Best Bookkeeping Software For Lawn Care is essential for managing your finances, tracking expenses, and ensuring profitability. CAR-REMOTE-REPAIR.EDU.VN understands the challenges lawn care professionals face and recommends solutions to simplify your financial tasks. Discover how the right software can streamline your operations, providing insights that will grow your business, and explore tools for efficient financial management, accurate reporting, and insightful analytics.

Contents

- 1. Why Is Bookkeeping Software Important for Lawn Care Businesses?

- 1.1 Tracking Income and Expenses

- 1.2 Streamlining Invoicing and Payments

- 1.3 Managing Cash Flow

- 1.4 Tax Compliance

- 1.5 Scalability

- 2. Key Features to Look for in Bookkeeping Software

- 2.1 Ease of Use

- 2.2 Invoicing and Billing

- 2.3 Expense Tracking

- 2.4 Reporting

- 2.5 Mobile Accessibility

- 2.6 Integration with Other Tools

- 2.7 Customer Support

- 3. Top Bookkeeping Software Options for Lawn Care Businesses

- 3.1 FreshBooks

- 3.2 QuickBooks Online

- 3.3 Xero

- 3.4 Wave Accounting

- 3.5 Jobber

- 4. Step-by-Step Guide to Setting Up Bookkeeping Software

- 4.1 Choosing the Right Software

- 4.2 Setting Up Your Account

- 4.3 Connecting Bank and Credit Card Accounts

- 4.4 Setting Up Chart of Accounts

- 4.5 Importing Existing Data

- 4.6 Setting Up Invoicing and Payment Processing

- 4.7 Training and Support

- 5. Maximizing Efficiency with Bookkeeping Software

- 5.1 Automating Tasks

- 5.2 Using Mobile Features

- 5.3 Regular Financial Reviews

- 5.4 Integrating with Other Tools

- 5.5 Leveraging Reporting Features

- 6. Overcoming Common Bookkeeping Challenges

- 6.1 Lack of Time

- 6.2 Difficulty Tracking Expenses

- 6.3 Difficulty Managing Invoices

- 6.4 Difficulty Understanding Financial Reports

- 6.5 Ensuring Tax Compliance

- 7. Case Studies: Success with Bookkeeping Software

- 7.1 Case Study 1: Streamlining Invoicing with FreshBooks

- 7.2 Case Study 2: Improving Expense Tracking with QuickBooks Online

- 7.3 Case Study 3: Enhancing Financial Reporting with Xero

- 7.4 Case Study 4: Mobile Management with Jobber

- 8. Future Trends in Bookkeeping Software

- 8.1 Artificial Intelligence (AI)

- 8.2 Blockchain Technology

- 8.3 Cloud-Based Solutions

- 8.4 Mobile Optimization

- 8.5 Integration with Fintech Solutions

- 9. How CAR-REMOTE-REPAIR.EDU.VN Can Help

- 10. Frequently Asked Questions (FAQs)

- 10.1. What is the best bookkeeping software for a small lawn care business?

- 10.2. Can I use free bookkeeping software for my lawn care business?

- 10.3. How can bookkeeping software help with tax preparation?

- 10.4. Is it necessary to hire an accountant if I use bookkeeping software?

- 10.5. What are the essential features to look for in bookkeeping software?

- 10.6. How do I choose the right bookkeeping software for my lawn care business?

- 10.7. Can I access my bookkeeping software on my mobile device?

- 10.8. How can I automate tasks with bookkeeping software?

- 10.9. What is a chart of accounts, and why is it important?

- 10.10. How can I ensure my data is secure in the cloud?

1. Why Is Bookkeeping Software Important for Lawn Care Businesses?

Bookkeeping software is incredibly important for lawn care businesses because it simplifies financial management, helps track expenses, and ensures profitability. Think of it as the financial GPS for your business, guiding you toward success.

1.1 Tracking Income and Expenses

Bookkeeping software provides a clear view of your financial inflows and outflows. It’s like having a detailed map of your money, showing where it comes from and where it goes.

- Detailed Records: Accurately record every transaction.

- Expense Categorization: Organize expenses into categories like fuel, equipment maintenance, and supplies.

- Profitability Insights: Understand which services are most profitable.

For example, FreshBooks allows you to track income from various lawn care services and categorize expenses, providing insights into your most profitable services.

1.2 Streamlining Invoicing and Payments

Managing invoices and payments can be time-consuming, but bookkeeping software automates these processes, making it easier to get paid promptly. It’s like having an automated billing assistant.

- Automated Invoicing: Create and send professional invoices quickly.

- Online Payments: Accept payments online via credit card or bank transfer.

- Payment Reminders: Send automated reminders for overdue invoices.

According to a study by Intuit, businesses using online invoicing get paid up to two times faster than those using traditional methods.

invoice ipad

invoice ipad

1.3 Managing Cash Flow

Effective cash flow management is critical for any business. Bookkeeping software provides tools to monitor your cash flow and make informed financial decisions. It’s like having a financial dashboard that keeps you informed.

- Cash Flow Projections: Forecast future cash flow based on current data.

- Real-Time Monitoring: Track income and expenses in real-time.

- Budgeting Tools: Set budgets and monitor performance against them.

1.4 Tax Compliance

Tax season can be stressful, but bookkeeping software simplifies the process by organizing your financial data and generating reports needed for filing taxes. It’s like having a tax preparation assistant.

- Organized Records: Keep all financial records in one place.

- Tax Reports: Generate reports like profit and loss statements and balance sheets.

- Deduction Tracking: Track eligible business deductions to minimize tax liability.

The IRS provides resources to help small businesses understand their tax obligations and utilize available deductions.

1.5 Scalability

As your lawn care business grows, your bookkeeping needs will evolve. Bookkeeping software can scale with your business, providing more advanced features and capabilities as you need them. It’s like having a financial partner that grows with you.

- User Roles and Permissions: Add employees and contractors with customized access levels.

- Advanced Reporting: Generate detailed reports to analyze business performance.

- Integration with Other Tools: Connect with other business tools like CRM and payroll systems.

2. Key Features to Look for in Bookkeeping Software

When selecting bookkeeping software for your lawn care business, consider these essential features to streamline financial management. It’s like choosing the right tools for the job to ensure efficiency and accuracy.

2.1 Ease of Use

The software should be user-friendly with an intuitive interface, so you can easily navigate and perform tasks without extensive training. It’s like having a user manual that makes sense.

- Intuitive Interface: Simple and easy-to-understand design.

- Easy Navigation: Quick access to essential features.

- Mobile Accessibility: Access your accounts on-the-go via mobile app.

2.2 Invoicing and Billing

Efficient invoicing and billing features help you create professional invoices, send them to clients, and track payments effortlessly. It’s like having an automated billing department.

- Customizable Templates: Create branded invoices with your logo and colors.

- Automated Reminders: Send automatic payment reminders to clients.

- Online Payment Options: Accept payments via credit card, bank transfer, or other online methods.

2.3 Expense Tracking

Effective expense tracking helps you monitor and categorize all your business expenses, ensuring accurate financial reporting and tax compliance. It’s like having a digital expense tracker.

- Categorize Expenses: Organize expenses into categories like fuel, supplies, and equipment maintenance.

- Receipt Scanning: Scan and upload receipts directly into the software.

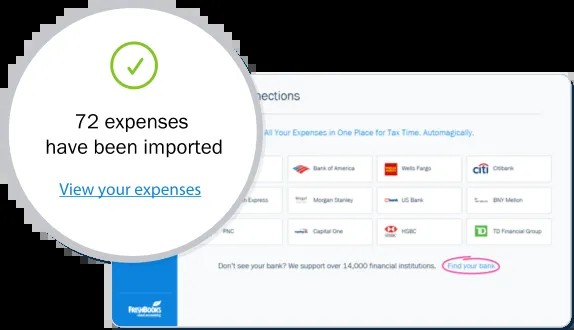

- Automated Bank Feeds: Connect bank accounts and credit cards to automatically import transactions.

freshbooks application

freshbooks application

2.4 Reporting

Comprehensive reporting features provide valuable insights into your business performance, helping you make informed decisions. It’s like having a financial analyst at your fingertips.

- Profit and Loss Statements: View your income, expenses, and net profit.

- Balance Sheets: Understand your assets, liabilities, and equity.

- Cash Flow Statements: Monitor the movement of cash in and out of your business.

2.5 Mobile Accessibility

Mobile accessibility allows you to manage your finances on-the-go, ensuring you’re always connected to your business, no matter where you are. It’s like having a portable office.

- Mobile App: Access your account via iOS or Android app.

- Real-Time Updates: Stay informed with real-time financial data.

- On-the-Go Invoicing: Create and send invoices from your mobile device.

2.6 Integration with Other Tools

Integration with other business tools like CRM, payroll, and payment processors streamlines your operations and eliminates the need for manual data entry. It’s like having a connected ecosystem of business tools.

- CRM Integration: Connect with customer relationship management software.

- Payroll Integration: Integrate with payroll systems to manage employee payments.

- Payment Processor Integration: Connect with payment processors like PayPal or Stripe for easy online payments.

2.7 Customer Support

Reliable customer support ensures you have assistance when you need it, whether you have questions, need help troubleshooting, or want to learn how to use a specific feature. It’s like having a support team on standby.

- 24/7 Support: Access support anytime via phone, email, or chat.

- Knowledge Base: Access a library of articles, tutorials, and FAQs.

- Training Resources: Participate in webinars and training sessions to learn how to use the software effectively.

3. Top Bookkeeping Software Options for Lawn Care Businesses

Choosing the right bookkeeping software can transform how you manage your finances, saving you time and improving accuracy. Here are some of the top options available:

3.1 FreshBooks

FreshBooks is designed specifically for small businesses and offers a user-friendly interface, making it easy to manage invoices, track expenses, and generate reports. It’s like having a financial assistant that understands your business.

- User-Friendly Interface: Simple and intuitive design for easy navigation.

- Invoicing: Create professional invoices with customizable templates.

- Expense Tracking: Track expenses by category and scan receipts.

- Reporting: Generate profit and loss statements, balance sheets, and more.

- Mobile App: Manage your finances on-the-go with iOS and Android apps.

- Pricing: Starts at $15 per month.

According to customer reviews, FreshBooks is praised for its ease of use and excellent customer support.

3.2 QuickBooks Online

QuickBooks Online is a popular choice for small businesses, offering a comprehensive set of features for managing accounting, payroll, and more. It’s like having a full-fledged accounting department.

- Accounting: Manage your chart of accounts, reconcile bank statements, and track inventory.

- Invoicing: Create and send invoices, track payments, and set up recurring billing.

- Expense Tracking: Automatically track expenses by connecting bank accounts and credit cards.

- Reporting: Generate detailed financial reports, including profit and loss statements and balance sheets.

- Payroll: Manage employee payroll, calculate taxes, and file forms.

- Mobile App: Access your account on-the-go with the QuickBooks Online mobile app.

- Pricing: Starts at $25 per month.

A study by FinancesOnline found that QuickBooks Online is used by over 5.6 million businesses worldwide.

3.3 Xero

Xero is a cloud-based accounting software that offers a range of features for managing invoices, expenses, and bank reconciliation. It’s like having a virtual accountant in the cloud.

- Invoicing: Create and send invoices, track payments, and set up automated reminders.

- Expense Tracking: Capture receipts and track expenses with ease.

- Bank Reconciliation: Automatically reconcile bank transactions with your accounting records.

- Reporting: Generate financial reports, including profit and loss statements, balance sheets, and cash flow statements.

- Mobile App: Manage your finances on-the-go with the Xero mobile app.

- Pricing: Starts at $12 per month.

Xero has been recognized as a leader in cloud accounting by G2 Crowd.

3.4 Wave Accounting

Wave Accounting is a free accounting software designed for small businesses. It offers basic features for managing invoices, expenses, and financial reporting. It’s like having a free financial toolkit.

- Invoicing: Create and send professional invoices.

- Expense Tracking: Track expenses by category.

- Financial Reporting: Generate basic financial reports.

- Payroll: Manage employee payroll (available in select states).

- Pricing: Free (additional fees for payroll and payment processing).

Wave Accounting is a popular choice for startups and small businesses looking for a free accounting solution.

3.5 Jobber

While Jobber is primarily field service management software, it includes strong invoicing and payment tracking features that can serve as a basic bookkeeping solution for lawn care businesses. It’s like having a field service command center.

- Invoicing: Create and send invoices directly from the field.

- Payment Tracking: Track payments and send automated reminders.

- Scheduling: Schedule jobs and assign them to team members.

- CRM: Manage customer information and communication.

- Mobile App: Access your account on-the-go with the Jobber mobile app.

- Pricing: Starts at $29 per month.

According to customer reviews, Jobber is praised for its ease of use and robust field service management features.

4. Step-by-Step Guide to Setting Up Bookkeeping Software

Setting up bookkeeping software for your lawn care business involves several key steps to ensure accurate financial management. Here’s a detailed guide:

4.1 Choosing the Right Software

Selecting the right software is crucial. Consider your business needs, budget, and the features you require. It’s like picking the right vehicle for a specific journey.

- Identify Your Needs: Determine what you need from the software (e.g., invoicing, expense tracking, reporting).

- Compare Options: Evaluate different software options based on features, pricing, and reviews.

- Try Free Trials: Take advantage of free trials to test out different software before making a decision.

4.2 Setting Up Your Account

Once you’ve chosen your software, create an account and configure your business settings. It’s like setting up your home base.

- Create an Account: Sign up for an account on the software’s website.

- Enter Business Information: Add your business name, address, and contact information.

- Configure Settings: Set up your currency, tax settings, and other preferences.

4.3 Connecting Bank and Credit Card Accounts

Connecting your bank and credit card accounts automates the process of importing transactions into your bookkeeping software. It’s like having a direct line to your financial data.

- Add Bank Accounts: Connect your business bank accounts to the software.

- Add Credit Card Accounts: Connect your business credit card accounts to the software.

- Enable Automatic Import: Set up automatic transaction imports to keep your records up-to-date.

4.4 Setting Up Chart of Accounts

The chart of accounts is a list of all the accounts used to record financial transactions. Setting it up correctly is essential for accurate financial reporting. It’s like creating a well-organized filing system.

- Review Default Accounts: Most software comes with a default chart of accounts. Review and customize it to fit your business.

- Add Custom Accounts: Add any additional accounts you need, such as specific expense categories or income streams.

- Categorize Accounts: Ensure each account is properly categorized (e.g., assets, liabilities, equity, income, expenses).

4.5 Importing Existing Data

If you’re switching from another bookkeeping system, import your existing data to ensure a seamless transition. It’s like moving all your belongings to a new home.

- Export Data: Export your data from your old system in a compatible format (e.g., CSV, Excel).

- Import Data: Import the data into your new software, mapping the fields to the correct accounts.

- Verify Data: Double-check the imported data to ensure accuracy.

4.6 Setting Up Invoicing and Payment Processing

Configure invoicing and payment processing to streamline your billing and payment collection processes. It’s like setting up an automated billing system.

- Customize Invoice Templates: Create professional invoice templates with your logo and branding.

- Set Up Payment Options: Configure online payment options like credit card, bank transfer, or PayPal.

- Enable Automated Reminders: Set up automated payment reminders to send to clients.

4.7 Training and Support

Take advantage of training resources and customer support to learn how to use the software effectively and troubleshoot any issues. It’s like having a guide and support team to help you along the way.

- Explore Training Resources: Access tutorials, webinars, and knowledge base articles.

- Contact Customer Support: Reach out to customer support for help with any questions or issues.

- Join User Communities: Connect with other users in online forums or communities to share tips and best practices.

5. Maximizing Efficiency with Bookkeeping Software

To get the most out of your bookkeeping software, focus on automating tasks, using mobile features, and regularly reviewing your financial data. It’s like fine-tuning a machine for peak performance.

5.1 Automating Tasks

Automation saves time and reduces the risk of errors. Set up recurring invoices, automated payment reminders, and automatic bank feeds. It’s like having a robot assistant handle repetitive tasks.

- Recurring Invoices: Set up recurring invoices for regular clients.

- Automated Payment Reminders: Schedule automatic payment reminders to send to clients.

- Automatic Bank Feeds: Connect your bank accounts to automatically import transactions.

5.2 Using Mobile Features

Mobile accessibility allows you to manage your finances on-the-go. Use the mobile app to track expenses, create invoices, and monitor your cash flow from anywhere. It’s like having a portable office.

- Expense Tracking: Use the mobile app to snap photos of receipts and track expenses on-the-go.

- Invoicing: Create and send invoices from your mobile device.

- Real-Time Monitoring: Monitor your cash flow and financial performance in real-time.

mobile devices

mobile devices

5.3 Regular Financial Reviews

Regularly review your financial data to identify trends, monitor performance against budgets, and make informed decisions. It’s like conducting a regular check-up to ensure everything is running smoothly.

- Monthly Reviews: Review your financial statements monthly to track income, expenses, and cash flow.

- Budgeting: Set budgets and monitor performance against them.

- Financial Analysis: Analyze your financial data to identify trends and opportunities for improvement.

5.4 Integrating with Other Tools

Integrating your bookkeeping software with other business tools like CRM and payroll systems streamlines your operations and eliminates the need for manual data entry. It’s like creating a connected ecosystem of business tools.

- CRM Integration: Connect with customer relationship management software to manage customer data and track sales.

- Payroll Integration: Integrate with payroll systems to manage employee payments and payroll taxes.

- Payment Processor Integration: Connect with payment processors like PayPal or Stripe for easy online payments.

5.5 Leveraging Reporting Features

Use the reporting features to gain insights into your business performance. Generate profit and loss statements, balance sheets, and cash flow statements to understand your financial health. It’s like having a crystal ball that reveals your financial future.

- Profit and Loss Statements: View your income, expenses, and net profit.

- Balance Sheets: Understand your assets, liabilities, and equity.

- Cash Flow Statements: Monitor the movement of cash in and out of your business.

6. Overcoming Common Bookkeeping Challenges

Bookkeeping can present several challenges for lawn care businesses. Here’s how to overcome some common issues:

6.1 Lack of Time

Many lawn care business owners struggle to find the time for bookkeeping. Automating tasks and using mobile features can help you manage your finances more efficiently. It’s like finding extra hours in the day.

- Automate Tasks: Set up recurring invoices, automated payment reminders, and automatic bank feeds.

- Use Mobile Features: Manage your finances on-the-go with the mobile app.

- Outsource Bookkeeping: Consider hiring a bookkeeper to handle your financial tasks.

6.2 Difficulty Tracking Expenses

Tracking expenses can be challenging, especially when you’re on the go. Use expense tracking features like receipt scanning and automatic bank feeds to simplify the process. It’s like having a digital expense tracker.

- Receipt Scanning: Use the mobile app to snap photos of receipts and upload them to your bookkeeping software.

- Automatic Bank Feeds: Connect your bank accounts to automatically import transactions.

- Categorize Expenses: Organize expenses into categories like fuel, supplies, and equipment maintenance.

6.3 Difficulty Managing Invoices

Managing invoices can be time-consuming, especially when dealing with multiple clients. Use invoicing features like customizable templates, automated reminders, and online payment options to streamline the process. It’s like having an automated billing department.

- Customizable Templates: Create professional invoice templates with your logo and branding.

- Automated Reminders: Set up automated payment reminders to send to clients.

- Online Payment Options: Offer online payment options like credit card, bank transfer, or PayPal.

6.4 Difficulty Understanding Financial Reports

Understanding financial reports can be daunting, especially if you’re not an accountant. Take advantage of training resources and customer support to learn how to interpret your financial data. It’s like having a financial translator.

- Explore Training Resources: Access tutorials, webinars, and knowledge base articles.

- Contact Customer Support: Reach out to customer support for help with any questions or issues.

- Consult with an Accountant: Consider consulting with an accountant to help you understand your financial reports.

6.5 Ensuring Tax Compliance

Tax compliance can be complex, especially with changing regulations. Stay organized, track your deductions, and consult with a tax professional to ensure you’re meeting your obligations. It’s like having a tax compliance checklist.

- Stay Organized: Keep all your financial records in one place.

- Track Deductions: Track eligible business deductions to minimize your tax liability.

- Consult with a Tax Professional: Consider consulting with a tax professional to help you navigate tax regulations.

7. Case Studies: Success with Bookkeeping Software

Real-world examples demonstrate how bookkeeping software transforms lawn care businesses, improving financial management and driving growth.

7.1 Case Study 1: Streamlining Invoicing with FreshBooks

A lawn care business struggled with late payments due to inefficient invoicing. By switching to FreshBooks, they automated invoicing, set up payment reminders, and offered online payment options. As a result, they reduced late payments by 50% and improved cash flow.

7.2 Case Study 2: Improving Expense Tracking with QuickBooks Online

A lawn care business found it challenging to track expenses accurately. By using QuickBooks Online, they connected their bank accounts, scanned receipts, and categorized expenses. This improved expense tracking, reduced errors, and simplified tax preparation.

7.3 Case Study 3: Enhancing Financial Reporting with Xero

A lawn care business lacked insights into their financial performance. By implementing Xero, they generated detailed financial reports, including profit and loss statements, balance sheets, and cash flow statements. This helped them identify areas for improvement, optimize expenses, and increase profitability.

7.4 Case Study 4: Mobile Management with Jobber

A lawn care business needed a way to manage their finances on-the-go. By using Jobber, they created invoices, tracked payments, and monitored their cash flow from their mobile devices. This improved efficiency, reduced paperwork, and enabled them to manage their business from anywhere.

8. Future Trends in Bookkeeping Software

The field of bookkeeping software is continually evolving. Here are some emerging trends:

8.1 Artificial Intelligence (AI)

AI is being integrated into bookkeeping software to automate tasks, improve accuracy, and provide insights. It’s like having an AI assistant that handles complex financial tasks.

- Automated Data Entry: AI can automatically extract data from invoices and receipts, eliminating the need for manual data entry.

- Fraud Detection: AI can detect fraudulent transactions and alert you to potential issues.

- Predictive Analytics: AI can analyze your financial data to forecast future performance and provide insights.

8.2 Blockchain Technology

Blockchain technology is being used to enhance security, transparency, and efficiency in bookkeeping. It’s like having a secure, transparent ledger for all your financial transactions.

- Secure Transactions: Blockchain provides a secure, tamper-proof record of all transactions.

- Real-Time Data: Blockchain enables real-time access to financial data for all parties involved.

- Automated Auditing: Blockchain simplifies the auditing process by providing a transparent record of all transactions.

8.3 Cloud-Based Solutions

Cloud-based bookkeeping software is becoming increasingly popular due to its accessibility, scalability, and security. It’s like having a virtual office in the cloud.

- Accessibility: Access your account from anywhere with an internet connection.

- Scalability: Scale your software to meet the needs of your growing business.

- Security: Cloud-based solutions offer robust security features to protect your financial data.

8.4 Mobile Optimization

Mobile optimization is becoming increasingly important as more business owners manage their finances on-the-go. It’s like having a portable office in your pocket.

- Mobile Apps: Access your account via iOS or Android app.

- Real-Time Updates: Stay informed with real-time financial data.

- On-the-Go Invoicing: Create and send invoices from your mobile device.

8.5 Integration with Fintech Solutions

Bookkeeping software is increasingly integrating with fintech solutions like payment processors, lending platforms, and investment tools. It’s like having a connected ecosystem of financial services.

- Payment Processing: Connect with payment processors like PayPal or Stripe for easy online payments.

- Lending Platforms: Access financing options directly from your bookkeeping software.

- Investment Tools: Manage your investments and track your portfolio performance.

9. How CAR-REMOTE-REPAIR.EDU.VN Can Help

At CAR-REMOTE-REPAIR.EDU.VN, we understand the challenges lawn care professionals face and offer solutions to simplify financial management and grow your business.

- Training Programs: We offer training programs to help you master bookkeeping software and improve your financial management skills.

- Consulting Services: We provide consulting services to help you choose the right software, set up your account, and optimize your financial processes.

- Support Resources: We offer a library of articles, tutorials, and FAQs to help you get the most out of your bookkeeping software.

10. Frequently Asked Questions (FAQs)

10.1. What is the best bookkeeping software for a small lawn care business?

The best bookkeeping software often depends on your specific needs, but popular choices include FreshBooks, QuickBooks Online, and Xero. FreshBooks is known for its user-friendly interface, while QuickBooks Online offers a comprehensive set of features, and Xero provides robust cloud-based accounting solutions.

10.2. Can I use free bookkeeping software for my lawn care business?

Yes, you can use free bookkeeping software like Wave Accounting. While free software offers basic features, it may lack the advanced capabilities and integrations needed as your business grows. Consider upgrading to a paid option for more comprehensive functionality.

10.3. How can bookkeeping software help with tax preparation?

Bookkeeping software helps with tax preparation by organizing your financial data, tracking expenses, and generating reports like profit and loss statements and balance sheets. This makes it easier to file your taxes accurately and on time.

10.4. Is it necessary to hire an accountant if I use bookkeeping software?

While bookkeeping software simplifies financial management, hiring an accountant can still be beneficial. An accountant can provide expert advice, help you interpret your financial data, and ensure you comply with tax regulations.

10.5. What are the essential features to look for in bookkeeping software?

Essential features include ease of use, invoicing and billing, expense tracking, reporting, mobile accessibility, integration with other tools, and customer support. These features streamline financial management and provide valuable insights into your business performance.

10.6. How do I choose the right bookkeeping software for my lawn care business?

To choose the right software, identify your needs, compare options based on features and pricing, and take advantage of free trials to test out different software before making a decision.

10.7. Can I access my bookkeeping software on my mobile device?

Yes, many bookkeeping software options offer mobile apps that allow you to manage your finances on-the-go. This enables you to track expenses, create invoices, and monitor your cash flow from anywhere.

10.8. How can I automate tasks with bookkeeping software?

You can automate tasks by setting up recurring invoices, automated payment reminders, and automatic bank feeds. This saves time and reduces the risk of errors.

10.9. What is a chart of accounts, and why is it important?

A chart of accounts is a list of all the accounts used to record financial transactions. Setting it up correctly is essential for accurate financial reporting and helps you organize your financial data effectively.

10.10. How can I ensure my data is secure in the cloud?

To ensure your data is secure, choose bookkeeping software that offers robust security features like encryption, multi-factor authentication, and regular backups. Also, follow best practices for password management and data protection.

By leveraging the best bookkeeping software, lawn care businesses can streamline financial management, improve accuracy, and drive growth.

Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States. Whatsapp: +1 (641) 206-8880. Visit CAR-REMOTE-REPAIR.EDU.VN today to explore our training programs and consulting services.