Bookkeeping Software For Car Dealers is essential for streamlining financial operations, improving accuracy, and saving time. CAR-REMOTE-REPAIR.EDU.VN offers insights and solutions to help car dealers leverage these tools for optimal business management. Implementing the right accounting tools can improve your financial reporting, streamline operations, and make tax season less stressful.

Contents

- 1. What Is Bookkeeping Software For Car Dealers?

- 2. Why Do Car Dealers Need Specialized Bookkeeping Software?

- 3. What Are The Key Features To Look For In Bookkeeping Software For Car Dealers?

- 4. How Does Bookkeeping Software Streamline Financial Operations For Car Dealerships?

- 5. What Are The Benefits Of Cloud-Based Bookkeeping Software For Car Dealers?

- 6. How Does Bookkeeping Software Help Car Dealers With Tax Preparation?

- 7. What Are The Common Mistakes Car Dealers Make In Bookkeeping And How Can Software Help?

- 8. How Can Car Dealers Integrate Bookkeeping Software With Other Business Systems?

- 9. What Are The Best Bookkeeping Software Options For Small To Medium-Sized Car Dealerships?

- 10. How To Choose The Right Bookkeeping Software For Your Car Dealership?

- FAQ About Bookkeeping Software for Car Dealers

1. What Is Bookkeeping Software For Car Dealers?

Bookkeeping software for car dealers is a specialized tool designed to manage the unique financial needs of automotive dealerships. This software helps dealerships track sales, expenses, inventory, and customer financing. It simplifies complex accounting tasks, ensuring accuracy and compliance, while providing real-time financial insights to improve decision-making.

Bookkeeping software offers several benefits:

- Efficiency: Automates routine tasks, such as invoicing and reconciliation.

- Accuracy: Reduces errors compared to manual bookkeeping.

- Reporting: Provides detailed financial reports for analysis.

- Compliance: Helps maintain compliance with tax regulations.

- Integration: Integrates with other business systems, such as CRM and inventory management.

2. Why Do Car Dealers Need Specialized Bookkeeping Software?

Car dealers need specialized bookkeeping software due to the unique financial complexities of their operations. These complexities include managing inventory, tracking vehicle sales, handling customer financing, and complying with industry-specific regulations. Standard accounting software often lacks the features necessary to efficiently handle these tasks.

Here’s why specialized software is crucial:

- Inventory Management: Car dealers must track a large and varied inventory of vehicles, parts, and accessories. Specialized software provides tools to manage this inventory effectively, including tracking costs, sales, and depreciation.

- Sales Tracking: Car dealerships handle a high volume of sales transactions, each with its own set of variables, such as trade-ins, financing, and warranties. Specialized software helps track these transactions accurately and efficiently.

- Customer Financing: Many car dealers offer financing options to their customers. Bookkeeping software can manage these loans, track payments, and calculate interest.

- Compliance: Car dealerships must comply with various industry-specific regulations, such as those related to vehicle sales and financing. Specialized software helps ensure compliance by providing tools to track and report on relevant data.

- Reporting: Car dealers need detailed financial reports to understand their business performance. Specialized software provides customizable reports that offer insights into sales, expenses, and profitability.

3. What Are The Key Features To Look For In Bookkeeping Software For Car Dealers?

The key features to look for in bookkeeping software for car dealers include inventory management, sales tracking, customer financing, reporting, integration, and compliance. These features help dealerships manage their unique financial needs efficiently and accurately. The software should also offer user-friendly interfaces, customizable options, and reliable customer support.

Here’s a closer look at these essential features:

| Feature | Description | Benefit |

|---|---|---|

| Inventory Management | Tracks vehicle inventory, parts, and accessories; monitors costs, sales, and depreciation. | Helps optimize inventory levels, reduce carrying costs, and improve profitability. |

| Sales Tracking | Manages sales transactions, including trade-ins, financing, and warranties; tracks revenue and sales performance. | Provides insights into sales trends, identifies top-selling vehicles, and improves sales strategies. |

| Customer Financing | Manages customer loans, tracks payments, and calculates interest; ensures compliance with lending regulations. | Streamlines financing operations, reduces risks, and enhances customer satisfaction. |

| Reporting | Generates detailed financial reports, including profit and loss statements, balance sheets, and cash flow statements; offers customizable reporting options. | Enables informed decision-making, tracks financial performance, and identifies areas for improvement. |

| Integration | Integrates with other business systems, such as CRM, inventory management, and payroll; streamlines data sharing and improves efficiency. | Eliminates data silos, automates data entry, and improves overall business operations. |

| Compliance | Ensures compliance with industry-specific regulations, such as those related to vehicle sales and financing; provides tools for tracking and reporting on compliance data. | Reduces the risk of penalties, ensures adherence to legal requirements, and protects the business’s reputation. |

4. How Does Bookkeeping Software Streamline Financial Operations For Car Dealerships?

Bookkeeping software streamlines financial operations for car dealerships by automating routine tasks, reducing errors, improving reporting, and enhancing compliance. This automation saves time and money while providing real-time financial insights. Automation enables dealerships to focus on core business activities, such as sales and customer service.

Here’s how the software streamlines operations:

- Automated Invoicing: Automatically generates and sends invoices to customers, reducing manual effort and improving accuracy.

- Bank Reconciliation: Simplifies the process of reconciling bank statements with accounting records, identifying discrepancies, and preventing errors.

- Expense Tracking: Tracks expenses automatically, categorizes them, and generates expense reports, helping dealerships manage costs and maximize tax deductions.

- Inventory Management: Provides real-time visibility into inventory levels, tracks costs, and automates inventory valuation, optimizing inventory management.

- Financial Reporting: Generates detailed financial reports, such as profit and loss statements, balance sheets, and cash flow statements, providing insights into business performance.

5. What Are The Benefits Of Cloud-Based Bookkeeping Software For Car Dealers?

Cloud-based bookkeeping software for car dealers offers numerous benefits, including accessibility, scalability, security, and cost savings. Cloud solutions allow dealerships to access their financial data from anywhere, at any time, using any device. They also provide scalability to accommodate business growth, robust security measures to protect sensitive data, and cost savings by reducing the need for on-premises infrastructure and IT support.

Here’s a more detailed look at the advantages:

- Accessibility: Access financial data from anywhere, at any time, using any device with an internet connection.

- Scalability: Easily scale up or down as the business grows or changes, without the need for additional hardware or software.

- Security: Benefit from robust security measures, including data encryption, firewalls, and regular backups, protecting sensitive financial information.

- Cost Savings: Reduce the need for on-premises infrastructure, IT support, and software maintenance, lowering overall costs.

- Real-Time Updates: Access real-time financial data, enabling better decision-making and faster responses to changing market conditions.

- Collaboration: Facilitate collaboration among team members, accountants, and other stakeholders, improving efficiency and communication.

Cloud bookkeeping software benefits

Cloud bookkeeping software benefits

Alt text: Car dealership employees collaborating on cloud bookkeeping software.

6. How Does Bookkeeping Software Help Car Dealers With Tax Preparation?

Bookkeeping software helps car dealers with tax preparation by providing organized and accurate financial records, automating tax calculations, and generating tax-related reports. This reduces the risk of errors, simplifies the tax filing process, and ensures compliance with tax regulations. Automated tax preparation saves time and money while improving the accuracy of tax filings.

Here’s how bookkeeping software assists with tax preparation:

- Organized Records: Maintains organized and accurate financial records, including income statements, expense reports, and balance sheets, making it easier to gather the necessary information for tax filing.

- Automated Calculations: Automates tax calculations, such as sales tax, property tax, and income tax, reducing the risk of errors and ensuring accuracy.

- Tax Reports: Generates tax-related reports, such as tax summaries, tax forms, and tax worksheets, simplifying the tax filing process.

- Compliance: Helps car dealers comply with tax regulations by providing tools to track and report on tax-related data, such as taxable income, deductions, and credits.

- Integration: Integrates with tax preparation software, such as TurboTax and H&R Block, making it easier to transfer financial data and file taxes electronically.

7. What Are The Common Mistakes Car Dealers Make In Bookkeeping And How Can Software Help?

Common mistakes car dealers make in bookkeeping include poor inventory management, inaccurate sales tracking, inadequate expense tracking, and non-compliance with tax regulations. Bookkeeping software helps prevent these mistakes by automating tasks, improving accuracy, and providing real-time financial insights. By using software, dealerships can avoid costly errors and improve their financial performance.

Here are some specific mistakes and how software can help:

| Mistake | Description | How Software Helps |

|---|---|---|

| Poor Inventory Management | Failing to track inventory accurately, leading to overstocking, stockouts, and lost revenue. | Provides real-time visibility into inventory levels, tracks costs, and automates inventory valuation, helping dealerships optimize inventory management and reduce carrying costs. |

| Inaccurate Sales Tracking | Errors in tracking sales transactions, leading to inaccurate revenue reporting and missed sales opportunities. | Automates sales tracking, captures all sales data accurately, and provides insights into sales performance, helping dealerships identify top-selling vehicles and improve sales strategies. |

| Inadequate Expense Tracking | Failing to track expenses properly, leading to missed tax deductions and inaccurate financial reporting. | Automates expense tracking, categorizes expenses, and generates expense reports, helping dealerships manage costs, maximize tax deductions, and improve financial reporting. |

| Non-Compliance With Tax Regulations | Failing to comply with tax regulations, leading to penalties, fines, and legal issues. | Tracks and reports on tax-related data, such as taxable income, deductions, and credits, helping dealerships comply with tax regulations and avoid penalties. |

| Poor Customer Financing Management | Errors in managing customer loans, leading to missed payments, inaccurate interest calculations, and compliance issues. | Automates customer financing management, tracks payments, calculates interest, and ensures compliance with lending regulations, reducing risks and enhancing customer satisfaction. |

8. How Can Car Dealers Integrate Bookkeeping Software With Other Business Systems?

Car dealers can integrate bookkeeping software with other business systems, such as CRM, inventory management, and payroll, through APIs, third-party connectors, and direct integrations. This integration streamlines data sharing, improves efficiency, and enhances overall business operations. By integrating systems, dealerships can create a seamless flow of information across their organization.

Here are some common integration methods:

- APIs (Application Programming Interfaces): Use APIs to connect bookkeeping software with other business systems, enabling data sharing and automation.

- Third-Party Connectors: Use third-party connectors, such as Zapier and Integromat, to integrate bookkeeping software with other systems that don’t have direct integrations.

- Direct Integrations: Use direct integrations provided by the bookkeeping software vendor to connect with other popular business systems.

- Custom Integrations: Develop custom integrations using programming languages and APIs to connect bookkeeping software with proprietary or niche systems.

Integrating bookkeeping software with CRM

Integrating bookkeeping software with CRM

Alt text: Car dealer reviewing CRM data integrated with bookkeeping software dashboard.

9. What Are The Best Bookkeeping Software Options For Small To Medium-Sized Car Dealerships?

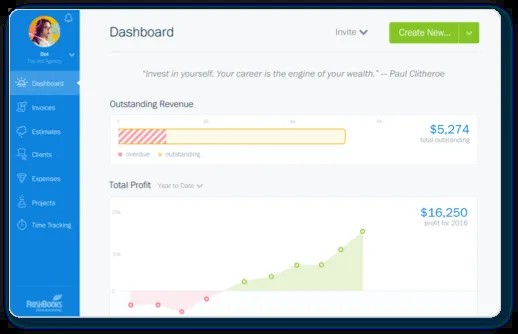

The best bookkeeping software options for small to medium-sized car dealerships include QuickBooks Online, Xero, FreshBooks, and Sage 50cloud. These software solutions offer features tailored to the automotive industry, such as inventory management, sales tracking, customer financing, and compliance. Each option provides a user-friendly interface, customizable options, and reliable customer support.

Here’s a comparison of these top options:

| Software | Description | Key Features | Pricing |

|---|---|---|---|

| QuickBooks Online | A popular cloud-based accounting software that offers a range of features for small to medium-sized businesses, including inventory management, sales tracking, and financial reporting. | Inventory management, sales tracking, customer invoicing, expense tracking, financial reporting, payroll integration. | Starting at $25/month. |

| Xero | A cloud-based accounting software that offers a user-friendly interface and a range of features for small to medium-sized businesses, including bank reconciliation, invoicing, and reporting. | Bank reconciliation, invoicing, expense tracking, financial reporting, inventory management, payroll integration. | Starting at $25/month. |

| FreshBooks | A cloud-based accounting software designed for small businesses, with a focus on invoicing, time tracking, and expense management. | Invoicing, time tracking, expense management, project management, financial reporting, online payments. | Starting at $15/month. |

| Sage 50cloud | A desktop accounting software that offers a range of features for small to medium-sized businesses, including inventory management, sales tracking, and financial reporting, with the option to store data in the cloud. | Inventory management, sales tracking, customer invoicing, expense tracking, financial reporting, payroll integration, job costing. | Starting at $34.08/month. |

10. How To Choose The Right Bookkeeping Software For Your Car Dealership?

Choosing the right bookkeeping software for your car dealership involves assessing your business needs, evaluating software options, considering integration capabilities, and testing software before making a decision. Start by identifying your specific requirements, such as inventory management, sales tracking, and compliance. Then, evaluate software options based on features, pricing, and user-friendliness. Finally, test the software with a free trial or demo to ensure it meets your needs.

Here’s a step-by-step guide to help you make the right choice:

- Assess Your Business Needs: Identify your specific requirements, such as inventory management, sales tracking, customer financing, and compliance.

- Evaluate Software Options: Research and evaluate software options based on features, pricing, user-friendliness, and customer support.

- Consider Integration Capabilities: Ensure the software integrates with other business systems, such as CRM, inventory management, and payroll.

- Test Software: Test the software with a free trial or demo to ensure it meets your needs and is easy to use.

- Read Reviews: Read reviews from other car dealers to get insights into the software’s strengths and weaknesses.

- Consider Scalability: Choose a software solution that can scale with your business as it grows.

- Evaluate Security: Ensure the software provides robust security measures to protect sensitive financial data.

- Check Customer Support: Evaluate the quality of customer support offered by the software vendor.

By following these steps, you can choose the right bookkeeping software for your car dealership and improve your financial operations.

FAQ About Bookkeeping Software for Car Dealers

-

What is the average cost of bookkeeping software for car dealers?

The average cost of bookkeeping software for car dealers varies depending on the features and functionality offered. Cloud-based solutions typically range from $25 to $150 per month, while desktop software can cost between $200 and $1,000 upfront.

-

Can I use QuickBooks for my car dealership?

Yes, you can use QuickBooks for your car dealership. QuickBooks Online and QuickBooks Desktop offer features tailored to the automotive industry, such as inventory management, sales tracking, and financial reporting.

-

Is cloud-based bookkeeping software secure?

Yes, cloud-based bookkeeping software is generally secure. Reputable vendors use robust security measures, such as data encryption, firewalls, and regular backups, to protect sensitive financial information.

-

Do I need an accountant if I use bookkeeping software?

While bookkeeping software can automate many accounting tasks, it is still beneficial to have an accountant. An accountant can provide expert advice, review your financial records, and ensure compliance with tax regulations.

-

Can I integrate bookkeeping software with my CRM system?

Yes, you can integrate bookkeeping software with your CRM system. This integration streamlines data sharing, improves efficiency, and enhances overall business operations.

-

What is the best way to track inventory in bookkeeping software?

The best way to track inventory in bookkeeping software is to use the inventory management features provided by the software. These features allow you to track inventory levels, costs, and sales in real-time.

-

How can bookkeeping software help with sales tax compliance?

Bookkeeping software can help with sales tax compliance by automating sales tax calculations, tracking sales tax collected, and generating sales tax reports.

-

Can I access bookkeeping software on my mobile device?

Yes, most cloud-based bookkeeping software solutions offer mobile apps that allow you to access your financial data from your smartphone or tablet.

-

What type of reports can I generate with bookkeeping software?

You can generate a variety of reports with bookkeeping software, including profit and loss statements, balance sheets, cash flow statements, sales reports, expense reports, and tax reports.

-

How often should I reconcile my bank accounts in bookkeeping software?

You should reconcile your bank accounts in bookkeeping software at least once a month. This ensures that your financial records are accurate and up-to-date.

Implementing the right bookkeeping software is a game-changer for car dealerships. It not only streamlines operations but also provides the financial clarity needed to drive profitability.

Are you ready to transform your car dealership’s financial management? Visit CAR-REMOTE-REPAIR.EDU.VN to explore our training programs and services tailored to the automotive industry in the USA. Contact us today at Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States, or via WhatsApp: +1 (641) 206-8880, and let us help you steer your business towards success.