verify the accuracy of financial records.

- Password Protection: Protecting financial data with strong passwords.

- Employee Training: Training employees on internal controls and ethical behavior.

7.4. Sales Tax Compliance

How can car dealerships ensure compliance with complex sales tax regulations? To ensure compliance with complex sales tax regulations:

- Stay Informed: Staying informed about changes in sales tax laws and regulations.

- Automate Calculation: Automating sales tax calculation and reporting.

- Maintain Records: Maintaining detailed records of all sales and sales tax collected.

- Seek Expert Advice: Seeking advice from tax professionals.

- Regular Audits: Conducting regular audits to verify compliance with sales tax regulations.

7.5. Professional Advice

Why is it beneficial for car dealerships to seek advice from accounting professionals? It is beneficial for car dealerships to seek advice from accounting professionals for several reasons:

- Expertise: Accounting professionals have expertise in accounting, tax, and financial management.

- Compliance: Accounting professionals can help dealerships comply with complex regulations.

- Financial Planning: Accounting professionals can provide advice on financial planning and decision-making.

- Objectivity: Accounting professionals can provide objective advice without being influenced by internal politics.

- Peace of Mind: Knowing that they have expert advice, dealerships can focus on running their business with peace of mind.

8. Real-World Success Stories

How have small car dealerships benefited from implementing specialized accounting software? Here are some real-world success stories.

8.1. Increased Efficiency

How did one dealership streamline operations and save time by automating accounting tasks? One dealership streamlined operations and saved time by automating accounting tasks such as invoicing, bank reconciliation, and reporting.

8.2. Improved Accuracy

What impact did specialized software have on reducing errors and discrepancies in financial records? The specialized software had a positive impact on reducing errors and discrepancies in financial records by automating data entry, validating data, and providing real-time visibility into financial transactions.

8.3. Enhanced Compliance

How did automated sales tax calculation and reporting help a dealership avoid penalties and fines? Automated sales tax calculation and reporting helped a dealership avoid penalties and fines by ensuring compliance with complex sales tax regulations and providing accurate and timely reports to tax authorities.

8.4. Better Decision-Making

What insights did comprehensive reporting provide to help a dealership make informed business decisions? Comprehensive reporting provided insights to help a dealership make informed business decisions by providing real-time visibility into sales performance, inventory levels, customer behavior, and financial health.

9. Common Mistakes to Avoid

What common mistakes should car dealerships avoid when selecting and implementing accounting software? Here are some mistakes to avoid.

9.1. Neglecting Needs Assessment

Why is it crucial to conduct a thorough needs assessment before selecting accounting software? It is crucial to conduct a thorough needs assessment because neglecting this step can result in selecting software that doesn’t meet the dealership’s specific needs.

9.2. Ignoring Integration Capabilities

Why is it important to consider how well the accounting software integrates with other dealership systems? It is important to consider integration capabilities because neglecting this step can result in isolated data silos and inefficient workflows.

9.3. Insufficient Training

What are the consequences of inadequate training on the use of new accounting software? The consequences of inadequate training:

- Underutilization of Features: Underutilization of the software’s features and capabilities.

- Errors: Increased errors and discrepancies in financial records.

- Frustration: Frustration among employees.

- Lowered Productivity: Lowered productivity and efficiency.

9.4. Overlooking Customization Options

Why should dealerships explore customization options to tailor the software to their specific needs? Dealerships should explore customization options to tailor the software to their specific needs. Ignoring customization options can result in the software not fully meeting the dealership’s needs and workflows.

9.5. Neglecting Ongoing Support

Why is it important to ensure that the software vendor provides ongoing support and maintenance? It is important to ensure the software vendor provides ongoing support to address issues, answer questions, and keep the software up-to-date with the latest regulations and technologies.

10. FAQs About Accounting Software for Car Dealerships

What are some frequently asked questions about accounting software for car dealerships?

10.1. What is the average cost of accounting software for a small car dealership?

The average cost of accounting software varies widely based on features and complexity.

10.2. Can I integrate my existing CRM system with new accounting software?

Yes, most modern accounting software solutions offer integration with popular CRM systems.

10.3. How long does it take to implement accounting software in a car dealership?

Implementation time varies, but typically ranges from a few weeks to a few months.

10.4. Is cloud-based accounting software more secure than on-premises solutions?

Cloud-based accounting software is generally considered secure, with providers investing heavily in security measures.

10.5. What type of training is needed for employees to use the new software effectively?

Comprehensive training should cover basic navigation, data entry, reporting, and troubleshooting.

10.6. How often should I reconcile my accounts?

Accounts should be reconciled at least monthly, and more frequently for high-volume accounts.

10.7. What is floorplan accounting?

Floorplan accounting refers to the specific accounting practices used to manage floorplan financing, including tracking interest and curtailments.

10.8. How can AI help with accounting tasks?

AI can automate data entry, detect fraud, predict cash flow, and personalize reporting.

10.9. What are the key features to look for in accounting software for car dealerships?

Inventory management, sales tax automation, floorplan accounting, customer financing management, and comprehensive reporting.

10.10. What are the benefits of using specialized accounting software?

Improved accuracy, increased efficiency, better inventory management, enhanced sales tax compliance, simplified financing management, data-driven insights, and regulatory compliance.

Choosing and implementing the right accounting software is a critical decision for small car dealerships. By understanding the unique challenges faced by dealerships, prioritizing key features, and following a structured implementation approach, dealerships can leverage accounting software to streamline operations, enhance accuracy, and ensure regulatory compliance. As technology continues to evolve, embracing emerging trends such as cloud computing, AI, and blockchain will further transform accounting practices and drive success in the automotive industry.

Ready to transform your dealership’s financial management? Visit CAR-REMOTE-REPAIR.EDU.VN today to explore our tailored training programs and expert remote technical support services designed to elevate your automotive repair skills and operational efficiency in the USA. Contact us at Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States or Whatsapp: +1 (641) 206-8880 to learn more and take the next step towards success.