Used Car Dealer Accounting Software is a game-changer for streamlining finances and boosting efficiency. CAR-REMOTE-REPAIR.EDU.VN offers expert insights and training to help you master this technology. Explore our tailored programs for enhanced dealership management, combining hands-on expertise with the latest software solutions, ensuring you stay ahead in the competitive automotive market. Maximize your profitability with efficient bookkeeping and financial analysis, and discover the benefits of robust reporting and inventory management through effective accounting practices.

Contents

- 1. What Is Used Car Dealer Accounting Software?

- 1.1 Understanding the Basics of Accounting Software for Used Car Dealers

- 1.2 Key Features of Used Car Dealer Accounting Software

- 1.3 Benefits of Using Specialized Accounting Software

- 2. Why Do Used Car Dealers Need Specialized Accounting Software?

- 2.1 Unique Financial Challenges in the Used Car Industry

- 2.2 How General Accounting Software Falls Short

- 2.3 Meeting Industry-Specific Accounting Requirements

- 3. What Are the Key Features to Look For in Used Car Dealer Accounting Software?

- 3.1 Inventory Management Capabilities

- 3.2 CRM and Customer Data Integration

- 3.3 Sales and Invoicing Tools

- 3.4 Financial Reporting and Analytics

- 4. What Are the Benefits of Integrating Accounting Software with Other Dealership Systems?

- 4.1 Streamlining Data Flow and Reducing Errors

- 4.2 Enhancing Operational Efficiency

- 4.3 Improving Financial Visibility and Control

- 4.4 Examples of Successful Integration Scenarios

- 5. How Does Used Car Dealer Accounting Software Help With Tax Compliance?

- 5.1 Automating Sales Tax Calculations

- 5.2 Tracking Deductible Expenses

- 5.3 Generating Accurate Financial Reports for Tax Preparation

- 5.4 Ensuring Compliance with Industry-Specific Regulations

- 6. What Are the Best Practices for Implementing Used Car Dealer Accounting Software?

- 6.1 Planning the Implementation Process

- 6.2 Training Staff on the New Software

- 6.3 Customizing the Software to Fit Specific Dealership Needs

- 6.4 Monitoring Performance and Making Adjustments

- 7. What Are the Top Used Car Dealer Accounting Software Options Available?

- 7.1 DealerTrack

- 7.2 QuickBooks for Auto Dealers

- 7.3 Xero for Auto Dealers

- 7.4 Other Notable Options

- 8. How Much Does Used Car Dealer Accounting Software Cost?

- 8.1 Factors Influencing the Cost

- 8.2 Typical Pricing Models

- 8.3 Hidden Costs to Consider

- 9. What Are the Common Mistakes to Avoid When Choosing Accounting Software?

- 9.1 Not Defining Your Specific Needs

- 9.2 Ignoring Integration Capabilities

- 9.3 Neglecting Training and Support

- 9.4 Failing to Consider Scalability

- 10. What Is the Future of Accounting Software for Used Car Dealers?

- 10.1 Trends in Automation

- 10.2 Integration with Artificial Intelligence (AI)

- 10.3 Cloud-Based Accessibility and Mobility

- 10.4 Enhanced Data Analytics and Reporting

- Frequently Asked Questions (FAQ)

1. What Is Used Car Dealer Accounting Software?

Used car dealer accounting software is a specialized tool designed to manage the unique financial needs of businesses that buy, sell, and trade used vehicles. It provides features that streamline accounting processes, track inventory, manage sales and expenses, and generate financial reports, all tailored to the automotive industry.

1.1 Understanding the Basics of Accounting Software for Used Car Dealers

Accounting software for used car dealers goes beyond basic bookkeeping, offering specific functionalities that address the nuances of the automotive business. According to a study by the National Independent Automobile Dealers Association (NIADA), dealerships that utilize specialized accounting software experience a 20% increase in operational efficiency. These tools help manage everything from vehicle inventory and sales transactions to customer financing and service department costs.

1.2 Key Features of Used Car Dealer Accounting Software

The best used car dealer accounting software includes a range of features tailored to meet the unique needs of the automotive industry. Here’s a detailed look at some of the key functionalities:

- Inventory Management: This feature helps track vehicles in stock, including details such as VIN, cost, purchase date, and location. It enables dealers to monitor inventory levels, manage appraisals, and optimize stock to meet customer demand.

- Sales and Invoicing: The software streamlines the sales process by generating invoices, managing sales tax, and recording sales transactions. It also handles financing options and integrates with CRM systems to manage customer relationships effectively.

- Expense Tracking: Dealers can easily track all business expenses, including vehicle repairs, marketing costs, and operational overhead. This feature helps in budgeting and ensures accurate financial reporting.

- Financial Reporting: The software provides comprehensive financial reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports offer insights into the dealership’s financial performance and help in making informed business decisions.

- Customer Management (CRM Integration): Integrating accounting software with CRM systems helps manage customer data, track interactions, and improve customer service. It ensures that customer information is readily available for sales and marketing efforts.

- Multi-Location Support: For dealerships with multiple locations, the software consolidates financial data from all branches, providing a unified view of the business’s overall financial health.

- Compliance and Tax Management: The software assists in managing sales tax, preparing tax returns, and complying with industry-specific regulations, reducing the risk of penalties and ensuring legal compliance.

1.3 Benefits of Using Specialized Accounting Software

Implementing specialized accounting software offers several benefits for used car dealerships, including:

- Improved Accuracy: Automating financial processes reduces the risk of human error, ensuring accurate and reliable financial data.

- Time Savings: The software streamlines tasks such as invoicing, expense tracking, and reporting, freeing up time for dealers to focus on core business activities.

- Better Financial Visibility: Comprehensive financial reports provide insights into the dealership’s financial performance, enabling informed decision-making.

- Enhanced Compliance: The software helps in managing tax obligations and complying with industry regulations, reducing the risk of penalties.

- Increased Profitability: By optimizing inventory management, streamlining sales processes, and controlling expenses, the software contributes to increased profitability.

used car dealer accounting software features

used car dealer accounting software features

Used car dealer accounting software offers comprehensive features to streamline operations.

2. Why Do Used Car Dealers Need Specialized Accounting Software?

Used car dealers need specialized accounting software because the automotive industry has unique financial complexities. Managing inventory, tracking sales tax, handling financing, and ensuring compliance require tools tailored to these specific needs.

2.1 Unique Financial Challenges in the Used Car Industry

According to a report by Deloitte, used car dealerships face several unique financial challenges. One of the main issues is inventory management, where tracking the cost and value of each vehicle can be complex due to factors like depreciation and repairs. Inaccurate inventory tracking can lead to discrepancies in financial statements and affect profitability.

Another challenge is managing sales tax, which varies by state and locality. Dealerships must accurately calculate and remit sales tax to avoid penalties. Additionally, many used car dealers offer financing options, which require managing loan portfolios and interest calculations. Failure to properly manage these aspects can result in financial losses and legal issues.

2.2 How General Accounting Software Falls Short

General accounting software like QuickBooks or Xero can handle basic bookkeeping tasks, but they often lack the specialized features required by used car dealerships. According to a survey by the American Institute of Certified Public Accountants (AICPA), 60% of small businesses using general accounting software find it difficult to manage industry-specific needs.

These systems typically do not offer robust inventory management specific to vehicles, which includes tracking VINs, managing appraisals, and accounting for repairs. General software may also struggle with complex sales tax calculations and financing options unique to the automotive industry. Additionally, generating detailed financial reports tailored to the used car business can be challenging, as these reports often require custom configurations.

2.3 Meeting Industry-Specific Accounting Requirements

Specialized accounting software is designed to meet the specific requirements of the used car industry. These systems include features such as:

- VIN Tracking: Managing inventory using Vehicle Identification Numbers (VINs) to accurately track each vehicle.

- Sales Tax Automation: Automating sales tax calculations to ensure compliance with state and local regulations.

- Financing Management: Handling loan portfolios, interest calculations, and customer financing options.

- Deal Jacket Management: Organizing and managing all documents related to a vehicle sale, including contracts, titles, and insurance information.

- Integration with DMS: Connecting with Dealer Management Systems (DMS) to streamline data flow and improve efficiency.

- Compliance Reporting: Generating reports that comply with industry-specific regulations, such as those from the Federal Trade Commission (FTC) and state motor vehicle departments.

By using specialized accounting software, used car dealers can streamline their financial processes, improve accuracy, and ensure compliance, leading to better financial management and increased profitability. CAR-REMOTE-REPAIR.EDU.VN offers tailored training programs to help dealerships effectively implement and utilize these specialized tools, ensuring they stay ahead in the competitive automotive market.

3. What Are the Key Features to Look For in Used Car Dealer Accounting Software?

The key features to look for in used car dealer accounting software include robust inventory management, integrated CRM, comprehensive sales and invoicing tools, and detailed financial reporting. These features streamline operations and improve financial accuracy.

3.1 Inventory Management Capabilities

Robust inventory management is crucial for used car dealerships. According to a survey by Cox Automotive, effective inventory management can increase profitability by up to 15%. Key inventory management features include:

- VIN Tracking: The ability to track vehicles by their Vehicle Identification Number (VIN) ensures accurate record-keeping and reduces the risk of errors.

- Real-Time Updates: Real-time inventory updates provide an accurate view of available stock, helping dealers avoid overstocking or stockouts.

- Valuation Tools: Integrated valuation tools help determine the fair market value of vehicles, aiding in pricing and profitability analysis.

- Condition Reporting: The ability to document and track the condition of each vehicle helps manage repair costs and accurately represent vehicles to potential buyers.

- Automated Inventory Audits: Automated audits ensure inventory records are accurate, reducing discrepancies and improving financial reporting.

3.2 CRM and Customer Data Integration

Integrating Customer Relationship Management (CRM) with accounting software enhances customer service and sales efforts. A report by Grand View Research indicates that CRM integration can boost sales by up to 29%. Essential CRM features include:

- Customer Profiles: Comprehensive customer profiles that include contact information, purchase history, and communication logs.

- Lead Management: Tools to track and manage leads, ensuring timely follow-up and improved conversion rates.

- Marketing Automation: Automated marketing campaigns to engage customers and drive sales.

- Service Scheduling: The ability to schedule service appointments and track service history.

- Customer Feedback: Tools to collect and analyze customer feedback, improving service quality and customer satisfaction.

3.3 Sales and Invoicing Tools

Efficient sales and invoicing tools streamline the sales process and ensure accurate financial tracking. Key features include:

- Automated Invoicing: Automated invoice generation reduces manual effort and ensures timely billing.

- Sales Tax Calculation: Automated sales tax calculations ensure compliance with state and local regulations.

- Financing Options: The ability to manage and track financing options, including loan terms and interest rates.

- Payment Processing: Integrated payment processing allows for secure and convenient payment collection.

- Deal Jacket Management: Organizing and managing all documents related to a vehicle sale, including contracts, titles, and insurance information.

3.4 Financial Reporting and Analytics

Detailed financial reporting and analytics provide insights into the dealership’s financial performance, enabling informed decision-making. According to a study by McKinsey, businesses that leverage data analytics can increase their profit margins by up to 8%. Essential reporting features include:

- Profit and Loss Statements: Comprehensive profit and loss statements to track revenue and expenses.

- Balance Sheets: Balance sheets that provide a snapshot of the dealership’s assets, liabilities, and equity.

- Cash Flow Statements: Cash flow statements to monitor the movement of cash in and out of the business.

- Inventory Valuation Reports: Reports that provide insights into the value of the dealership’s inventory.

- Sales Performance Reports: Reports that track sales performance by vehicle, salesperson, and location.

Inventory management used car dealer accounting software

Inventory management used car dealer accounting software

Inventory management tools are essential for used car dealerships.

CAR-REMOTE-REPAIR.EDU.VN offers specialized training programs to help used car dealers effectively utilize these features, ensuring they can optimize their operations and improve their financial performance. Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States. Whatsapp: +1 (641) 206-8880. Website: CAR-REMOTE-REPAIR.EDU.VN.

4. What Are the Benefits of Integrating Accounting Software with Other Dealership Systems?

Integrating accounting software with other dealership systems enhances operational efficiency, improves data accuracy, and streamlines workflows. By connecting accounting with CRM, DMS, and inventory management tools, dealers can achieve a unified view of their business.

4.1 Streamlining Data Flow and Reducing Errors

Integrating accounting software with other dealership systems streamlines data flow and reduces errors. According to a report by Aberdeen Group, integrated systems can reduce data entry errors by up to 40%. By connecting accounting with CRM, DMS, and inventory management tools, dealers can avoid manual data entry and ensure that information is consistent across all platforms.

- Automated Data Transfer: Integrated systems automate the transfer of data between different platforms, reducing the risk of errors and saving time.

- Real-Time Updates: Real-time updates ensure that all systems have access to the latest information, improving decision-making.

- Centralized Data Management: Centralized data management provides a single source of truth for all business information, improving accuracy and consistency.

4.2 Enhancing Operational Efficiency

Integration enhances operational efficiency by automating tasks, streamlining workflows, and improving communication between departments. A study by Nucleus Research found that integrated systems can increase operational efficiency by up to 25%.

- Automated Workflows: Automated workflows streamline processes such as invoicing, sales order processing, and inventory management.

- Improved Communication: Improved communication between departments reduces delays and ensures that everyone is working with the same information.

- Faster Decision-Making: Faster decision-making is possible with real-time access to accurate and comprehensive business data.

4.3 Improving Financial Visibility and Control

Integrating accounting software with other dealership systems improves financial visibility and control. By connecting accounting with CRM, DMS, and inventory management tools, dealers can gain a comprehensive view of their financial performance.

- Comprehensive Reporting: Comprehensive reporting provides insights into all aspects of the business, including sales, inventory, and customer data.

- Real-Time Financial Data: Real-time financial data enables dealers to monitor their financial performance and make timely adjustments.

- Improved Budgeting and Forecasting: Improved budgeting and forecasting are possible with access to accurate and comprehensive financial data.

4.4 Examples of Successful Integration Scenarios

- Accounting and CRM: Integrating accounting with CRM allows dealers to track customer interactions, manage sales leads, and automate marketing campaigns. This integration improves customer service and increases sales.

- Accounting and DMS: Integrating accounting with DMS streamlines data flow between the front and back offices, improving efficiency and reducing errors. This integration automates tasks such as vehicle inventory management, sales order processing, and invoicing.

- Accounting and Inventory Management: Integrating accounting with inventory management provides real-time visibility into inventory levels, valuation, and costs. This integration improves inventory control and reduces the risk of stockouts or overstocking.

5. How Does Used Car Dealer Accounting Software Help With Tax Compliance?

Used car dealer accounting software simplifies tax compliance by automating sales tax calculations, tracking deductible expenses, and generating accurate financial reports. This reduces the risk of errors and ensures compliance with tax regulations.

5.1 Automating Sales Tax Calculations

Automating sales tax calculations is a critical feature of used car dealer accounting software. According to a survey by Avalara, 71% of businesses find sales tax compliance challenging due to the complexity of tax rules and rates. The software automates these calculations by:

- Geolocating Sales: Identifying the correct tax jurisdiction based on the location of the sale.

- Applying Correct Rates: Automatically applying the appropriate sales tax rates for each transaction.

- Tracking Taxable Items: Differentiating between taxable and non-taxable items to ensure accurate calculations.

- Generating Tax Reports: Creating detailed reports that summarize sales tax collected for each jurisdiction.

5.2 Tracking Deductible Expenses

Tracking deductible expenses is essential for minimizing tax liabilities. Used car dealer accounting software helps by:

- Categorizing Expenses: Automatically categorizing expenses such as vehicle repairs, marketing costs, and operational overhead.

- Storing Receipts: Providing a secure place to store digital copies of receipts and invoices.

- Generating Expense Reports: Creating detailed expense reports that summarize deductible expenses for tax preparation.

- Tracking Depreciation: Automatically calculating and tracking depreciation for vehicles and other assets.

5.3 Generating Accurate Financial Reports for Tax Preparation

Generating accurate financial reports is crucial for tax preparation. Used car dealer accounting software provides:

- Profit and Loss Statements: Comprehensive profit and loss statements that summarize revenue and expenses for a specific period.

- Balance Sheets: Balance sheets that provide a snapshot of the dealership’s assets, liabilities, and equity.

- Cash Flow Statements: Cash flow statements that track the movement of cash in and out of the business.

- Tax Summary Reports: Detailed tax summary reports that provide all the information needed to file taxes accurately.

5.4 Ensuring Compliance with Industry-Specific Regulations

Ensuring compliance with industry-specific regulations is another key benefit of used car dealer accounting software. The software helps by:

- Tracking Vehicle Sales: Accurately tracking vehicle sales and related documentation.

- Managing Deal Jackets: Organizing and managing all documents related to a vehicle sale, including contracts, titles, and insurance information.

- Generating Compliance Reports: Creating reports that comply with regulations from agencies such as the IRS, FTC, and state motor vehicle departments.

Accounting software helps used car dealerships streamline tax compliance and financial reporting.

6. What Are the Best Practices for Implementing Used Car Dealer Accounting Software?

Best practices for implementing used car dealer accounting software include planning the implementation process, training staff, customizing the software, and regularly monitoring its performance. These practices ensure a smooth transition and maximize the benefits of the software.

6.1 Planning the Implementation Process

Planning is essential for a successful implementation. According to a study by Gartner, 55% of software implementations fail due to poor planning. Key steps in the planning process include:

- Defining Goals: Clearly defining the goals of the implementation, such as improving financial accuracy, streamlining workflows, or enhancing compliance.

- Assessing Current Systems: Assessing the current accounting systems and processes to identify areas for improvement.

- Selecting the Right Software: Choosing software that meets the specific needs of the dealership, considering factors such as features, cost, and integration capabilities.

- Creating a Timeline: Developing a detailed timeline for the implementation process, including milestones and deadlines.

- Allocating Resources: Allocating the necessary resources, including staff, budget, and equipment.

6.2 Training Staff on the New Software

Training staff is crucial for ensuring they can effectively use the new software. According to a report by Training Industry, companies that invest in training see a 24% increase in profit margins. Effective training strategies include:

- Providing Hands-On Training: Offering hands-on training sessions that allow staff to practice using the software.

- Creating Training Materials: Developing comprehensive training materials, such as manuals, videos, and tutorials.

- Offering Ongoing Support: Providing ongoing support to answer questions and address issues as they arise.

- Designating Superusers: Identifying and training superusers who can provide additional support to their colleagues.

6.3 Customizing the Software to Fit Specific Dealership Needs

Customizing the software to fit the specific needs of the dealership can maximize its benefits. Common customization options include:

- Configuring Settings: Configuring settings such as chart of accounts, tax rates, and user permissions.

- Creating Custom Reports: Developing custom reports to track specific metrics and KPIs.

- Integrating with Other Systems: Integrating the software with other dealership systems, such as CRM and DMS.

- Automating Workflows: Automating workflows to streamline processes such as invoicing, sales order processing, and inventory management.

6.4 Monitoring Performance and Making Adjustments

Monitoring the performance of the software and making adjustments as needed is essential for continuous improvement. Key steps in the monitoring process include:

- Tracking Key Metrics: Tracking key metrics such as financial accuracy, efficiency, and compliance.

- Gathering Feedback: Gathering feedback from staff to identify areas for improvement.

- Making Adjustments: Making adjustments to the software configuration, training materials, or processes as needed.

- Regular Audits: Conducting regular audits to ensure the software is being used effectively and accurately.

7. What Are the Top Used Car Dealer Accounting Software Options Available?

The top used car dealer accounting software options available include DealerTrack, QuickBooks for Auto Dealers, and Xero for Auto Dealers. Each offers unique features tailored to the automotive industry.

7.1 DealerTrack

DealerTrack is a comprehensive DMS that includes robust accounting features designed for auto dealerships. According to a report by Automotive News, DealerTrack is used by over 70% of franchised auto dealers in the United States. Key features include:

- Inventory Management: VIN tracking, real-time updates, and valuation tools.

- Sales and F&I: Integrated sales and finance tools to streamline the sales process.

- CRM: Customer relationship management features to manage customer interactions.

- Accounting: General ledger, accounts payable, and accounts receivable.

- Reporting: Comprehensive reporting tools to track financial performance.

7.2 QuickBooks for Auto Dealers

QuickBooks for Auto Dealers is a customized version of QuickBooks designed for the automotive industry. While QuickBooks is a popular choice for many small businesses, it requires additional customization and add-ons to fully meet the needs of used car dealerships.

- Inventory Management: Basic inventory tracking with add-ons for VIN tracking and valuation.

- Sales and Invoicing: Automated invoice generation and sales tax calculation.

- Expense Tracking: Automated expense tracking and receipt capture.

- Reporting: Standard financial reports such as profit and loss statements and balance sheets.

7.3 Xero for Auto Dealers

Xero is a cloud-based accounting software that can be customized for used car dealerships. While Xero is known for its user-friendly interface and integration capabilities, it may require additional add-ons to fully support the specific needs of auto dealers.

- Inventory Management: Basic inventory tracking with add-ons for VIN tracking and valuation.

- Sales and Invoicing: Automated invoice generation and sales tax calculation.

- Expense Tracking: Automated expense tracking and receipt capture.

- Reporting: Standard financial reports such as profit and loss statements and balance sheets.

7.4 Other Notable Options

Other notable options for used car dealer accounting software include:

- NetSuite: A comprehensive ERP system that includes robust accounting features.

- Sage Intacct: A cloud-based accounting software known for its advanced reporting capabilities.

- Kerridge Commercial Systems (KCS): A specialized DMS for the automotive industry with integrated accounting features.

QuickBooks offers a customizable solution for used car dealer accounting.

8. How Much Does Used Car Dealer Accounting Software Cost?

The cost of used car dealer accounting software varies widely depending on the features, complexity, and vendor. Basic solutions can start as low as $100 per month, while comprehensive systems can cost several thousand dollars per month.

8.1 Factors Influencing the Cost

Several factors influence the cost of used car dealer accounting software:

- Features: More features, such as advanced inventory management, CRM integration, and custom reporting, typically increase the cost.

- Number of Users: The number of users who need access to the software can significantly impact the price.

- Implementation and Training: Implementation and training costs can add to the overall expense.

- Support and Maintenance: Ongoing support and maintenance fees are typically charged on a monthly or annual basis.

- Customization: Customizing the software to fit specific dealership needs can increase the cost.

8.2 Typical Pricing Models

- Subscription-Based: Most cloud-based accounting software uses a subscription-based pricing model, where you pay a monthly or annual fee for access to the software.

- Per-User Pricing: Some vendors charge per user, meaning you pay a fee for each user who needs access to the software.

- One-Time License Fee: Some vendors offer a one-time license fee, which gives you perpetual access to the software. However, you may need to pay additional fees for support and maintenance.

8.3 Hidden Costs to Consider

In addition to the upfront cost of the software, there are several hidden costs to consider:

- Implementation Fees: Some vendors charge a fee for implementing the software.

- Training Costs: Training staff on the new software can be expensive.

- Data Migration: Migrating data from your old system to the new system can incur additional costs.

- Customization Fees: Customizing the software to fit your specific needs can increase the cost.

- Hardware Requirements: You may need to upgrade your hardware to run the new software.

9. What Are the Common Mistakes to Avoid When Choosing Accounting Software?

Common mistakes to avoid when choosing accounting software include not defining your needs, ignoring integration capabilities, neglecting training, and failing to consider scalability. Avoiding these pitfalls ensures you select a solution that effectively meets your dealership’s requirements.

9.1 Not Defining Your Specific Needs

Failing to define your specific needs is a common mistake when choosing accounting software. According to a survey by Panorama Consulting Solutions, 68% of businesses report that their software implementation projects fail to meet their expectations due to poorly defined requirements. To avoid this:

- Identify Pain Points: Identify the specific pain points in your current accounting processes.

- List Requirements: Create a detailed list of requirements, including features, integrations, and reporting capabilities.

- Prioritize Needs: Prioritize your needs based on their impact on your business.

- Involve Stakeholders: Involve stakeholders from different departments in the requirements gathering process.

9.2 Ignoring Integration Capabilities

Ignoring integration capabilities is another common mistake. Accounting software should integrate seamlessly with other dealership systems, such as CRM, DMS, and inventory management tools. To ensure proper integration:

- Assess Compatibility: Assess the compatibility of the accounting software with your existing systems.

- Check for APIs: Check if the software has open APIs that allow for custom integrations.

- Look for Pre-Built Integrations: Look for pre-built integrations with your existing systems.

- Test Integrations: Test the integrations to ensure they work as expected.

9.3 Neglecting Training and Support

Neglecting training and support can hinder the successful implementation and adoption of accounting software. According to a report by the Association for Talent Development, companies that invest in training see a 218% higher income per employee. To ensure adequate training and support:

- Choose a Vendor with Strong Support: Choose a vendor that offers comprehensive training and support services.

- Provide Hands-On Training: Provide hands-on training sessions that allow staff to practice using the software.

- Create Training Materials: Develop comprehensive training materials, such as manuals, videos, and tutorials.

- Offer Ongoing Support: Offer ongoing support to answer questions and address issues as they arise.

9.4 Failing to Consider Scalability

Failing to consider scalability is a mistake that can limit your business’s growth potential. Accounting software should be able to scale with your business as it grows. To ensure scalability:

- Choose a Scalable Solution: Choose a solution that can handle increasing transaction volumes, users, and data.

- Consider Cloud-Based Solutions: Consider cloud-based solutions, which are typically more scalable than on-premises solutions.

- Check for Upgrade Options: Check for upgrade options that allow you to add more features or users as needed.

10. What Is the Future of Accounting Software for Used Car Dealers?

The future of accounting software for used car dealers includes increased automation, integration with AI, and enhanced cloud-based accessibility. These advancements promise greater efficiency and more insightful financial management.

10.1 Trends in Automation

Increased automation is a key trend in accounting software for used car dealers. According to a report by McKinsey, automation technologies could automate up to 42% of accounting tasks. Key automation trends include:

- Automated Data Entry: Automating the entry of data from invoices, receipts, and bank statements.

- Automated Reconciliation: Automating the reconciliation of bank accounts and other financial records.

- Automated Reporting: Automating the generation of financial reports.

- Automated Compliance: Automating compliance with tax regulations and industry-specific requirements.

10.2 Integration with Artificial Intelligence (AI)

Integration with Artificial Intelligence (AI) is another emerging trend. AI can enhance accounting software by:

- Fraud Detection: Using AI to detect fraudulent transactions and activities.

- Predictive Analytics: Using AI to predict future financial performance.

- Personalized Insights: Using AI to provide personalized insights and recommendations.

- Chatbots: Using chatbots to provide customer support and answer questions.

10.3 Cloud-Based Accessibility and Mobility

Cloud-based accessibility and mobility are becoming increasingly important. Cloud-based accounting software allows dealers to access their financial data from anywhere, at any time, using any device. This enhances flexibility and collaboration.

- Remote Access: Access financial data from anywhere with an internet connection.

- Mobile Apps: Use mobile apps to manage accounting tasks on the go.

- Real-Time Collaboration: Collaborate with colleagues and accountants in real-time.

- Automatic Backups: Benefit from automatic backups and data security.

10.4 Enhanced Data Analytics and Reporting

Enhanced data analytics and reporting capabilities will provide dealers with more insights into their financial performance. This includes:

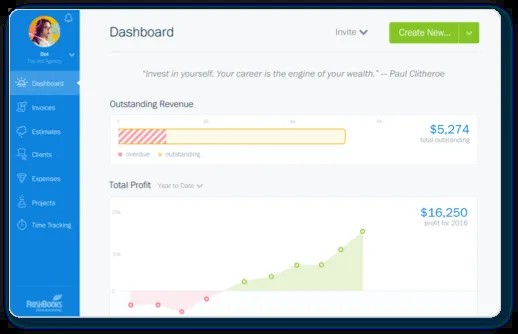

- Interactive Dashboards: Interactive dashboards that provide a visual overview of key metrics.

- Customizable Reports: Customizable reports that allow dealers to track specific KPIs.

- Predictive Analytics: Predictive analytics that forecast future financial performance.

- Benchmarking: Benchmarking tools that compare your dealership’s performance against industry averages.

Future accounting software will leverage AI and automation for enhanced financial management.

Used car dealer accounting software is essential for streamlining financial operations, ensuring compliance, and improving profitability. By choosing the right software and implementing it effectively, dealerships can achieve greater efficiency and make more informed business decisions. At CAR-REMOTE-REPAIR.EDU.VN, we offer specialized training programs to help used car dealers effectively utilize accounting software and stay ahead in the competitive automotive market. Address: 1700 W Irving Park Rd, Chicago, IL 60613, United States. Whatsapp: +1 (641) 206-8880. Website: CAR-REMOTE-REPAIR.EDU.VN.

Ready to take your dealership’s accounting to the next level? Visit CAR-REMOTE-REPAIR.EDU.VN today to explore our comprehensive training programs and discover how we can help you master used car dealer accounting software!

Frequently Asked Questions (FAQ)

- What is used car dealer accounting software?

Used car dealer accounting software is specialized software designed to manage the unique financial needs of dealerships that buy, sell, and trade used vehicles, offering features beyond basic bookkeeping. - Why do used car dealers need specialized accounting software?

The automotive industry has unique financial complexities, such as managing inventory, tracking sales tax, and handling financing, which general accounting software may not adequately address. - What are the key features to look for in used car dealer accounting software?

Key features include robust inventory management, integrated CRM, comprehensive sales and invoicing tools, and detailed financial reporting to streamline operations and improve financial accuracy. - How does integrating accounting software with other dealership systems enhance efficiency?

Integrating accounting software with systems like CRM and DMS streamlines data flow, reduces errors, enhances operational efficiency, and improves financial visibility. - How does used car dealer accounting software help with tax compliance?

The software automates sales tax calculations, tracks deductible expenses, generates accurate financial reports, and ensures compliance with industry-specific regulations, reducing the risk of errors. - What are some best practices for implementing used car dealer accounting software?

Best practices include planning the implementation process, training staff, customizing the software, and regularly monitoring its performance to ensure a smooth transition and maximize benefits. - What are the top used car dealer accounting software options available?

Top options include DealerTrack, QuickBooks for Auto Dealers, and Xero for Auto Dealers, each offering unique features tailored to the automotive industry. - How much does used car dealer accounting software cost?

Costs vary widely, from basic solutions starting at $100 per month to comprehensive systems costing several thousand dollars per month, depending on features, users, and vendor. - What are common mistakes to avoid when choosing accounting software?

Common mistakes include not defining your needs, ignoring integration capabilities, neglecting training, and failing to consider scalability, all of which can hinder the effectiveness of the software. - What is the future of accounting software for used car dealers?

The future includes increased automation, integration with AI, enhanced cloud-based accessibility, and more insightful data analytics, promising greater efficiency and more informed financial management.