Used Car Lot Accounting Software is a game-changer for dealerships looking to streamline operations and boost profitability, and CAR-REMOTE-REPAIR.EDU.VN is here to guide you. This software not only simplifies financial management but also provides valuable insights into your business performance. Discover how the right system can revolutionize your dealership, offering efficiency gains and a clearer financial picture through effective floor plan accounting and inventory management.

Contents

- 1. What is Used Car Lot Accounting Software?

- 2. Who Benefits from Used Car Lot Accounting Software?

- 3. Why is Accounting Software Important for Used Car Lots?

- 4. How Does Used Car Lot Accounting Software Streamline Operations?

- 5. What are the Key Features of Effective Used Car Lot Accounting Software?

- 6. What is Floor Plan Accounting and Why is It Important?

- 7. How Does Used Car Lot Accounting Software Handle Inventory Management?

- 8. What Financial Reports Can Used Car Lot Accounting Software Generate?

- 9. How Does Used Car Lot Accounting Software Help with Tax Compliance?

- 10. Can Used Car Lot Accounting Software Integrate with Other Dealership Systems?

- 11. How Much Does Used Car Lot Accounting Software Cost?

- 12. What are the Benefits of Cloud-Based Used Car Lot Accounting Software?

- 13. How to Choose the Right Used Car Lot Accounting Software?

- 14. What are Some Popular Used Car Lot Accounting Software Options?

- 15. How to Implement Used Car Lot Accounting Software?

- 16. What Training is Needed for Staff to Use the Software Effectively?

- 17. How to Ensure Data Security with Used Car Lot Accounting Software?

- 18. What are the Common Challenges of Using Used Car Lot Accounting Software?

- 19. How to Overcome the Challenges of Implementing New Software?

- 20. What is the Future of Used Car Lot Accounting Software?

- 21. What are the Key Metrics to Track with Used Car Lot Accounting Software?

- 22. How Does Used Car Lot Accounting Software Improve Decision-Making?

- 23. How to Maximize the ROI of Used Car Lot Accounting Software?

- 24. What are Some Common Mistakes to Avoid When Using the Software?

- 25. How to Keep Up with the Latest Trends in Accounting Technology?

- 26. How to Get Support for Used Car Lot Accounting Software?

- 27. What Role Does AI Play in Modern Accounting Software?

- 28. How Can Mobile Apps Enhance Used Car Lot Accounting?

- 29. What is the Impact of Blockchain on Accounting Systems?

- 30. How Does Data Analytics Help in Used Car Lot Accounting?

- 31. How to Integrate CRM and Accounting for Better Customer Management?

- 32. What Security Measures Should Be Implemented for Online Accounting?

- 33. How to Prepare for an Accounting Software Audit?

- 34. What are the Best Practices for Managing Accounts Payable?

- 35. How Can Dashboards Help in Monitoring Financial Health?

- 36. What is the Role of Accountants in the Age of Accounting Software?

- 37. How to Properly Manage Depreciation for Your Car Inventory?

- 38. What Are Best Practices for Handling Cash Flow Management?

- FAQ About Used Car Lot Accounting Software

1. What is Used Car Lot Accounting Software?

Used car lot accounting software is a specialized tool designed to manage the unique financial aspects of running a used car dealership. This software helps with tracking inventory, managing sales, handling finances, and generating reports. It integrates all these functions into one system, making it easier to maintain accurate records and make informed business decisions, ensuring compliance and profitability for your automotive business.

- Inventory Management: Tracks vehicle acquisitions, sales, and costs associated with each vehicle.

- Sales Tracking: Records sales transactions, including financing, trade-ins, and warranties.

- Financial Reporting: Generates financial statements, such as profit and loss statements and balance sheets.

- Customer Management: Stores customer information and tracks sales history.

- Integration: Connects with other dealership systems, such as CRM and DMS.

2. Who Benefits from Used Car Lot Accounting Software?

Any used car dealership, regardless of size, can benefit significantly from implementing used car lot accounting software. Dealerships of all sizes can benefit from optimized financial processes and increased efficiency. Let’s break it down:

- Small Dealerships: Benefit from simplified accounting processes and reduced administrative burden.

- Medium-Sized Dealerships: Experience improved inventory management and enhanced financial reporting.

- Large Dealerships: Gain better control over multiple locations and complex financial transactions.

- Independent Dealers: Can compete more effectively with larger dealerships by using advanced software tools.

3. Why is Accounting Software Important for Used Car Lots?

Accounting software is crucial for used car lots because it automates many of the complex financial tasks involved in running a dealership. Used car lot accounting software centralizes financial data, improves accuracy, and provides real-time insights into your business. Accurate financial records, improved efficiency, and better decision-making are all benefits.

- Accuracy: Reduces the risk of errors in financial records.

- Efficiency: Automates tasks such as invoicing, reconciliation, and reporting.

- Real-Time Insights: Provides up-to-date information on sales, expenses, and profitability.

- Compliance: Helps ensure compliance with tax laws and industry regulations.

4. How Does Used Car Lot Accounting Software Streamline Operations?

Used car lot accounting software streamlines operations by automating key processes and providing a centralized platform for managing financial data. It automates tasks such as invoicing, inventory tracking, and financial reporting. Here’s how:

- Automation: Automates repetitive tasks such as data entry and reconciliation.

- Centralization: Consolidates financial data into a single, accessible platform.

- Integration: Connects with other dealership systems to share data and streamline workflows.

- Reporting: Generates detailed reports that provide insights into business performance.

5. What are the Key Features of Effective Used Car Lot Accounting Software?

Effective used car lot accounting software should include features that address the specific needs of used car dealerships. Key features include inventory management, sales tracking, financial reporting, and integration with other systems.

- Inventory Management: Tracks vehicle acquisitions, sales, and costs associated with each vehicle.

- Sales Tracking: Records sales transactions, including financing, trade-ins, and warranties.

- Financial Reporting: Generates financial statements, such as profit and loss statements and balance sheets.

- Customer Management: Stores customer information and tracks sales history.

- Integration: Connects with other dealership systems, such as CRM and DMS.

- Floor Plan Accounting: Manages floor plan financing and tracks interest expenses.

- Compliance Tracking: Helps ensure compliance with tax laws and industry regulations.

6. What is Floor Plan Accounting and Why is It Important?

Floor plan accounting is a specialized accounting method used by car dealerships to manage the financing of their vehicle inventory. It’s essential because it allows dealerships to borrow money to purchase vehicles, which are then held as collateral. Here’s why it’s so critical:

- Financing Inventory: Enables dealerships to finance their inventory through a floor plan loan.

- Tracking Interest Expenses: Accurately tracks interest expenses associated with the loan.

- Managing Loan Balances: Monitors loan balances and ensures timely payments.

- Optimizing Cash Flow: Helps optimize cash flow by managing inventory financing effectively.

7. How Does Used Car Lot Accounting Software Handle Inventory Management?

Used car lot accounting software manages inventory by tracking each vehicle from acquisition to sale. It monitors costs, sales prices, and profitability for each vehicle. Key functions include:

- Vehicle Tracking: Tracks each vehicle from acquisition to sale.

- Cost Monitoring: Monitors costs associated with each vehicle, such as purchase price, reconditioning costs, and transportation fees.

- Sales Price Tracking: Records sales prices and profit margins for each vehicle.

- Reporting: Generates reports on inventory turnover, aging, and profitability.

8. What Financial Reports Can Used Car Lot Accounting Software Generate?

Used car lot accounting software can generate a variety of financial reports that provide insights into the dealership’s performance. Common reports include profit and loss statements, balance sheets, cash flow statements, and sales reports. These reports help dealerships understand their financial health and make informed decisions.

- Profit and Loss Statement: Shows revenues, expenses, and net income over a period of time.

- Balance Sheet: Provides a snapshot of assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement: Tracks the movement of cash into and out of the business.

- Sales Reports: Analyzes sales performance by vehicle, salesperson, and time period.

- Inventory Reports: Provides insights into inventory levels, turnover, and aging.

9. How Does Used Car Lot Accounting Software Help with Tax Compliance?

Used car lot accounting software helps with tax compliance by maintaining accurate financial records and generating reports that are needed for tax filings. It automates tasks such as sales tax calculation and reporting. The software assists in:

- Sales Tax Calculation: Automatically calculates sales tax on each transaction.

- Tax Reporting: Generates reports that summarize sales tax collected and remitted.

- Expense Tracking: Tracks deductible business expenses.

- Record Keeping: Maintains accurate financial records that support tax filings.

10. Can Used Car Lot Accounting Software Integrate with Other Dealership Systems?

Yes, used car lot accounting software can typically integrate with other dealership systems, such as CRM (Customer Relationship Management) and DMS (Dealership Management System). This integration streamlines workflows and improves data accuracy.

- CRM Integration: Shares customer data between the accounting software and CRM system.

- DMS Integration: Integrates accounting data with the dealership management system for a comprehensive view of operations.

- Inventory Integration: Automatically updates inventory levels in the accounting software based on sales and acquisitions.

- Financial Data Integration: Streamlines the flow of financial data between systems.

11. How Much Does Used Car Lot Accounting Software Cost?

The cost of used car lot accounting software varies depending on the features, number of users, and deployment method. Pricing models typically include monthly subscriptions, one-time license fees, and custom pricing. Pricing can range from a few hundred to several thousand dollars per month.

- Monthly Subscription: A recurring fee based on the number of users and features included.

- One-Time License Fee: A single payment for the software license, with additional fees for support and updates.

- Custom Pricing: Tailored pricing based on the specific needs of the dealership.

- Factors Affecting Cost: The size of the dealership, the complexity of the accounting needs, and the level of support required.

12. What are the Benefits of Cloud-Based Used Car Lot Accounting Software?

Cloud-based used car lot accounting software offers several benefits, including accessibility, scalability, and automatic updates. This type of software is accessible from anywhere with an internet connection.

- Accessibility: Access the software from anywhere with an internet connection.

- Scalability: Easily scale the software to accommodate growth.

- Automatic Updates: Receive automatic software updates and maintenance.

- Data Security: Benefit from enhanced data security and backup measures.

- Collaboration: Facilitate collaboration among team members by sharing data and reports in real-time.

13. How to Choose the Right Used Car Lot Accounting Software?

Choosing the right used car lot accounting software involves assessing your dealership’s specific needs and evaluating different software options. Consider factors such as features, ease of use, integration capabilities, and cost.

- Assess Your Needs: Identify your dealership’s specific accounting needs and challenges.

- Evaluate Features: Compare the features of different software options.

- Consider Ease of Use: Choose software that is intuitive and easy to learn.

- Check Integration Capabilities: Ensure the software integrates with your other dealership systems.

- Evaluate Cost: Consider the total cost of ownership, including subscription fees, implementation costs, and support fees.

14. What are Some Popular Used Car Lot Accounting Software Options?

Several popular used car lot accounting software options are available, each with its own strengths and weaknesses. Research and compare these options to find the best fit for your dealership.

- QuickBooks Online: A popular accounting software that offers a range of features for small businesses.

- Xero: A cloud-based accounting software that is known for its ease of use and integration capabilities.

- DealerTrack: A comprehensive DMS that includes accounting, CRM, and inventory management features.

- CDK Global: A leading provider of DMS solutions for automotive dealerships.

- Frazer: A dealership management software specifically designed for independent car dealers.

- IDS Astra G2: A fully integrated DMS and accounting software for auto dealerships.

15. How to Implement Used Car Lot Accounting Software?

Implementing used car lot accounting software involves planning, data migration, training, and testing. A well-planned implementation can minimize disruption and maximize the benefits of the software.

- Planning: Develop a detailed implementation plan that outlines the steps, timeline, and responsibilities.

- Data Migration: Migrate your existing financial data into the new software.

- Training: Provide training to your staff on how to use the software.

- Testing: Test the software to ensure it is working correctly.

- Go-Live: Launch the software and monitor its performance.

- Support: Provide ongoing support and training to your staff.

16. What Training is Needed for Staff to Use the Software Effectively?

Effective training is essential for ensuring that your staff can use the used car lot accounting software effectively. Training should cover basic navigation, data entry, report generation, and troubleshooting.

- Basic Navigation: Teach staff how to navigate the software and access key features.

- Data Entry: Train staff on how to enter data accurately and efficiently.

- Report Generation: Show staff how to generate and interpret reports.

- Troubleshooting: Provide guidance on how to troubleshoot common issues.

- Ongoing Support: Offer ongoing support and training to address questions and challenges.

17. How to Ensure Data Security with Used Car Lot Accounting Software?

Data security is a critical consideration when using used car lot accounting software. Implement measures such as strong passwords, data encryption, and regular backups to protect your financial data.

- Strong Passwords: Require staff to use strong, unique passwords.

- Data Encryption: Encrypt sensitive data to protect it from unauthorized access.

- Regular Backups: Perform regular backups of your financial data.

- Access Controls: Implement access controls to limit access to sensitive data.

- Security Audits: Conduct regular security audits to identify and address vulnerabilities.

- Software Updates: Keep the software up to date with the latest security patches.

18. What are the Common Challenges of Using Used Car Lot Accounting Software?

While used car lot accounting software offers many benefits, it also presents some challenges. These challenges may include data migration issues, integration problems, and user adoption.

- Data Migration Issues: Migrating data from an old system to a new one can be complex and time-consuming.

- Integration Problems: Integrating the accounting software with other dealership systems can be challenging.

- User Adoption: Getting staff to adopt and use the new software can be difficult.

- Training Costs: Providing adequate training to staff can be expensive.

- Technical Issues: Technical issues can disrupt operations and require technical support.

19. How to Overcome the Challenges of Implementing New Software?

Overcoming the challenges of implementing new software requires careful planning, communication, and support. Address potential issues proactively to ensure a smooth transition.

- Plan Carefully: Develop a detailed implementation plan that addresses potential challenges.

- Communicate Effectively: Communicate the benefits of the new software to staff.

- Provide Adequate Training: Offer comprehensive training to ensure staff can use the software effectively.

- Offer Support: Provide ongoing support to address questions and issues.

- Monitor Progress: Monitor the implementation progress and address any issues promptly.

- Seek Expert Advice: Consult with experts to help overcome technical challenges.

20. What is the Future of Used Car Lot Accounting Software?

The future of used car lot accounting software is likely to involve greater automation, integration with other technologies, and enhanced analytics capabilities. Expect to see more cloud-based solutions and mobile apps.

- Greater Automation: Increased automation of tasks such as data entry, reconciliation, and reporting.

- Integration with Other Technologies: Seamless integration with other technologies such as AI, machine learning, and blockchain.

- Enhanced Analytics Capabilities: More advanced analytics tools that provide deeper insights into business performance.

- Cloud-Based Solutions: Continued adoption of cloud-based solutions that offer accessibility and scalability.

- Mobile Apps: Greater use of mobile apps for managing accounting tasks on the go.

- Real-Time Data: Access real-time data and analytics for improved decision-making.

21. What are the Key Metrics to Track with Used Car Lot Accounting Software?

Tracking key metrics is essential for monitoring the performance of your used car lot. Some important metrics to track include sales volume, gross profit, inventory turnover, and customer acquisition cost.

- Sales Volume: The total number of vehicles sold over a period of time.

- Gross Profit: The difference between revenue and cost of goods sold.

- Inventory Turnover: The rate at which inventory is sold and replaced.

- Customer Acquisition Cost: The cost of acquiring a new customer.

- Net Profit Margin: The percentage of revenue that remains after all expenses have been deducted.

- Return on Investment (ROI): The return on investment for each vehicle sold.

22. How Does Used Car Lot Accounting Software Improve Decision-Making?

Used car lot accounting software improves decision-making by providing accurate, real-time data on your dealership’s performance. This data can be used to identify trends, make informed decisions, and optimize operations.

- Accurate Data: Provides accurate financial data that can be used to make informed decisions.

- Real-Time Insights: Offers real-time insights into sales, expenses, and profitability.

- Trend Analysis: Helps identify trends and patterns in the business.

- Performance Monitoring: Allows you to monitor the performance of your dealership and identify areas for improvement.

- Strategic Planning: Supports strategic planning by providing data that can be used to set goals and track progress.

23. How to Maximize the ROI of Used Car Lot Accounting Software?

To maximize the ROI of used car lot accounting software, focus on using the software to improve efficiency, reduce costs, and increase revenue. Implement best practices and provide ongoing training to your staff.

- Improve Efficiency: Use the software to automate tasks and streamline workflows.

- Reduce Costs: Identify and eliminate unnecessary expenses.

- Increase Revenue: Use the software to track sales performance and identify opportunities to increase revenue.

- Implement Best Practices: Implement best practices for accounting and financial management.

- Provide Ongoing Training: Offer ongoing training to ensure staff can use the software effectively.

24. What are Some Common Mistakes to Avoid When Using the Software?

Avoiding common mistakes is essential for ensuring that you get the most out of your used car lot accounting software. Some common mistakes to avoid include inaccurate data entry, failure to reconcile accounts, and neglecting to use the software’s reporting features.

- Inaccurate Data Entry: Ensure that data is entered accurately and consistently.

- Failure to Reconcile Accounts: Reconcile accounts regularly to identify and correct errors.

- Neglecting Reporting Features: Use the software’s reporting features to monitor performance and make informed decisions.

- Ignoring Security Measures: Implement and enforce security measures to protect your financial data.

- Lack of Training: Provide adequate training to ensure staff can use the software effectively.

25. How to Keep Up with the Latest Trends in Accounting Technology?

Keeping up with the latest trends in accounting technology is essential for staying competitive and maximizing the benefits of your accounting software. Attend industry conferences, read industry publications, and network with other professionals.

- Attend Industry Conferences: Attend industry conferences to learn about the latest trends and technologies.

- Read Industry Publications: Read industry publications to stay informed about new developments.

- Network with Other Professionals: Network with other professionals to share insights and best practices.

- Follow Technology Blogs: Follow technology blogs and websites to stay up to date on the latest trends.

- Take Online Courses: Take online courses to learn about new accounting technologies.

26. How to Get Support for Used Car Lot Accounting Software?

Getting support for used car lot accounting software is essential for resolving technical issues and getting the most out of the software. Contact the software vendor for technical support, consult online forums, and network with other users.

- Contact the Software Vendor: Contact the software vendor for technical support.

- Consult Online Forums: Consult online forums and communities for help with common issues.

- Network with Other Users: Network with other users to share insights and best practices.

- Read Documentation: Read the software documentation for guidance on using the software.

- Hire a Consultant: Hire a consultant for expert advice and support.

27. What Role Does AI Play in Modern Accounting Software?

Artificial intelligence (AI) is increasingly playing a significant role in modern accounting software, automating tasks, improving accuracy, and providing insights. AI is streamlining operations and enhancing decision-making.

- Automation: AI automates tasks such as data entry, reconciliation, and invoice processing.

- Improved Accuracy: AI improves accuracy by detecting errors and anomalies.

- Insights: AI provides insights by analyzing financial data and identifying trends.

- Fraud Detection: AI helps detect fraudulent transactions and activities.

- Predictive Analytics: AI enables predictive analytics by forecasting future financial performance.

28. How Can Mobile Apps Enhance Used Car Lot Accounting?

Mobile apps enhance used car lot accounting by providing access to financial data and tools on the go. Sales staff, managers, and owners can stay connected and make informed decisions. Mobile apps improve accessibility and efficiency.

- Accessibility: Access financial data and tools from anywhere.

- Efficiency: Automate tasks such as expense tracking and invoice creation.

- Real-Time Data: Access real-time data and insights.

- Remote Management: Manage accounting tasks remotely.

- Improved Communication: Facilitate communication among team members.

29. What is the Impact of Blockchain on Accounting Systems?

Blockchain technology has the potential to revolutionize accounting systems by providing secure, transparent, and immutable records of financial transactions. Blockchain enhances security and transparency.

- Secure Records: Blockchain provides secure, tamper-proof records of financial transactions.

- Transparency: Blockchain enhances transparency by making transaction data accessible to authorized parties.

- Efficiency: Blockchain streamlines processes such as reconciliation and auditing.

- Reduced Costs: Blockchain reduces costs by eliminating intermediaries.

- Improved Trust: Blockchain improves trust by providing a verifiable record of transactions.

30. How Does Data Analytics Help in Used Car Lot Accounting?

Data analytics helps in used car lot accounting by providing insights into financial performance, customer behavior, and market trends. Data analytics informs strategic decisions and optimize operations.

- Financial Performance Insights: Data analytics provides insights into sales, expenses, and profitability.

- Customer Behavior Analysis: Data analytics helps understand customer preferences and buying patterns.

- Market Trend Identification: Data analytics identifies market trends and opportunities.

- Risk Management: Data analytics helps manage financial risks.

- Strategic Decision-Making: Data analytics supports strategic decision-making by providing data-driven insights.

31. How to Integrate CRM and Accounting for Better Customer Management?

Integrating CRM (Customer Relationship Management) and accounting systems allows dealerships to manage customer interactions and financial data in one place. Integration improves customer service and sales efficiency.

- Centralized Data: Centralize customer and financial data in one system.

- Improved Customer Service: Provide better customer service by having access to all customer information.

- Sales Efficiency: Improve sales efficiency by tracking customer interactions and sales performance.

- Targeted Marketing: Implement targeted marketing campaigns based on customer data.

- Data Analysis: Analyze customer and financial data to identify trends and opportunities.

32. What Security Measures Should Be Implemented for Online Accounting?

Implementing strong security measures is essential for protecting your financial data when using online accounting software. Safeguard sensitive data and prevent unauthorized access.

- Strong Passwords: Require staff to use strong, unique passwords.

- Two-Factor Authentication: Implement two-factor authentication to add an extra layer of security.

- Data Encryption: Encrypt sensitive data to protect it from unauthorized access.

- Regular Backups: Perform regular backups of your financial data.

- Access Controls: Implement access controls to limit access to sensitive data.

- Security Audits: Conduct regular security audits to identify and address vulnerabilities.

33. How to Prepare for an Accounting Software Audit?

Preparing for an accounting software audit involves ensuring that your financial records are accurate, complete, and well-organized. Simplify the audit process and demonstrate compliance.

- Accurate Records: Ensure that your financial records are accurate and complete.

- Organized Data: Organize your financial data in a clear and consistent manner.

- Documentation: Maintain proper documentation for all transactions.

- Internal Controls: Implement strong internal controls to prevent errors and fraud.

- Audit Trail: Maintain an audit trail that tracks all changes to your financial data.

- Review Policies: Review and update your accounting policies and procedures.

34. What are the Best Practices for Managing Accounts Payable?

Managing accounts payable effectively is essential for maintaining good relationships with suppliers and optimizing cash flow. Streamline payment processes and maintain financial health.

- Timely Payments: Make timely payments to suppliers.

- Invoice Verification: Verify invoices for accuracy before payment.

- Discount Utilization: Utilize available discounts for early payment.

- Payment Scheduling: Schedule payments to optimize cash flow.

- Supplier Communication: Maintain open communication with suppliers.

- Payment Tracking: Track payments to ensure accuracy and prevent errors.

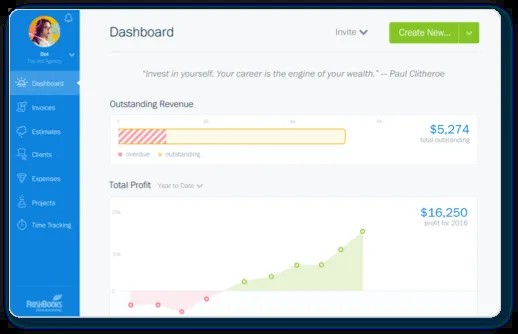

35. How Can Dashboards Help in Monitoring Financial Health?

Dashboards provide a visual overview of your dealership’s financial health, allowing you to quickly identify trends and issues. Improve decision-making and track performance.

- Visual Overview: Provide a visual overview of financial performance.

- Real-Time Data: Display real-time data and key performance indicators (KPIs).

- Trend Identification: Help identify trends and patterns.

- Performance Monitoring: Allow you to monitor the performance of your dealership and identify areas for improvement.

- Customization: Customize the dashboard to display the most important metrics.

- Improved Decision-Making: Support better decision-making by providing quick access to critical information.

36. What is the Role of Accountants in the Age of Accounting Software?

Even with advanced accounting software, accountants continue to play a crucial role in helping dealerships manage their finances, providing expert advice and support. Benefit from expert guidance and strategic planning.

- Expert Advice: Provide expert advice on accounting and financial management.

- Strategic Planning: Help develop and implement strategic financial plans.

- Audit Support: Provide support during audits.

- Complex Issues: Address complex accounting issues.

- Compliance: Ensure compliance with tax laws and regulations.

- Data Analysis: Analyze financial data and provide insights.

37. How to Properly Manage Depreciation for Your Car Inventory?

Properly managing depreciation for your car inventory involves accurately calculating and recording the decrease in value of your vehicles over time. Accurate financial reporting and tax compliance.

- Accurate Calculation: Accurately calculate depreciation using appropriate methods.

- Consistent Recording: Consistently record depreciation expenses in your financial records.

- Method Selection: Select the appropriate depreciation method for your vehicles.

- Compliance: Ensure compliance with tax regulations.

- Regular Review: Regularly review depreciation calculations to ensure accuracy.

- Documentation: Maintain proper documentation of depreciation methods and calculations.

38. What Are Best Practices for Handling Cash Flow Management?

Effective cash flow management is vital for ensuring that your used car lot has enough cash on hand to meet its obligations and invest in growth. Optimize financial stability and long-term success.

- Forecasting: Forecast future cash flows to anticipate potential shortages or surpluses.

- Budgeting: Create a budget to manage income and expenses.

- Monitoring: Monitor cash flow regularly to identify trends and issues.

- Payment Management: Manage payments to suppliers and customers effectively.

- Expense Control: Control expenses to maximize cash flow.

- Emergency Funds: Maintain emergency funds to cover unexpected expenses.

Used car lot accounting software is an essential tool for dealerships looking to improve their financial management and operational efficiency. By understanding the key features, benefits, and challenges of the software, dealerships can make informed decisions and maximize their ROI. Ready to transform your dealership’s financial management? Visit CAR-REMOTE-REPAIR.EDU.VN to explore our training programs and services designed to help you master used car lot accounting software. Elevate your skills and drive your business forward with our expert guidance. Contact us today at 1700 W Irving Park Rd, Chicago, IL 60613, United States, or WhatsApp +1 (641) 206-8880.

Car Dealership Accounting Software Dashboard

Car Dealership Accounting Software Dashboard

FAQ About Used Car Lot Accounting Software

- What is the main purpose of used car lot accounting software?

- The main purpose is to streamline financial operations, manage inventory, and provide accurate financial reporting.

- How does this software help with inventory management?

- It tracks each vehicle from acquisition to sale, monitors costs, and generates inventory reports.

- Can the software integrate with other dealership systems?

- Yes, it typically integrates with CRM and DMS systems for seamless data sharing.

- What types of financial reports can it generate?

- It can generate profit and loss statements, balance sheets, cash flow statements, and sales reports.

- How does it assist with tax compliance?

- It automates sales tax calculations and generates necessary tax reports.

- What are the benefits of cloud-based accounting software?

- Benefits include accessibility from anywhere, scalability, and automatic updates.

- How much does used car lot accounting software cost?

- Costs vary, typically ranging from monthly subscriptions to one-time license fees.

- What are some popular software options?

- Popular options include QuickBooks Online, Xero, DealerTrack, and CDK Global.

- How important is staff training for using the software effectively?

- Effective training is essential to ensure staff can use the software efficiently and accurately.

- How does AI play a role in modern accounting software?

- AI automates tasks, improves accuracy, and provides valuable insights for better decision-making.